WTI Crude Oil

The WTI Crude Oil market gapped higher at the open on Wednesday, clearing the $50 level. We went as high as the $51 level but found some resistance. By doing so, we turned around to look for some type of support, and I think we will find it somewhere near the $50 level. If we can break above the highs of the session, I think we then go to the $52.50 level. However, if we were to break down below the $49 level that would be a very negative sign for crude oil. I believe we will continue to see a lot of volatility, and the Federal Reserve being a bit more hawkish than anticipated could provide yet another reason to think that this market will be difficult to handle.

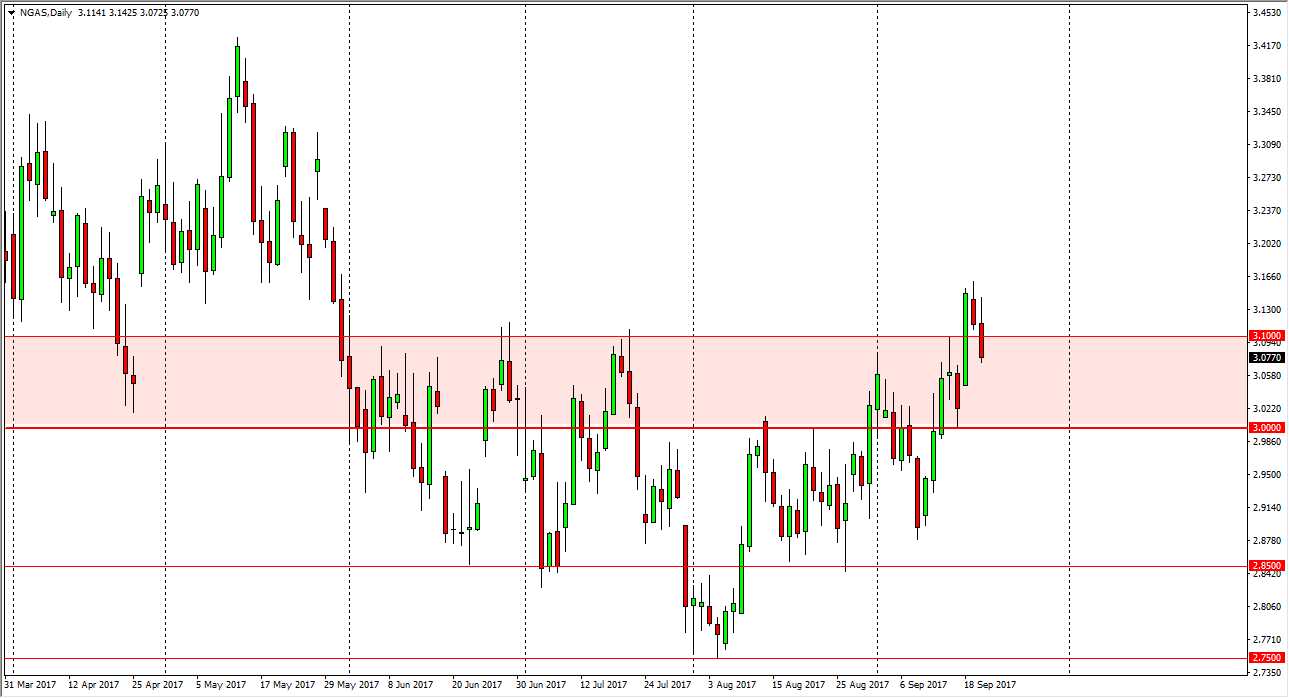

Natural Gas

Natural gas markets initially tried to rally but then fell through the $3.10 level. We close towards the bottom of the day, and that’s a negative sign. However, I would not be willing to sell this market until we break down below the $3 level again. I think in the meantime, some type of supportive daily candle could be a buy signal, but regardless, this is going to be a very choppy market that causes a lot of headaches for those who feel the need to be involved. For myself, I’m standing on the sidelines because quite frankly, there is no clarity. Sometimes taking no position is the best position, and I feel that’s going to be the case with natural gas of the next several sessions. Obviously, we have gotten very bullish in the short amount of time, but this pullback and slicing through what should have been rather supportive levels has me scratching my head, which tells me it’s time to sit on the sidelines.