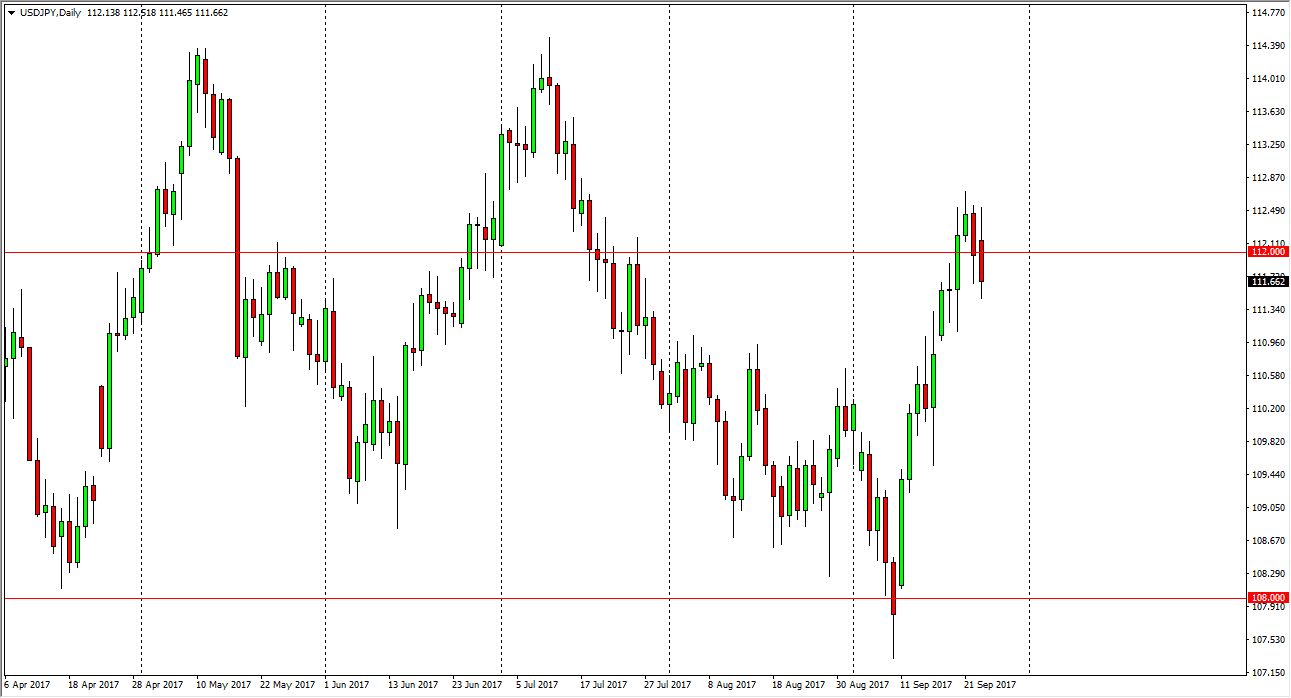

USD/JPY

The US dollar initially tried to rally during the session on Monday, but found enough resistance at the 112.50 level to turn around and break significantly below the 112 handle. Ultimately, this market looks as if it could roll over a bit, but I think there’s plenty of support below. I think this pullback will be a nice buying opportunity given enough time, and then eventually the buyers will see the value in the US dollar. We are a bit overextended, so it makes sense that we may have to rollover slightly. Ultimately, the 114.50 level above should be the target, which is the top of the overall consolidation that we have seen for months. I believe that the market should continue to find buyers, especially near the 111 level, and that the overall risk appetite of the market will recommend the direction as well.

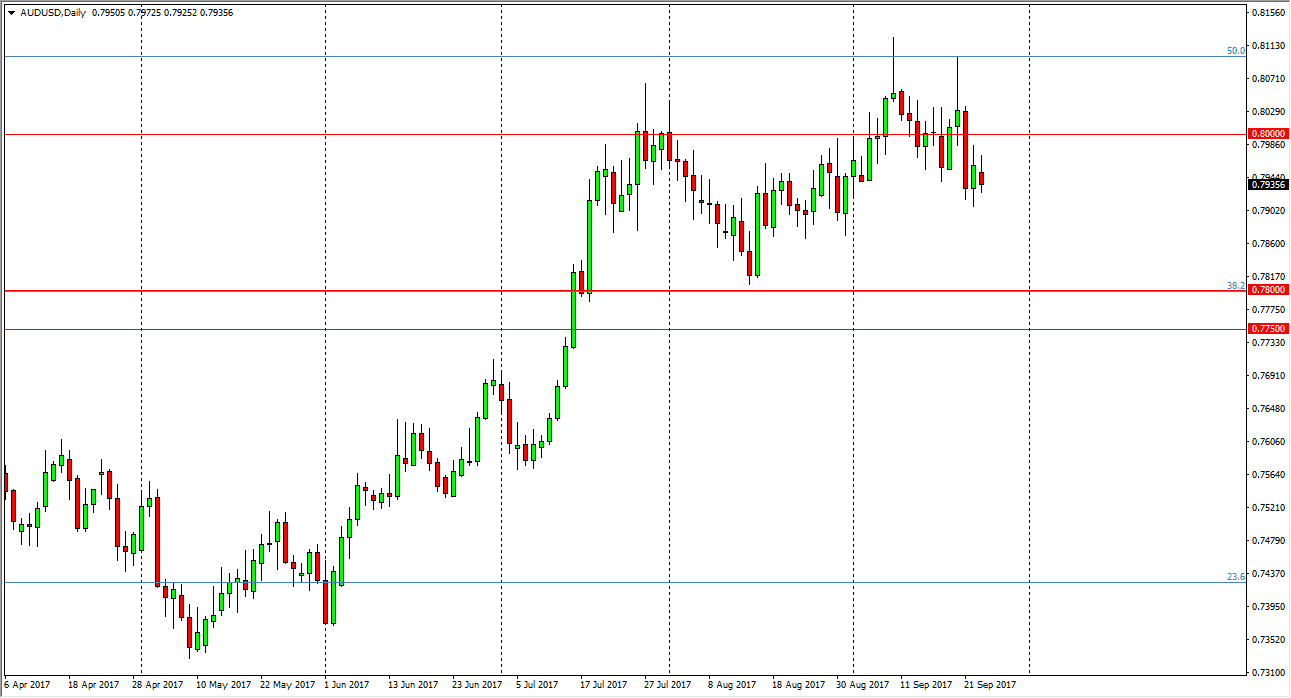

AUD/USD

The Australian dollar initially tried to rally but then gave back most of the gains as we rolled over. The market looks as if it is trying to fall from here, perhaps looking towards the 0.78 level. Given enough time the market is extraordinarily risk sensitive, and with that the noise coming out of North Korea, it makes sense that we may rollover a bit. However, I think that gold markets are also a major driver of this market, and gold can get a bit of a lift if the “risk off” trade comes into play. Because of this, expect extreme amounts of volatility but I suspect that the market is probably more apt to sell off than to go higher in the short term. Ultimately, I do think that there are plenty of buyers underneath but we may need to digest some of the news first.