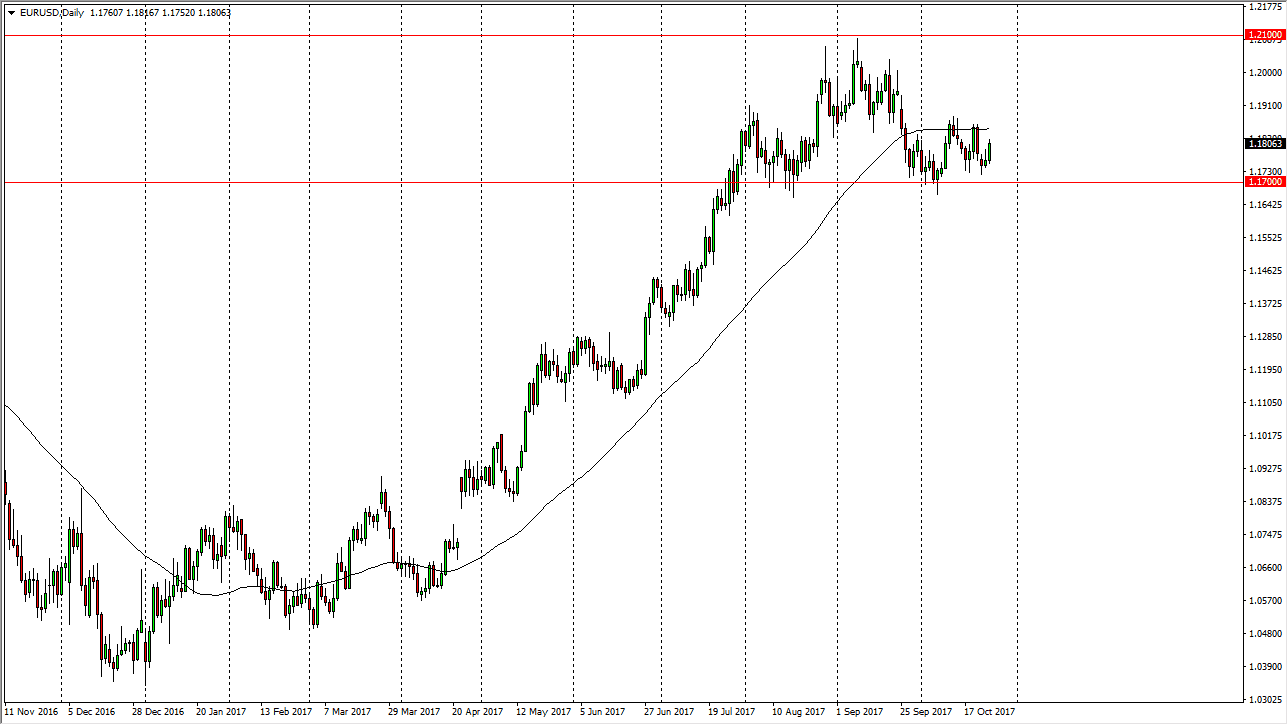

EUR/USD

The EUR/USD pair rally during the day on Wednesday, breaking above the top of the shooting star from the previous session. We have also seen the 1.17 level offer a significant amount of support, so I think that the market is ready to continue to rally. Having said all of that, I think that the market needs to clear the 50-day exponential moving average to show signs of a buying opportunity. If we get that, the market then goes to the 1.20 level above, and the 1.21 level. The 1.17 be broken to the downside should signify that we have just broken the neckline of a head and shoulders pattern, and that would send the market to the 1.13 level. In the meantime, wait for a signal to get involved, as we could see a lot of choppiness and noise in the market due to the interest rate announcement and more importantly the press conference afterwards coming out today from the European Central Bank.

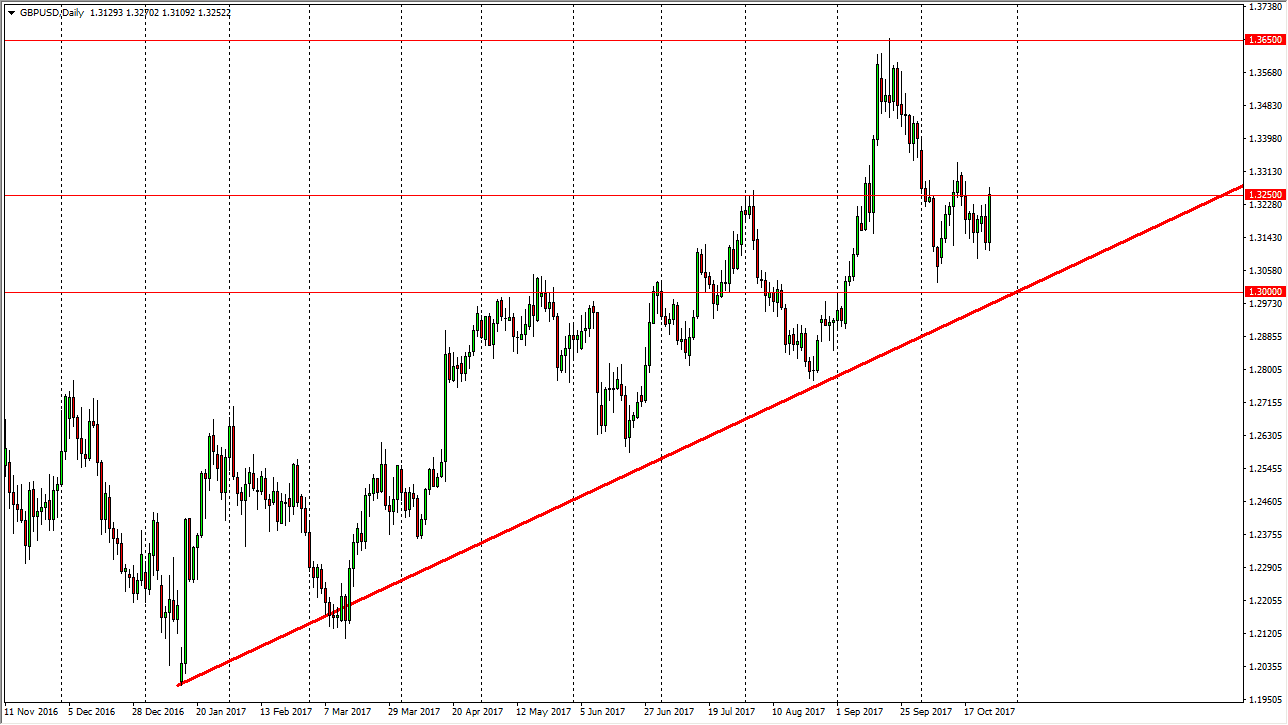

GBP/USD

The British pound exploded to the upside during the day after a stronger than anticipated CPI figure out of London was released. The 1.3250 level offers a bit of resistance, but I think it’s only a matter of time before we break out to the upside and continue to go even higher. The 1.3650 level will be the target, and I think that given enough time we will get there. If we do pull back from here, I would look for buying opportunity closer to the 1.31 level underneath that has been supportive over the last several sessions. The British pound looks likely to be supported by potential interest rate hikes coming out of London, although we also have an interest rate hikes coming out of Washington DC.