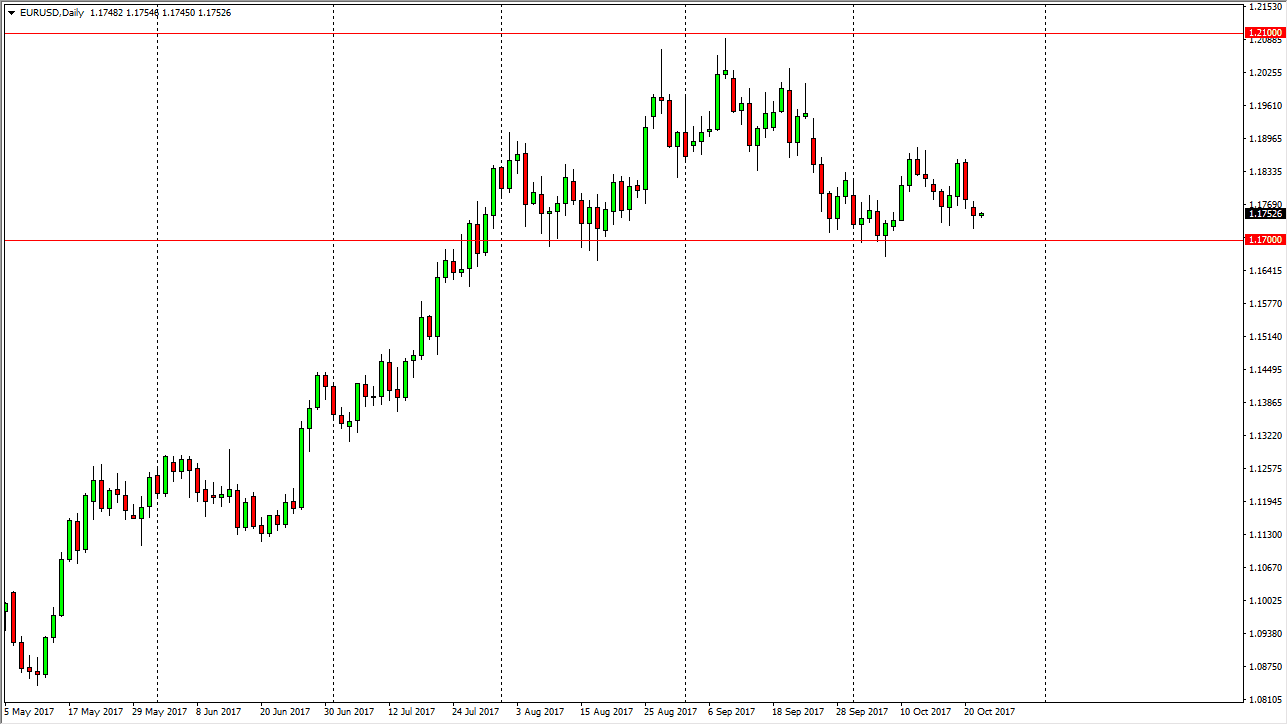

EUR/USD

The EUR/USD pair gapped lower at the open on Monday, as the US dollar continues to show strength. With the potential of tax cuts coming to America, the US dollar showed the signs of strength. It looks likely that we are going to test the 1.17 region, and we did in fact do that on Monday. Having said that, we ended up forming a bit of a hammer, so I think we have a real fight on our hands. If we can break above the top of the range for the day on Monday, then I think we bounced towards the 1.19 level. Alternately, if we break down below the 1.17 level, the market breaks down significantly due to the head and shoulders the just got broken down. At that point, I would anticipate that the 1.15 level is an easy target.

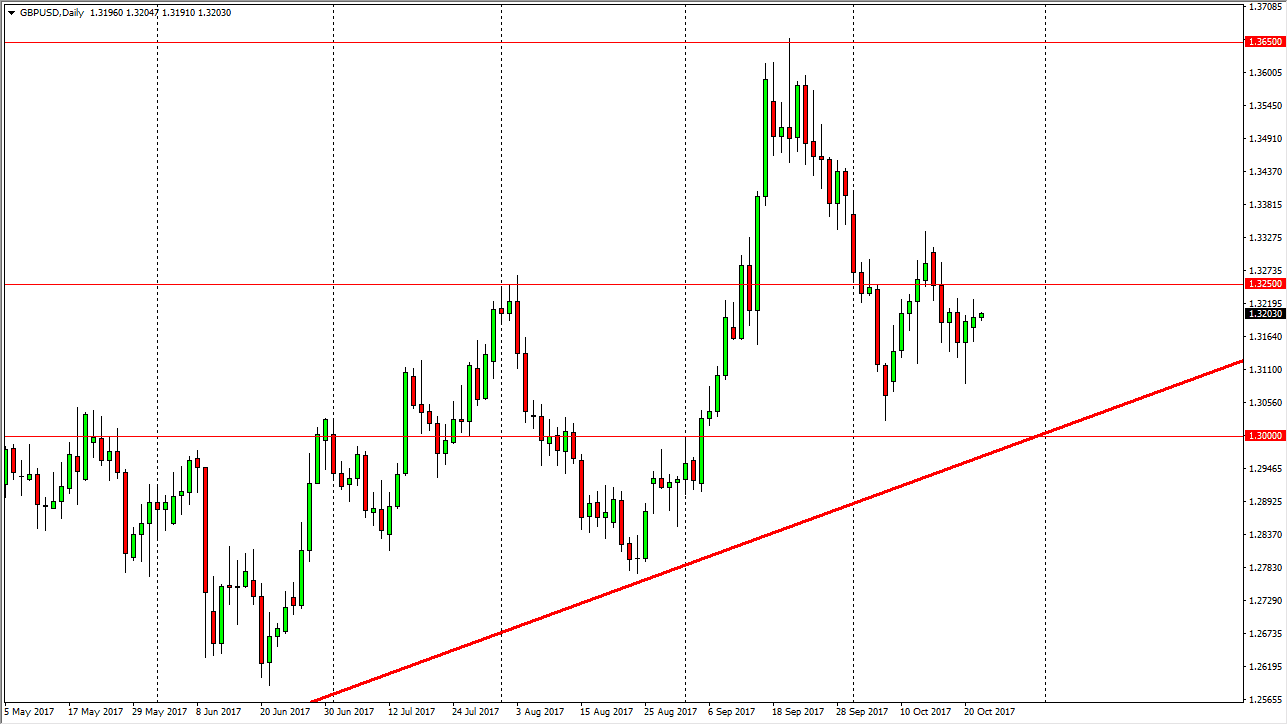

GBP/USD

The British pound had a volatile session on Monday as well, and as we go into the Tuesday session it looks like we are likely to reach towards the 1.3250 level above. If we can break above there, the market should continue to show signs of strength and we should go higher. I think this recently making a “higher low”, should send this market towards the 1.35 level above, and then possibly the 1.3650 level. Ultimately, this is a market that chomps around significantly, and it makes sense that the uptrend line below should continue to keep the uptrend intact. The Bank of England looks likely to raise interest rates, so I think it’s only a matter of time before we rally for a longer-term move. I also recognize that there’s a lot of value to be had in the British pound longer term, so I think that longer-term investors are probably interested as well.