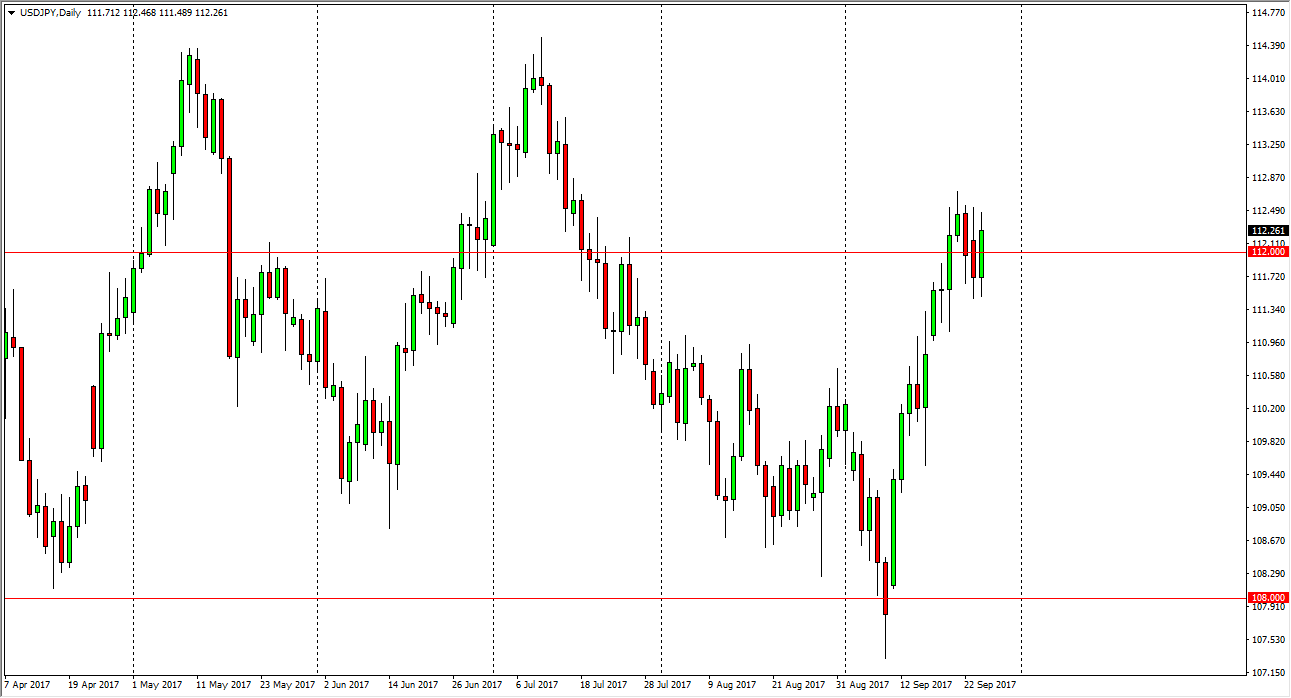

USD/JPY

The US dollar rallied against the Japanese yen, breaking above the 112 level. This is a market that is highly influenced by the attitude of stock markets in general, and of course the treasury market. We are starting to see a bit of consolidation in the S&P 500, with a bullish attitude. If we get a move higher in the market, that will probably be enough to send this market higher as well. I believe the pullbacks should find plenty of support near the 111 level, so he the way I’m not interested in selling and I believe that we will reach towards the top of the longer-term consolidation, near the 114.50 level above.

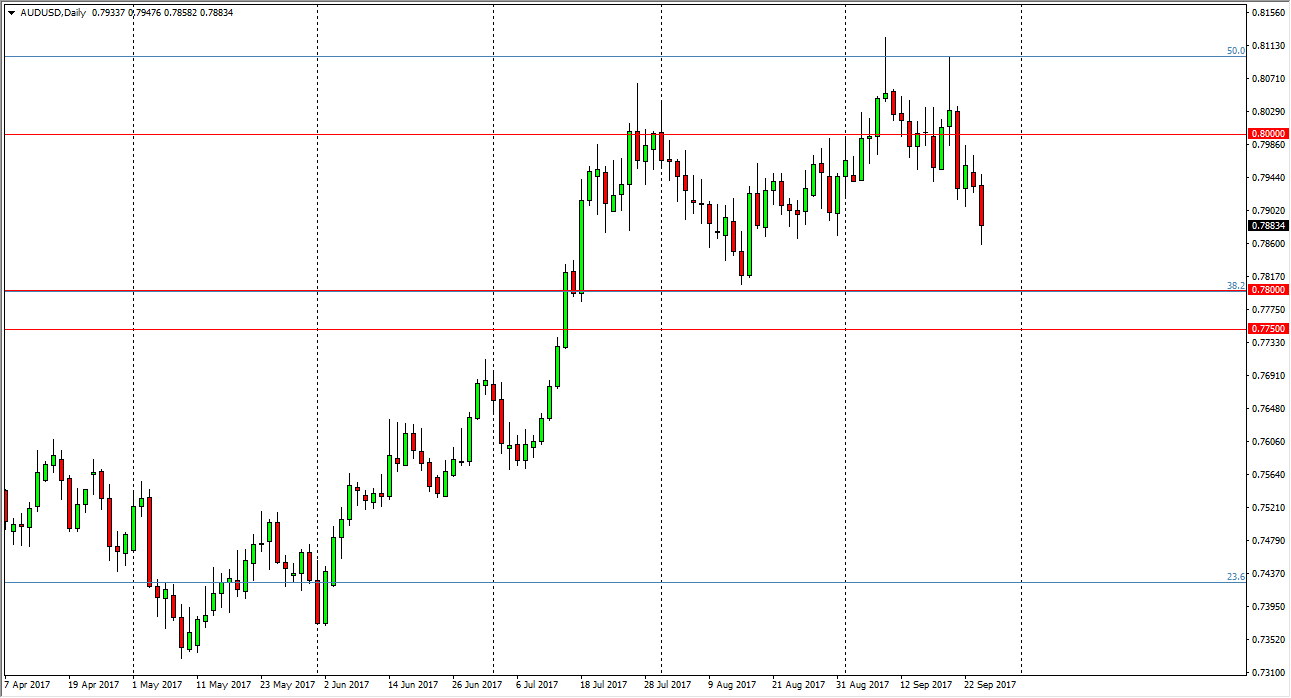

AUD/USD

The Australian dollar sold off rather drastically during the day, as gold got pummeled. The US dollar continues to strengthen, and I think were to go looking towards the 0.70 level underneath. Because of this, it’s likely that we will continue to see bearish pressure over the next day or so, but I think at that area we should start to see buyers coming back. If we get that, it could be a nice buying opportunity as we continue to bang around and try to build up enough momentum to finally clear the 0.80 level for good. Alternately, if we break down below the 0.7750 level, the market probably breaks down significantly, and the uptrend would then be over. If we do get to break out to the upside, then it becomes more of a “buy-and-hold” scenario, as this market should continue to see value in this pair. Gold markets of course have an influence as well, so pay attention to them which currently sit at precipitous levels. Because of this, I believe that the market will be volatile.