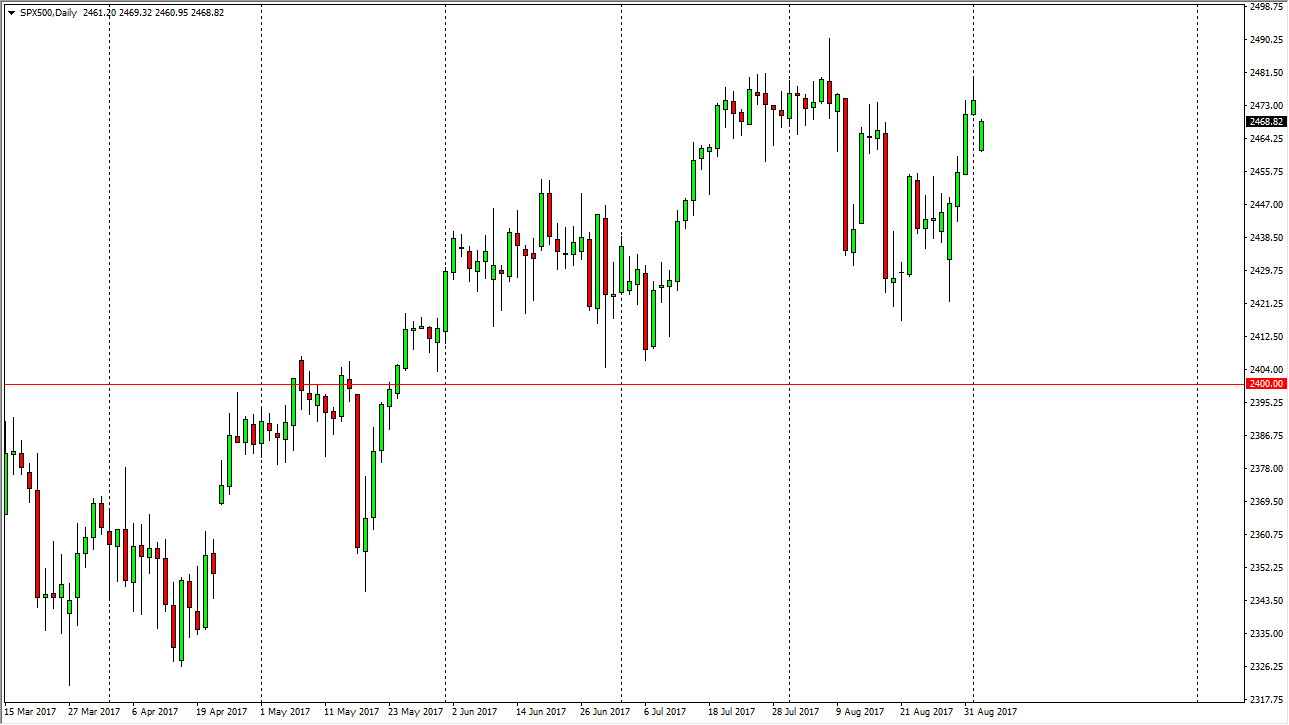

S&P 500

The S&P 500 was close during the session on Monday, as it was Labor Day in the United States. The same is true for the NASDAQ itself, but the CFD markets were very much awake. We gapped lower in the S&P 500 as the world got wind of North Korea testing a suspected hydrogen bomb. This caused the “risk off” trade, and as a result the CFD markets fell. However, with the Americans away, there was no underlying instrument the base the trade from. My inclination is that we will continue to see a move higher, unless of course tensions arise again. Quite often, the shocks to the market last but 24 hours. Ultimately, I think you can expect volatility, and even if we did pull back, it would be healthy in the context of the uptrend.

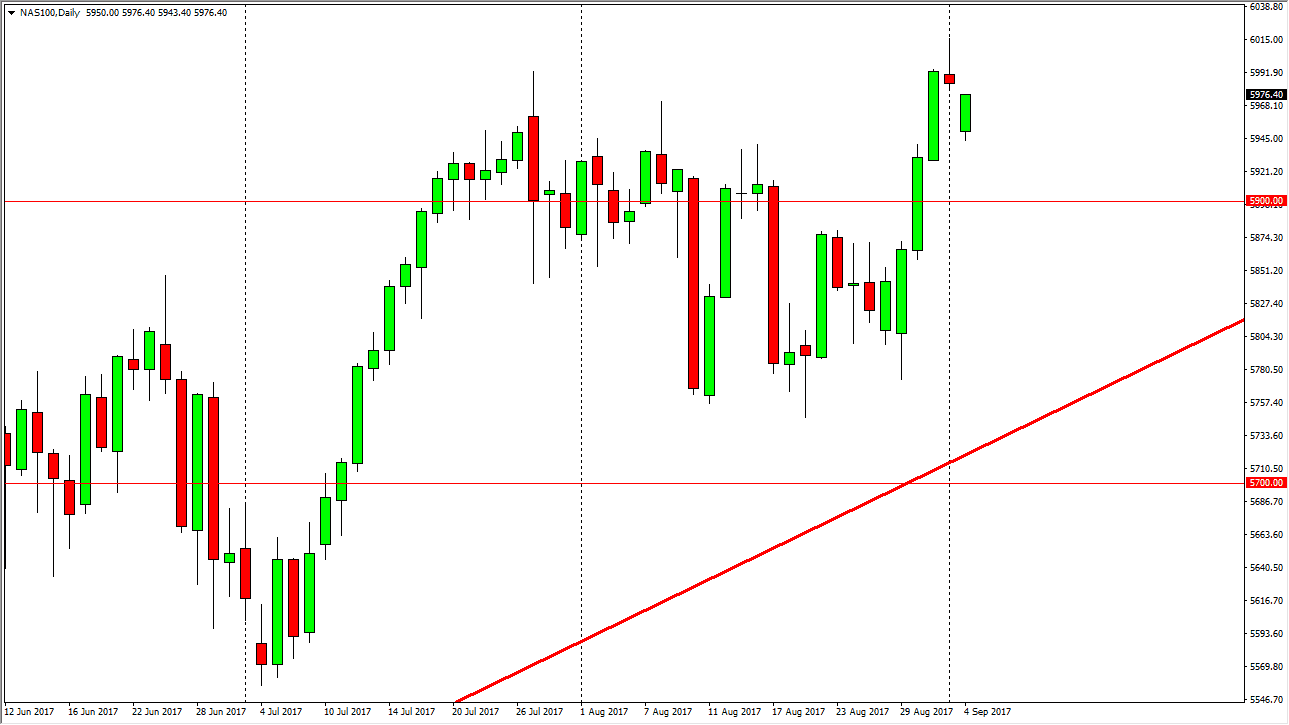

NASDAQ 100

The NASDAQ 100 fell as well, but again, I think this is a temporary situation. I believe that the 5900-level underneath should be supportive, and I’m waiting to see some type of supportive candle or a bounce to take advantage of. Ultimately, I think we will break above the 6000 handle, and once we do we should continue to go much higher. I would expect volatility, but traders are starting to come back from the summer break, and I think that volume will get back into the picture. That should be good for the market in general, and I think that eventually we follow the longer-term uptrend. I have no interest in selling, least not until we break down below the 5700 level, which would take some doing from here. I believe that the buyers will continue to jump into this market, as algorithmic trading seems to look at pullbacks as an opportunity.