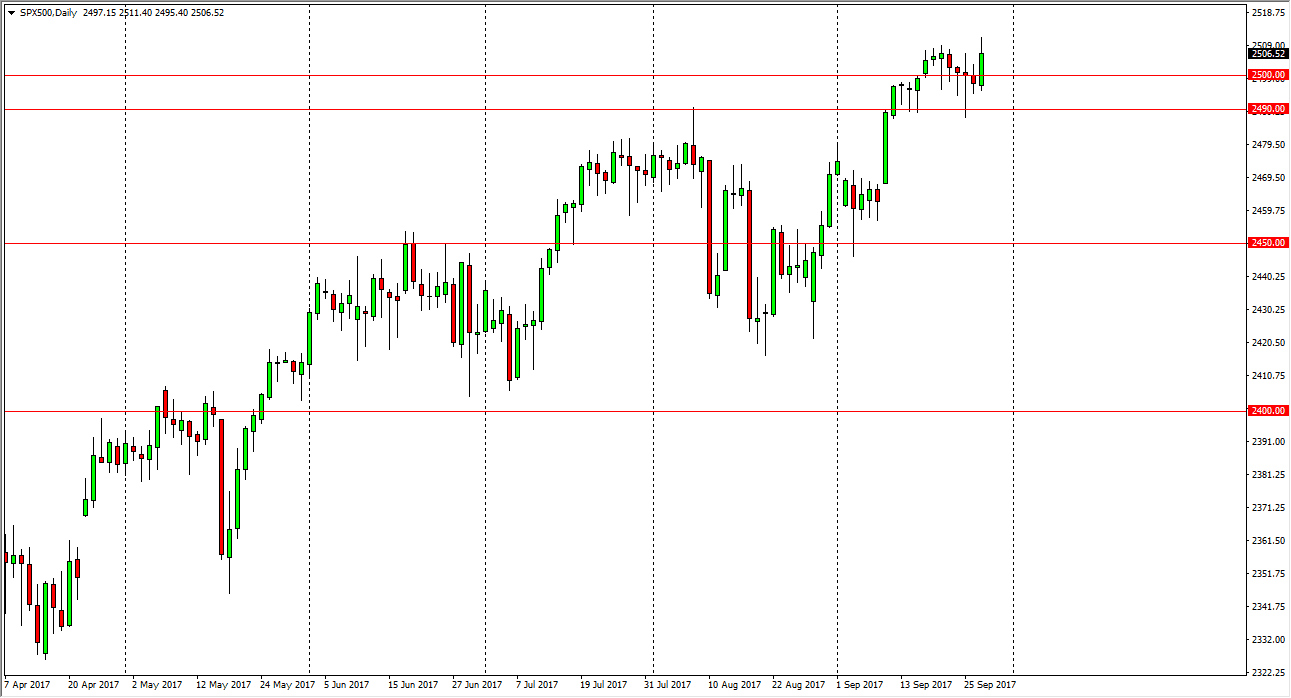

S&P 500

The S&P 500 rallied significantly during the day on Wednesday, breaking above the 2500 level again. Because of this, the market looks like it is ready to go higher, although we gave back a significant amount of the gains towards the end of the day. I believe that the market continues to rally from here on pullbacks. This market is one that continues to refuse to go lower, and the hammer that formed on Monday may have been the sign that we are getting ready to break out to a longer-term move. I believe that the market has a bit of a floor near the 2490 level, and that should continue to elevate the market over the longer term. Ultimately, I believe that the market is going to go towards the 2525 handle, and then the 2550 level. We are in a nice and steady uptrend, and I think that doesn’t change.

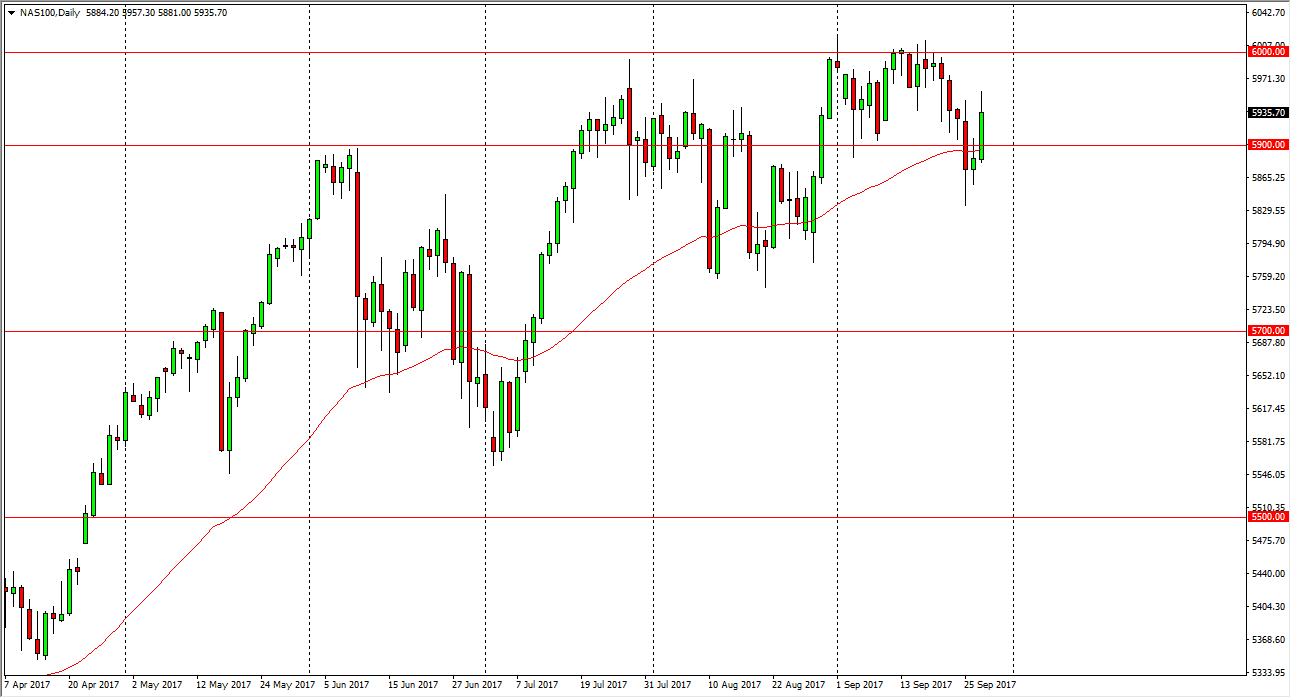

NASDAQ 100

The NASDAQ 100 broke higher at the open on Wednesday, slicing through the top of a shooting star from the previous session. When shooting star forms at the bottom of a downtrend and gets broken to the upside, that’s a very bullish sign. I believe that the market should then go to the 6000 handle, perhaps breaking above there given enough time. If we break above the 6000 level, the market should continue to go much higher, and continue to reach towards the 6100 level. I believe the pullbacks are buying opportunities, and I believe that the market continues to find value on these dips. Ultimately, I think that the NASDAQ 100 is starting to pick up a bit of interest by the trading public, and therefore think that the market is about to continue to grind higher. I believe that the market is going to continue to be strong.