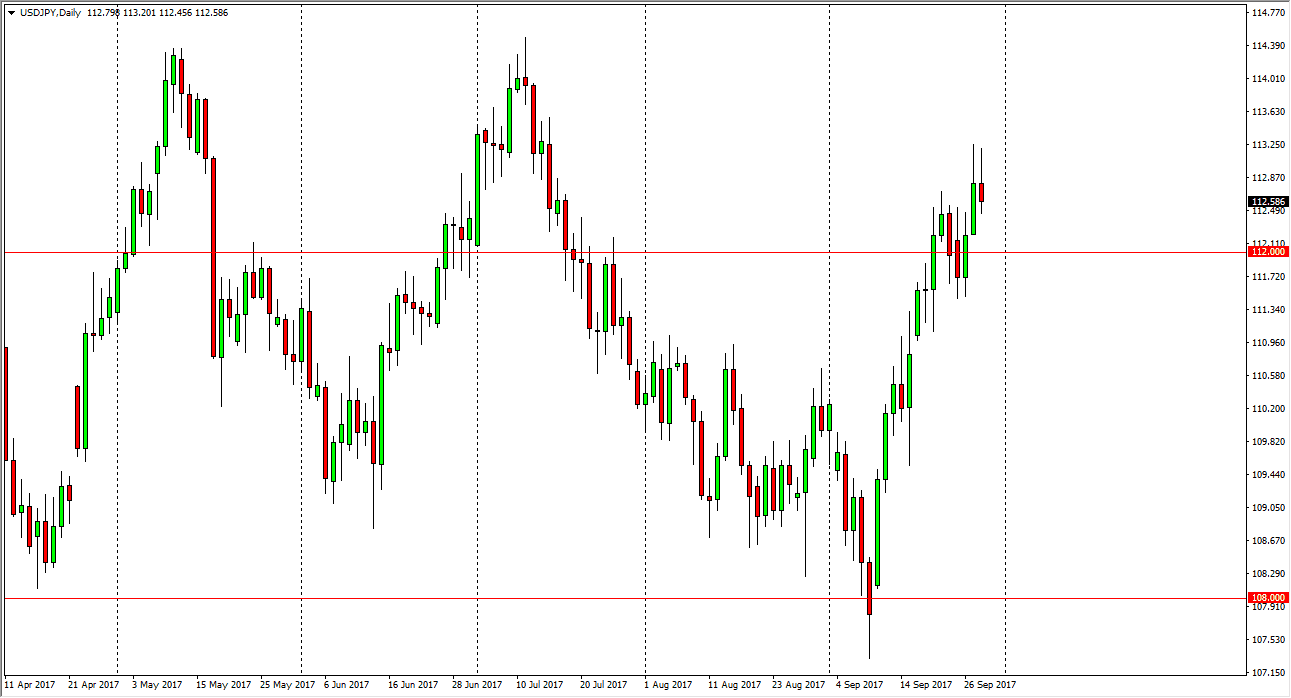

USD/JPY

The US dollar went back and forth during the course of the day on Thursday, as we ended up forming a bit of a shooting star. However, I think there is a massive amount of support just below, especially near the 112 handle. Even if we were to break down below there, I think the 111 level is also supportive as well. The longer-term consolidation in this market dictates that we will probably go looking towards the 114.50 level. Typically, the market tends to reach towards these areas, and this market should continue to favor the US dollar due to the bond trade, and of course the idea that the Federal Reserve is shrinking its balance sheet. I believe that although we are bit overextended, pullback should be looked at as value.

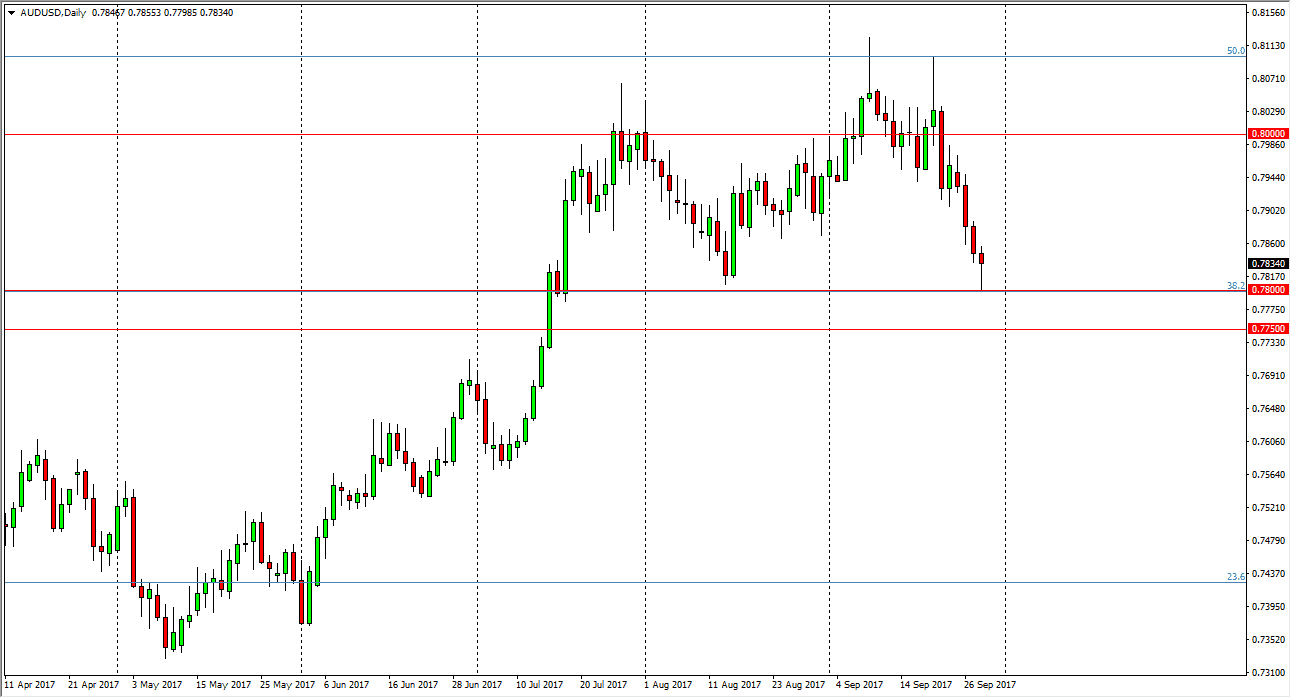

AUD/USD

The Australian dollar fell towards the 0.78 handle, which was the top of the range of resistance from the previous consolidation area. By forming a hammer, it looks as if the market is going to continue to go higher, and a break above the top of the daily range should send this market looking towards the 0.80 level. That’s an area that has been important over the last several decades, and I think it will be attracted to market participants regardless. I believe that a break above the 0.81 level will send this market much higher, and more of a buy-and-hold attitude will take over as we continue to go towards the 0.90 level. If we do break down below the 0.7750 level, that is a very negative sign and that should send this market much lower. Pay attention to gold, and has its typical influence on the Australian dollar as the 2 markets are positively correlated. I have no interest in shorting until we break down.