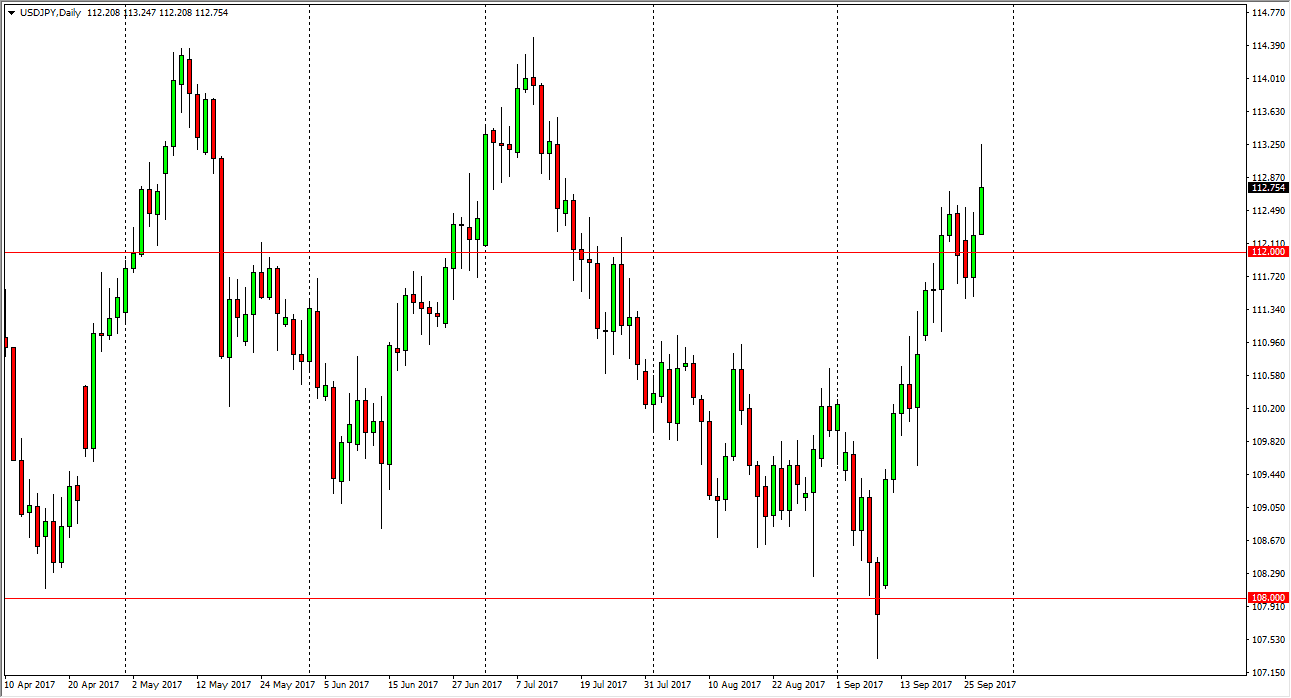

USD/JPY

The US dollar rallied significantly during the session on Wednesday, breaking towards the 113.25 level. We did pull back a little bit though, but I still think there’s plenty of support underneath, especially near the 112 level. Given enough time, I think we go towards the 114.50 level above, which is the top of the recent consolidation. I think if we can break above the 115 level, then we go much higher. Pullbacks should continue to be buying opportunities, extending down to the 111 level. The interest rate differential between the United States and Japan continue to be expanding, and that should continue to drive this market to the upside overall. A breakdown from here could go as low as the 108 level, but I doubt that’s about to happen.

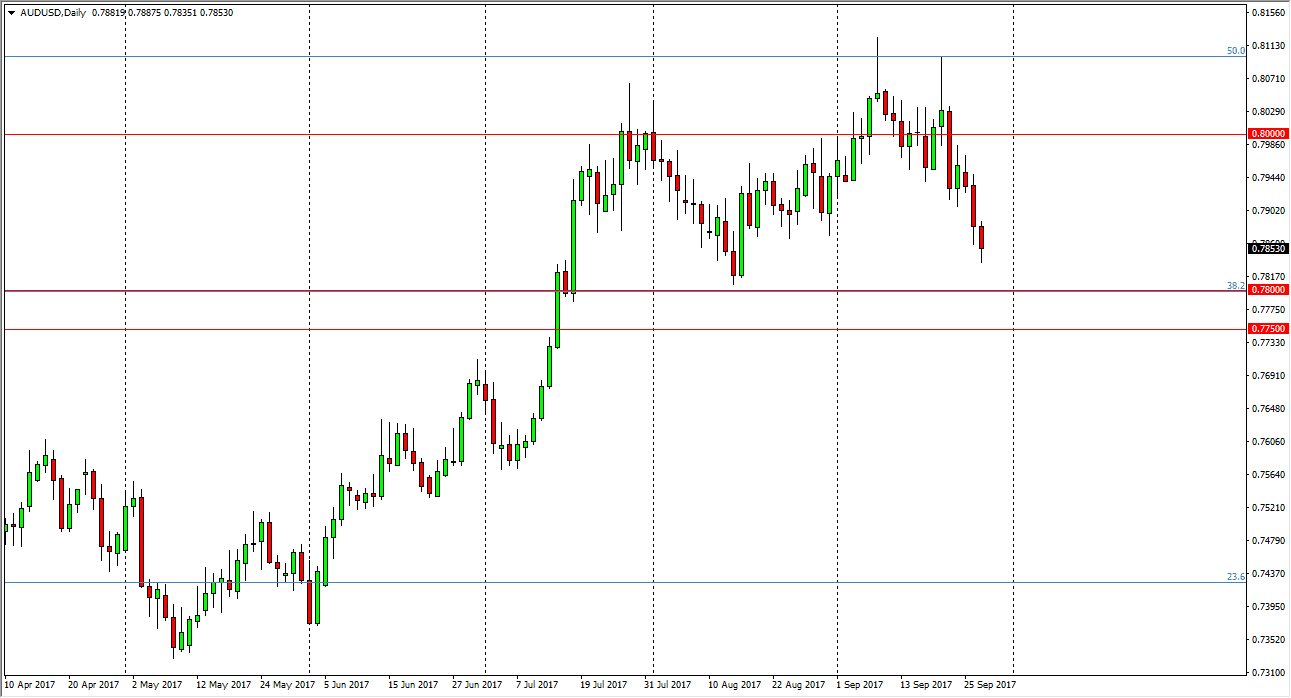

AUD/USD

The Australian dollar fell during the session, as it looks like we are going to go lower and look for support at the 0.78 handle. The 0.78 level underneath extends down to the 0.7750 level, which is a zone of resistance that we broke above there, and now we should find support in this area. I suspect that we are trying to build up enough momentum to finally break above the 0.80 level, which is a longer-term resistance barrier going back decades, and is an area where we continue to see a lot of noise and attention when it comes to the Aussie dollar. If we were to break down below the 0.7750 level, the market should then break down. However, I believe that the market will continue to be bullish longer-term, but right now we are having a bit of softness in the gold market, and that of course isn’t helping the situation with the Australian dollar at the moment.