WTI Crude Oil

The WTI Crude Oil market fell during the session on Tuesday, but found enough support near the $51.50 level to turn around. By doing so, we ended up forming a hammer which is of course a bullish sign, and I believe it is only a matter of time before the buyers return. I suspect that there is a certain amount of a “floor” in the market near the $50 level, and with the Crude Oil Inventories figures coming out today, we could get furthermore reason to see the market go higher. However, if we pull back from here, the knee-jerk reaction after the inventory number could be a buying opportunity as traders look out into the future. A breakdown below the $49 level would be very negative, but until then I think that there is more of a proclivity for buyers to jump in and pick up pullbacks.

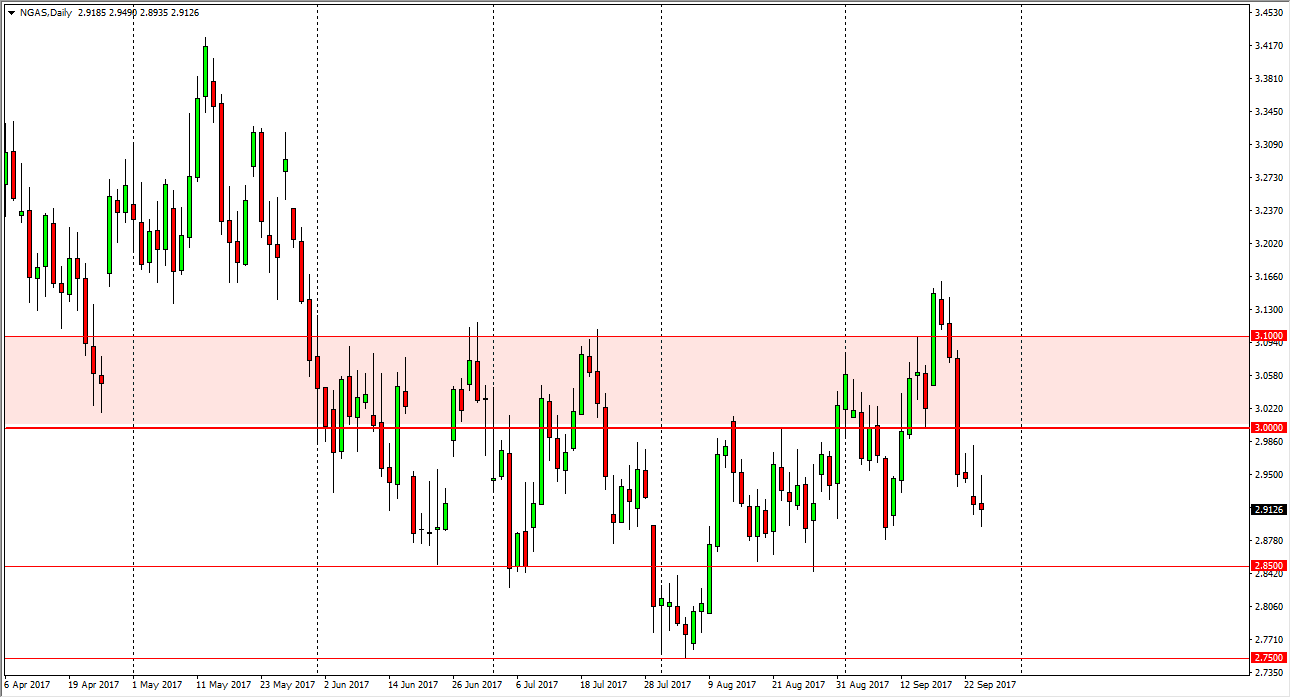

Natural Gas

Natural gas markets continue to be very choppy, and of course show a lot of indecision. I believe that the market should continue to find sellers though, because every time we rally, the sellers come back. In fact, the oversupply of natural gas should continue to be a longer-term issue, and I believe that the market won’t be able to rally for any significant amount of time, even though we are heading towards the higher demand part of the year. Quite frankly, if 2 hurricanes can’t wipe out the supply of natural gas, it’s hard to believe that anything else will. I believe that the $2.85 level underneath continues to be very supportive, but if we can break down below there, the market should continue to be bearish and could go as low as the $2.75 level next.