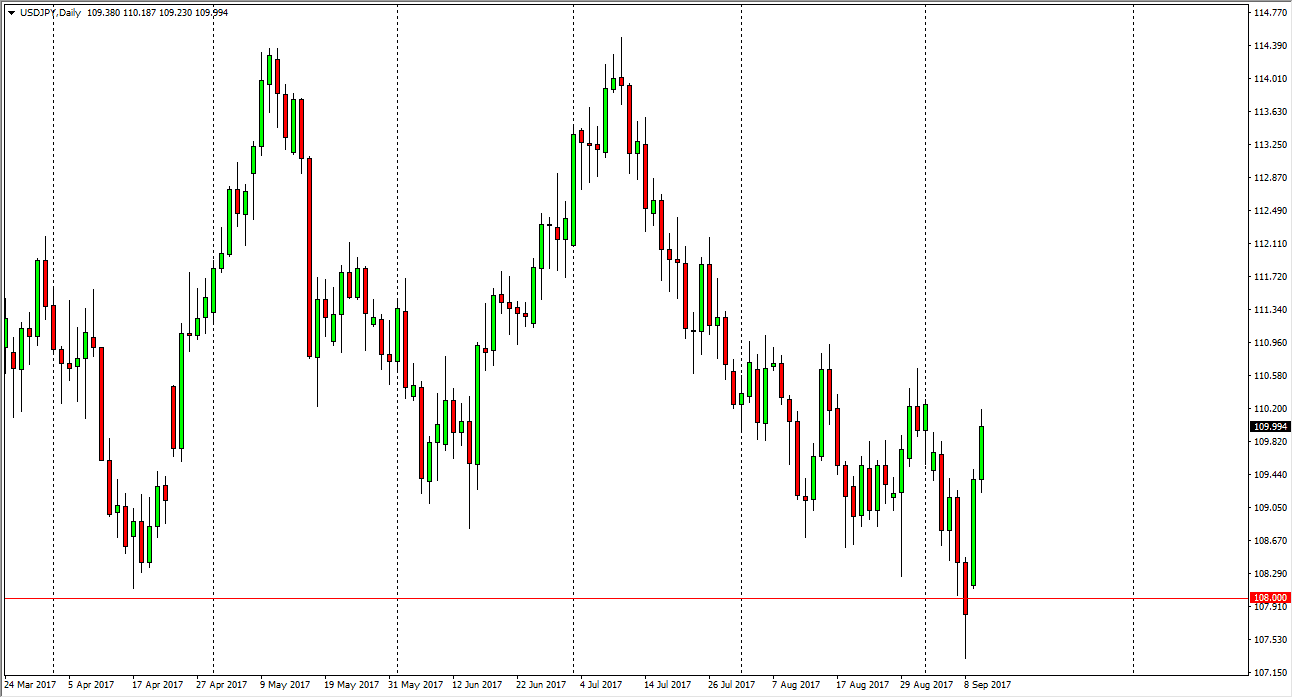

USD/JPY

This is going to be one of the more interesting pairs to watch. We have gone parabolic over the last several sessions, as we have slammed into the 110 level. Most of this rally will have been a bit of a relief rally, as the North Korean situation has calm down and the damage from the hurricane in Florida wasn’t as bad as once feared. However, I see a significant amount of resistance extending to the 111 level, so I think the sellers will be coming back. If we clear the 111 level, then I might be more convinced. I think were a bit overextended at this point and there is probably more downside risk than up. I don’t think we are going to break down significantly, just that we need to continue to churn.

AUD/USD

The Australian dollar fell to the psychologically important 0.0 level during the Tuesday trading session, which is an area that needs to hold. If it does not hold, then the uptrend will be in for a couple of days of pulling back, perhaps sending this market down to the 0.79 handle. I think that eventually we will break out too much higher levels, but we currently are looking at a market that is chewing through massive resistance. The 0.80 level is important on charts going back decades, so I think it’s important that we can maintain above that level. If we do, I don’t see the reason we don’t go as high as 0.90, but the lift that the precious metals markets had given us is all but gone. This now comes down to the Federal Reserve, and whether they can raise interest rates or not. Longer-term, I believe that the buyers will assert their well.