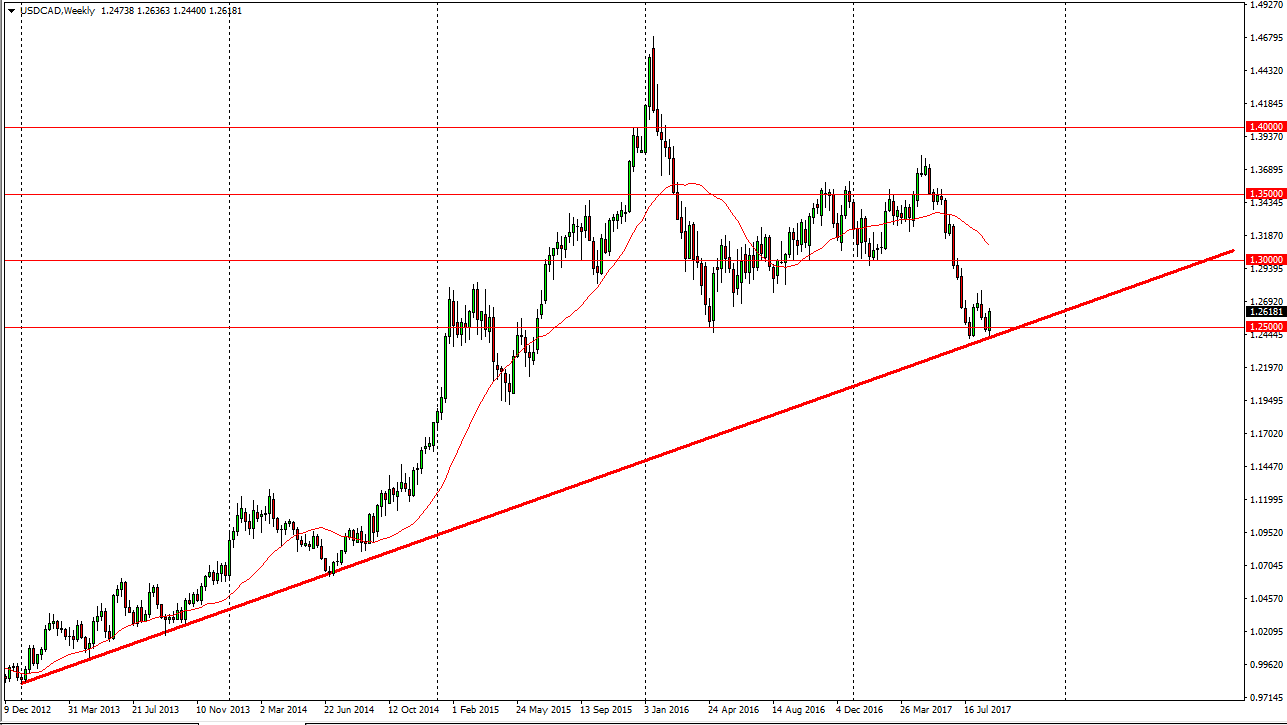

The US dollar has been very choppy over the last several weeks, as we test the massive uptrend line I have marked on the chart. I believe this month will be crucial for this pair, and if there’s any hope of the US dollar recovering some of the losses against the Canadian dollar, I believe that we should rally from here. If we break down below the 1.2450 level on a weekly close, I think that the market will continue to go lower, perhaps reaching towards the 1.20 level next. Obviously, there is quite a bit of influence from the crude oil markets, which have been negative as of late. But there’s also a much more important trade, the bond trade.

Bond spreads matter

Currently, the Canadian bond market has been on fire, as the Bank of Canada looks to raise interest rates soon. If that’s the case, that should continue to be a signal that the market is going to break down. Ultimately, if we break above the 1.27 handle, I think that the market will probably go back to the 1.30 level. Expect a lot of volatility this month, as volume picks up and more traders come back to the office. Ultimately, this is a market that has been in an uptrend for some time, but the recent selloff has been absolutely brutal.

I believe that we could make an argument for a bit of a bearish flag, so that would be yet another reason to sell if we break down below the uptrend line significantly. That would measure for a move as low as 1.13, but that’s obviously a longer-term move. In the meantime, I expect to see a lot of choppiness and volatility. Eventually, we will get an impulsive move that we can follow. Being patient is going to be mandatory.