WTI Crude Oil

The WTI Crude Oil market fell initially during the session on Thursday, but found enough support at the $50 level to turn around to form a nice-looking hammer. The hammer of course is a bullish sign, and if we can break above the top of that we should continue to go higher. This will be especially true if we can break above the $51 level, as it sends the market looking for $53.50. I think pullbacks will continue to be buying opportunities until we break down below the $49 level. This is a market that will continue to be choppy, but at the end of the day, it looks like the buyers are in control and that we should continue to go to the upside when given the opportunity.

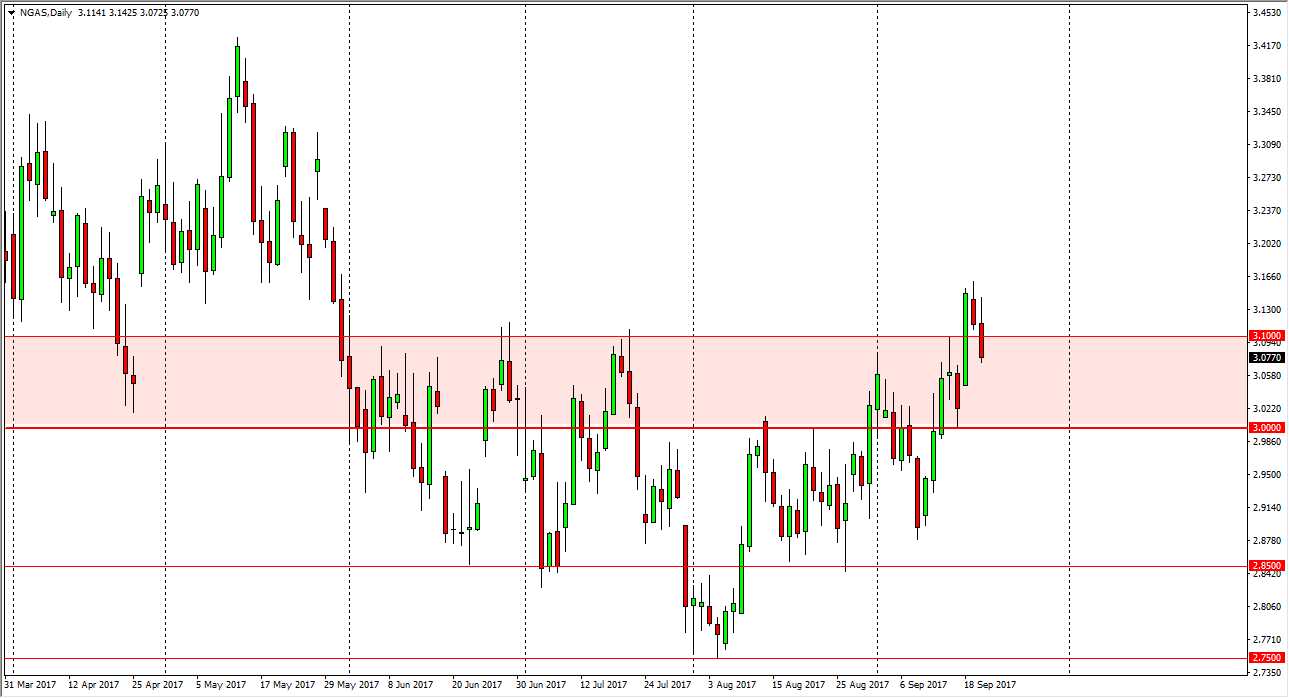

Natural Gas

Natural gas markets had an extraordinarily volatile and negative day during the day on Thursday, with the inventory number disappointing. You can see that we lost almost 5%, and now that we have sliced through the $3 level, I think we will probably go looking towards the $2.85 level underneath. Rallies at this point should show signs of exhaustion given enough time, as we have suddenly turned around yet again. I think that this turnaround is extraordinarily negative, as breaking above the $3.10 level was supposed to be a massive breakout, but clearly, we have not done so. This market could not build up value after the damage of the hurricanes, so I honestly have no idea what will finally send this market higher for the longer term. Ultimately, this is a market that seems to be suffering from mass of oversupply on a longer-term perspective. I have no interest in buying, now that we have seen this complete repudiation of any type of rally.