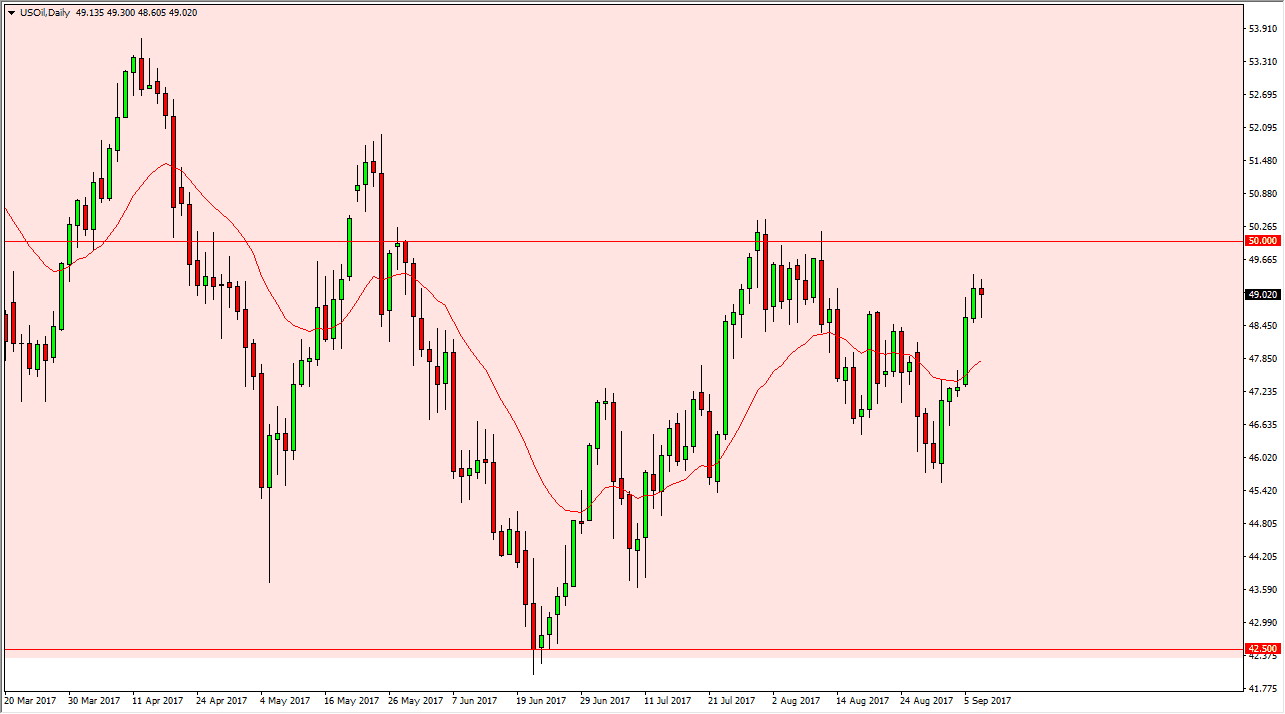

WTI Crude Oil

The WTI Crude Oil market fell during most of the session on Thursday, but found enough support at the $48.50 level to turn around and form a hammer. Ultimately, it looks as if we are going to continue to try to go towards the $50 handle, as hurricane Irma is going to continue to be on the minds of traders. We don’t know where it’s going to go yet, and depending on where it lands, this will dictate where the WTI market goes. Because of this, I believe that if you buy at this level you are chasing the trade. I suspect that if we get an exhaust a daily candle, especially near the $50 level, that’s a nice selling opportunity. This is a very dangerous market.

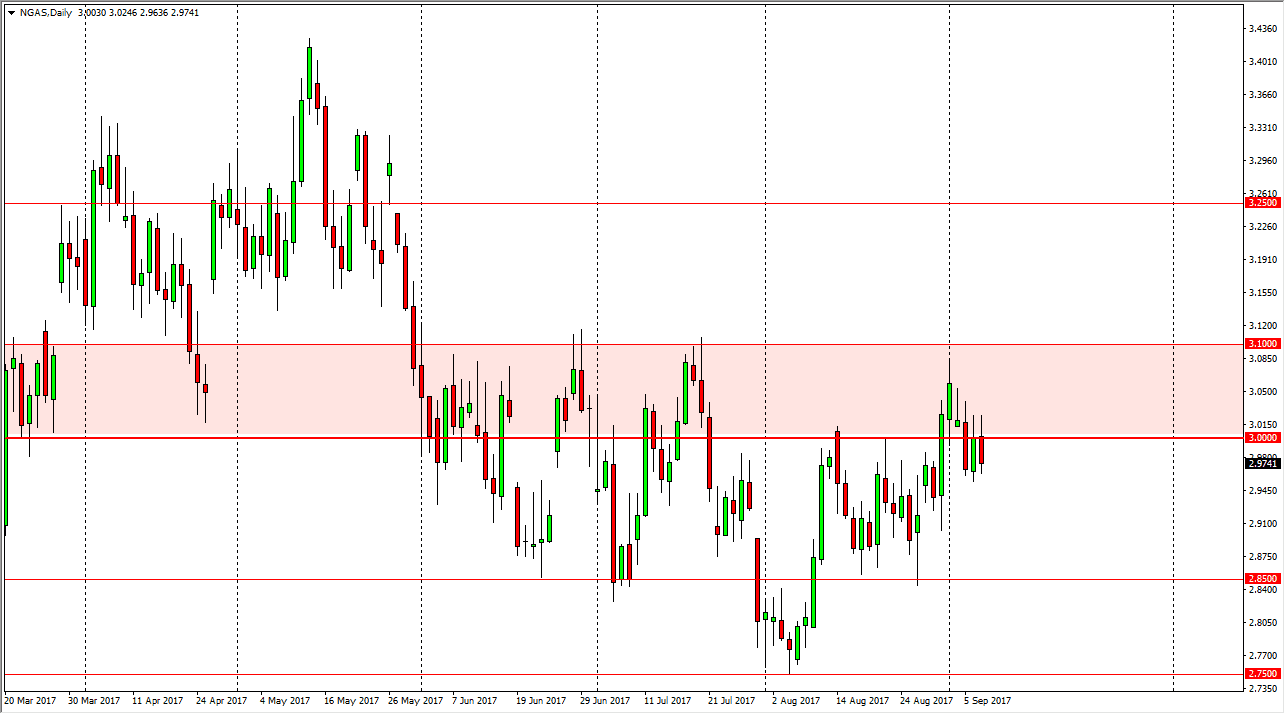

Natural Gas

Natural gas markets initially tried to rally during the day but continue to find resistance above the $3 handle. It looks now as if we are going to continue to go lower, perhaps reach down to the $2.85 handle. That’s an area that could be supportive, and I think that some of the bullish pressure has been speculators suggesting that perhaps the natural gas markets will see disruption due to the hurricane. It does not appear to be the case, and we had a slightly larger than expected build number come out during Thursday, yet another reason to think the natural gas will fall. Natural gas use in cooling will fall in America as we are rolling over into the fall season, and that leads us into a historically weak time of the year. With all of this going on, I think it’s only a matter of time before we continue to drift much lower. The $2.85 level will be supportive though, and I also see that there will be bumps along the way.