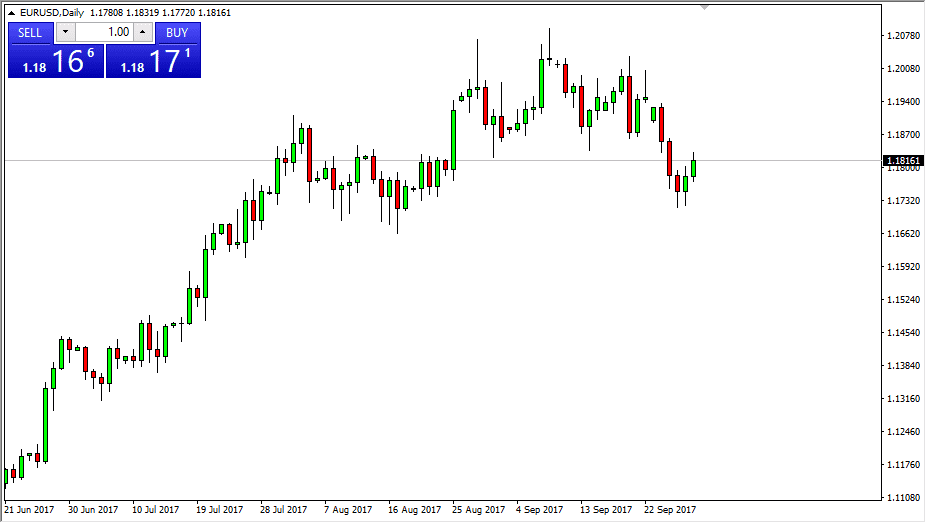

EUR/USD

The euro rallied a bit during the day on Friday, breaking above the 1.18 level. I think that the market has been sold off a bit too much over the last couple of sessions, we may see a return towards the 1.19 level. It looks to me as if the 1.1750 level has offered support, and if we can continue to find buyers in that area, we should continue to grind towards the 1.20 level again. However, if we were to break down below the 1.17 level, at that point I think the market is going to go looking towards 1.15 level which would to the scene of a major break out recently. A move above 1.21 is necessary to continue the longer-term uptrend that we have been involved in.

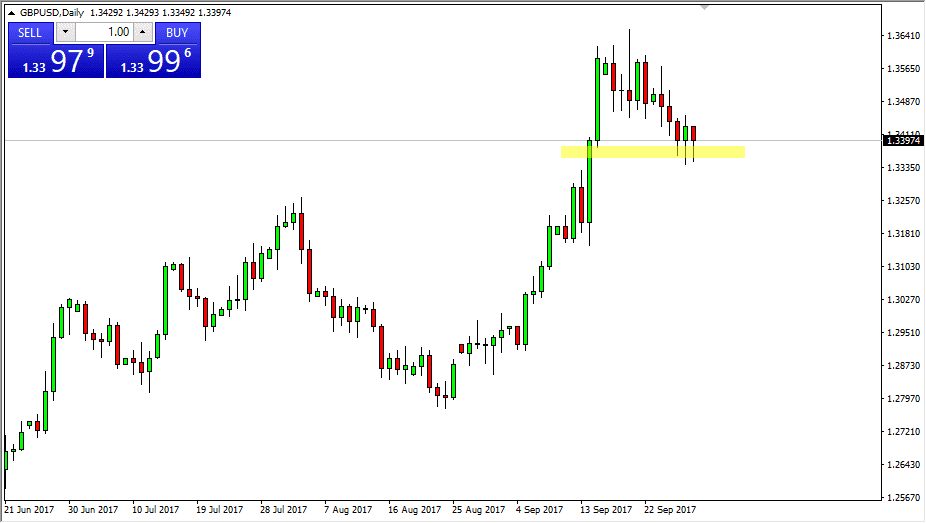

GBP/USD

The British pound initially fell on Friday, but just as we saw on both Wednesday and Thursday, found buyers underneath the 1.34 region. By forming a hammer for the third day in a row, it suggests to me that we are going to go looking towards the high is again. This is a market that is focusing on the Bank of England raising interest rates and the relative near future, and that should continue to propel the British pound higher. I believe in buying dips, I think that it’s only matter of time before we build up enough momentum to test the 1.3650 level again. Remember, that was where we gap lower after the boat to leave the European Union became public. Because of that, I think there’s a lot of resistance in that area, so this pullback to build up momentum has not been much of a surprise, especially considering that the market had gone somewhat parabolic beforehand.