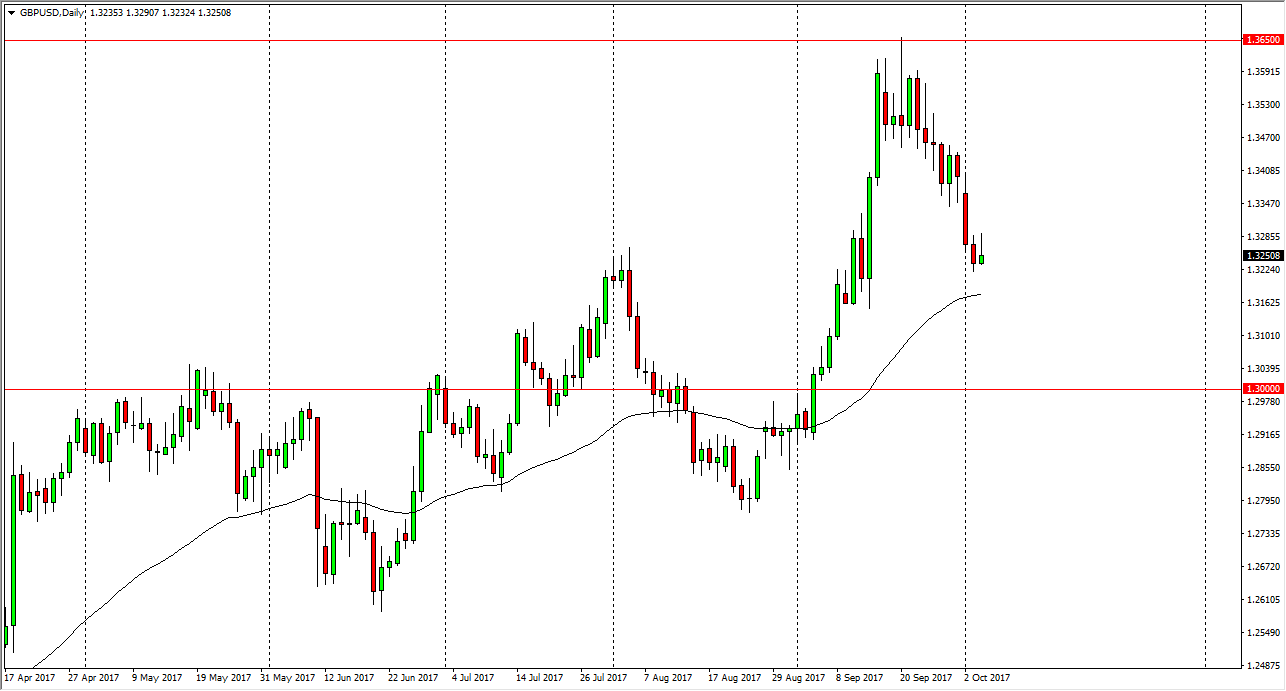

EUR/USD

The EUR/USD pair rallied slightly during the day on Wednesday, showing signs of resiliency. Ultimately, I think that the market will probably rally from here, and a break above the top of the range for the day should send this market towards the 1.19 level above. I also believe that the market will probably go looking towards the 1.20 level above, which has been resistance. I believe that a breakdown from here has plenty of support underneath, especially near the 1.15 level. Ultimately, I believe that the longer-term move to the 1.25 level is still valid, and that we will eventually see this happen. If we were to break down below the 1.15 handle, then I would be very concerned about the overall market.

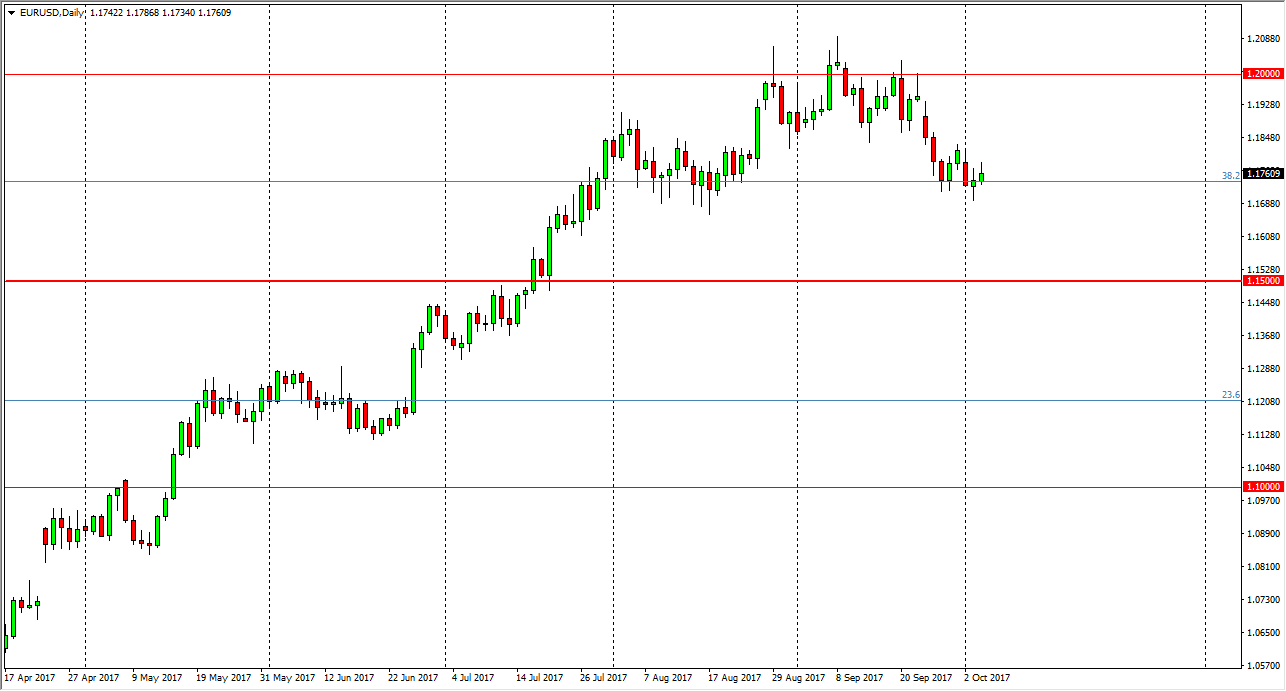

GBP/USD

The British pound rallied against the US dollars well during the day, testing the 1.33 level. If we can break above the 1.33 level, the market should continue to go towards the 1.35 handle, and then possibly even the 1.3650 level after that. That is where the market had gapped lower after the vote to leave the European Union, so I think it’s only a matter of time before we reset level and test it again. I think that the market will eventually build up the necessary amount of momentum to get above that level, but it will probably take several attempts. The 1.30 level underneath is the “floor” in the market, and I believe that the 1.32 level between here and there is probably supportive as well. Given enough time, I believe that the buyers will overcome the massive amounts of noise in the market, but keep in mind that choppiness will be a mainstay of this market and it will probably be something you have to live with.