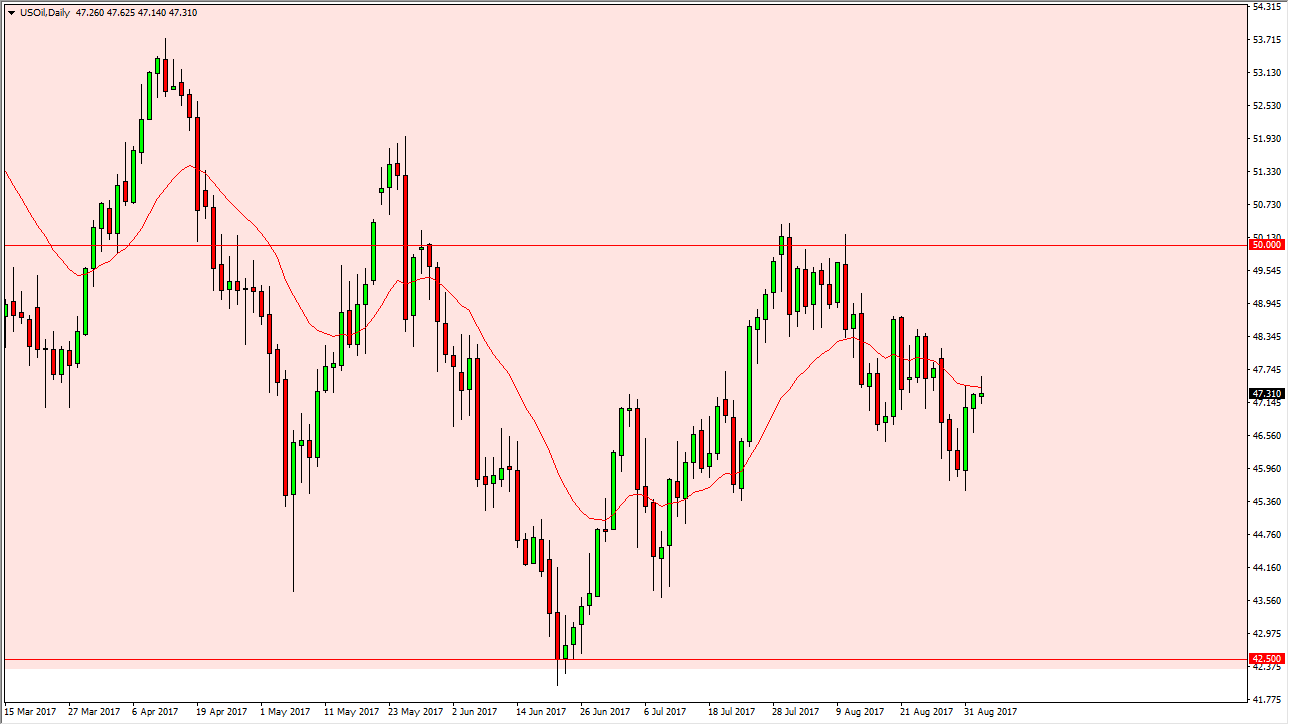

WTI Crude Oil

The WTI Crude Oil market tried to rally a bit during the thin trading session on Monday, but you can see that we turned around. Ultimately, the shooting star that formed for the day suggests that we could roll over again. Ultimately, the market will continue to be volatile, and you can make an argument for a downtrend in general. However, if we break above the shooting star for the day, it’s likely that the market will continue to reach towards the $49 level, and then eventually the $50 level. I think the $50 level will be massively resistive, and would be an excellent area the start selling from. However, it’s possible we may not get the opportunity as it looks like the market is already running into a bit of exhaustion.

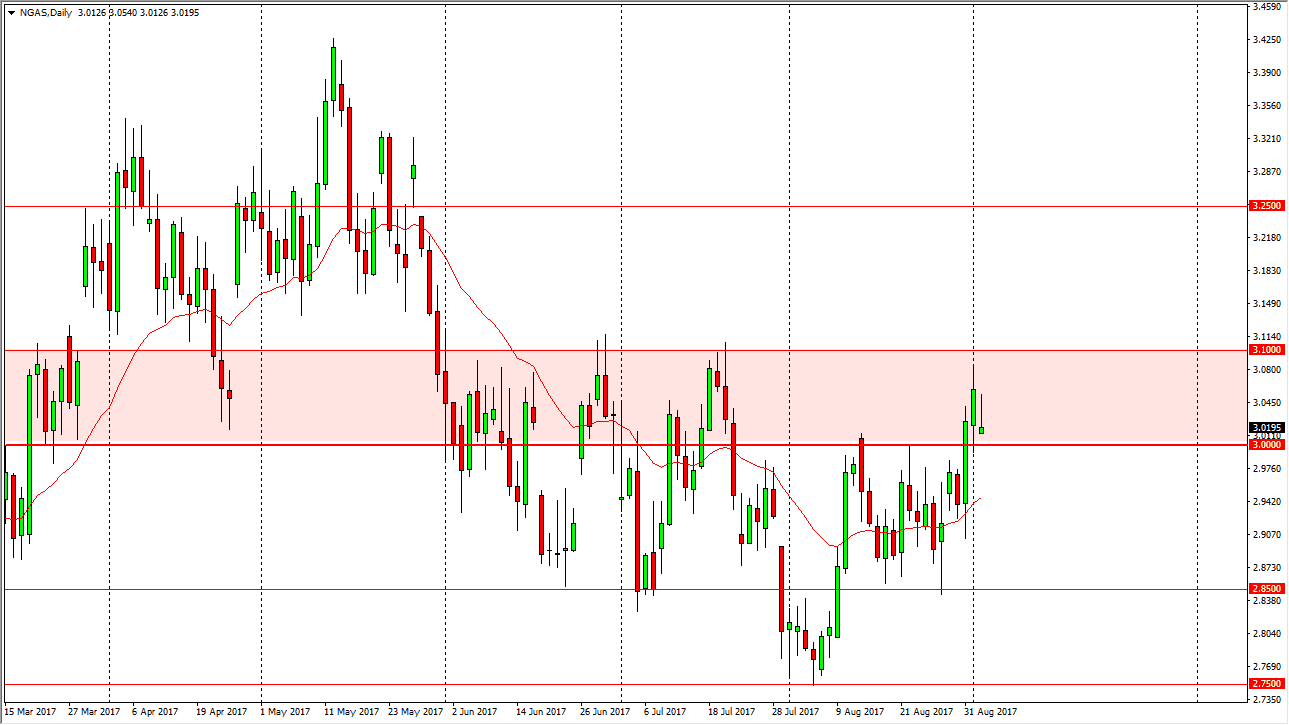

Natural Gas

The natural gas markets gapped lower at the open on Monday, but then shot much higher to fill that gap. We have turned back around to form a shooting star, and I now think that if we break below the $3 level, the sellers would jump into this market to punish it yet again. That would be a very strong indication that the bullish pressure after the hurricane is probably all but about done, and if that’s the case I think that the market will probably continue to go down to the $2.90 level, and then possibly the $2.85 level. A breakdown below there sends this market down to the $2.75 level, but I think it will be difficult to break down to that area in the short term. I look at rallies as selling opportunities, and the bullish pressure after the hurricane is a bit of an anomaly. Longer-term bearish pressure should continue.