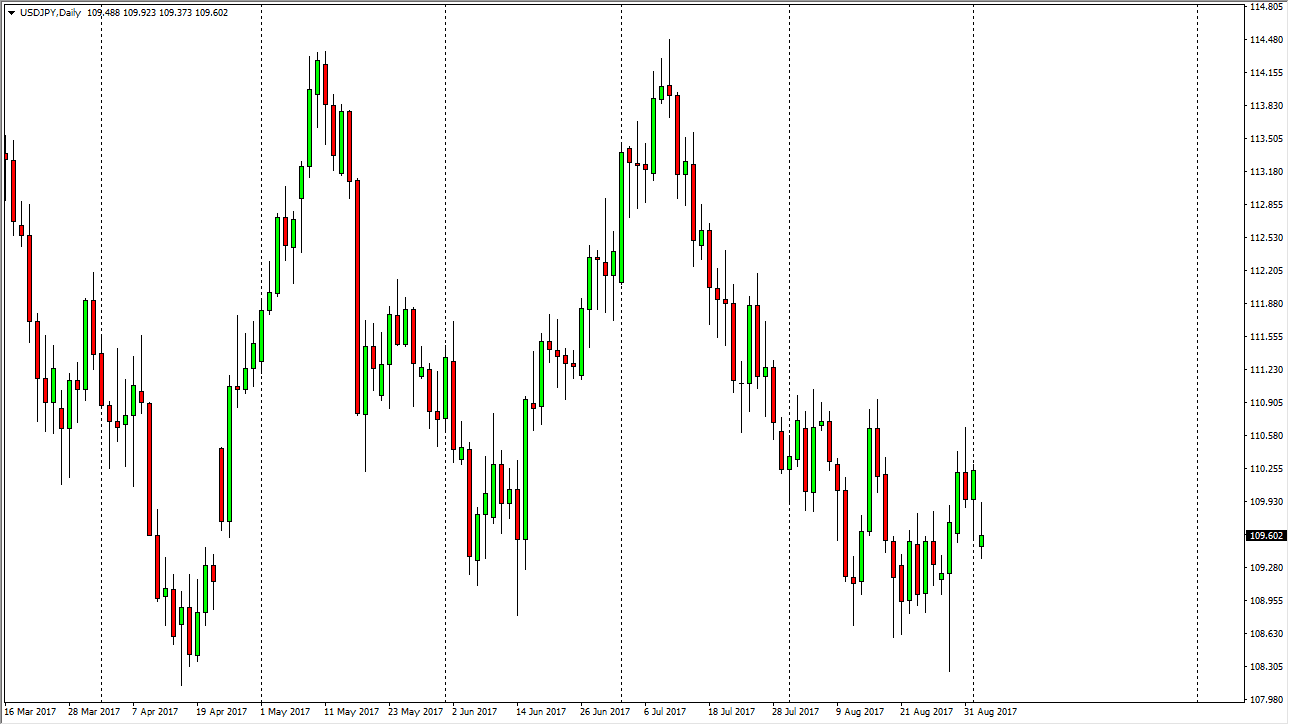

USD/JPY

The US dollar gapped lower at the open on Monday against the Japanese yen as the North Koreans tested a nuclear bomb. This had a “flight to safety” effect on the Forex markets, and that generally means that people by the Japanese yen. We have rallied to fill that gap, and ended up forming a less than stellar candle. I think that there is plenty of support down to the 108.50 level though, so I’m waiting to see a supportive candle that I can start buying. Alternately, a break above the 111 level would be reason enough to go long as well. Although we have sold off recently, the reality is that we are still well within a consolidated rectangle. I think it’s only a matter of time before the market goes higher. If we do break down below the 108.50 level, then the market could very well drop to the 105 handle.

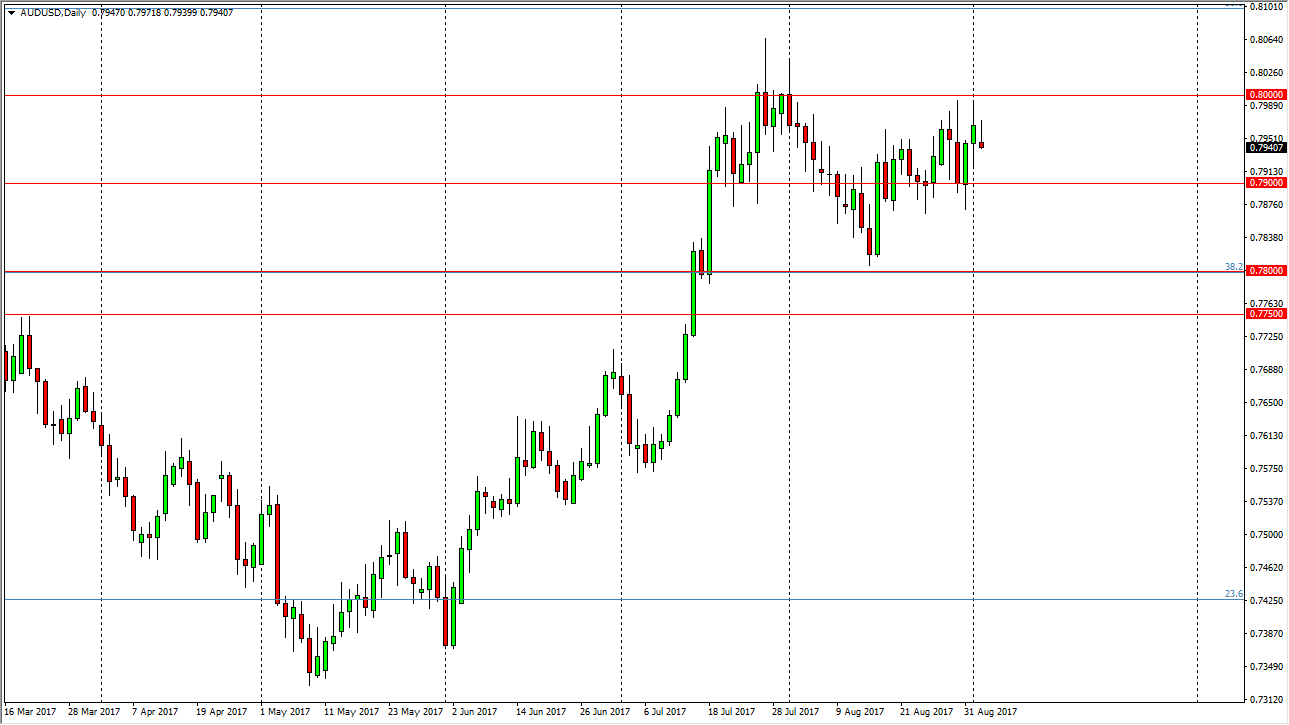

AUD/USD

The Australian dollar had a very volatile day as well, but we are awaiting an interest rate decision out of Australia. That will have an effect on this market, but not much is expected to come out of the announcement itself. Because of this, I believe that we will probably pull back slightly, finding support at the 0.79 handle. Alternately, if we break above the 0.80 level, it’s a longer-term buy-and-hold strategy just waiting to happen, if we can clear it significantly. Expect volatility, but I think ultimately, we will break out. This will be especially true if the gold markets continue to look as strong as they have as of late. This is a market that continues to look healthy, and this recent pullback makes sense as we have gotten a bit ahead of ourselves. I expect difficult trading ahead.