WTI Crude Oil

The WTI Crude Oil market shot higher during the day on Tuesday, as hurricane Irma looks likely to wreak havoc in the Gulf of Mexico. That will grind production to a halt, and that should send markets higher, as there will be less supply in the short term. However, longer-term we still have massive issues with oversupply, and I also think that the $50 level will offer resistance. Short-term though, looks like the buyers are in control, and I think that short-term pullbacks are opportunities to pick up value in a market that looks very bullish in the meantime. It’s not until the hurricane blows by that the market will calm down. At this point, it really comes down to the damage that does or does not happen, but right now it appears that traders are betting on disruption at the very least.

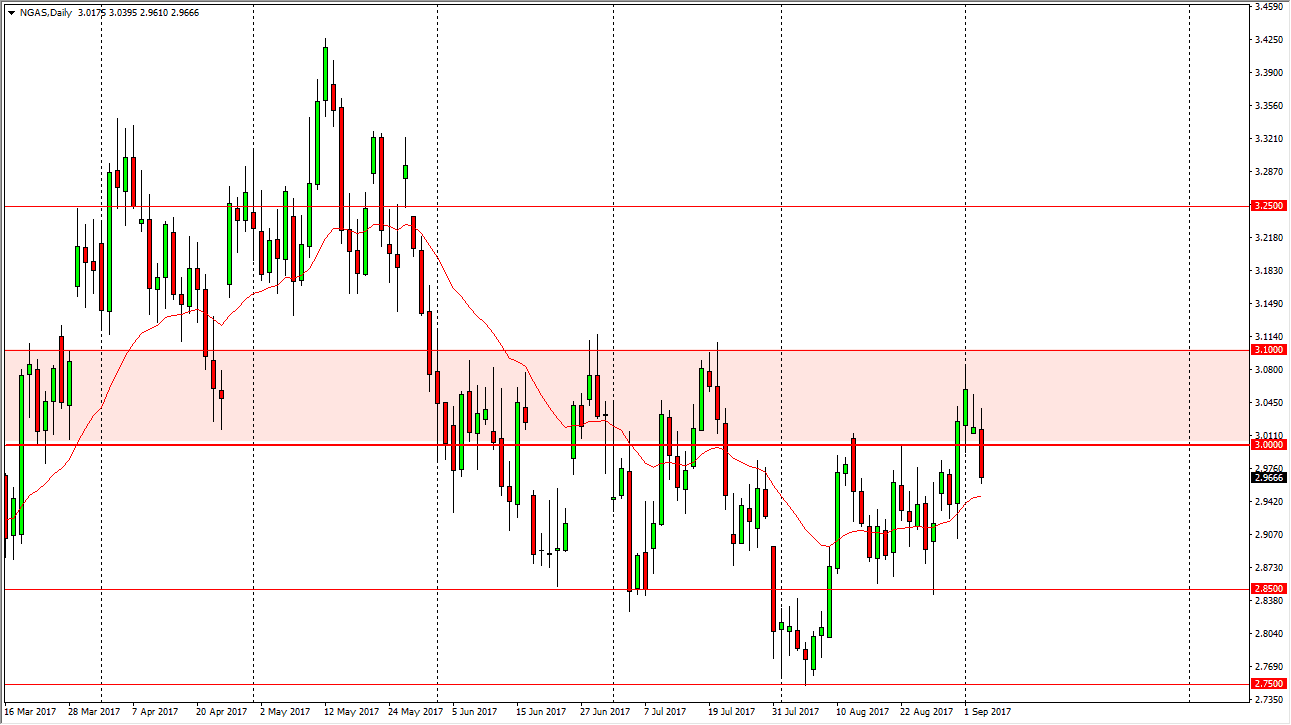

Natural Gas

Natural gas markets initially tried to rally, but just as we did on Monday, the sellers jump into the market and started pushing the contract lower. Not only that, but we have broken significantly below the $3 level. I think that the markets probably going to go looking for the $2.85 level over the longer term, but there so much noise underneath that I would anticipate that the volatility will be fairly strong. There’s a lot of chatter by retail traders that this market could turn around due to the hurricane, but right now it does not look like the hurricane is can come anywhere near disrupting the natural gas markets. Because of this, I think that the resistance barrier between the $3 and $3.10 level continues to be the top of the range that we are trading in, and that we will eventually go lower. It’s possible may be trying to form some type of bottoming pattern, but we have a long way to go before the trend would change. With over 300,000,000,000,000 ft.³ of proven natural gas in the ground in America, any rally is can be short-lived.