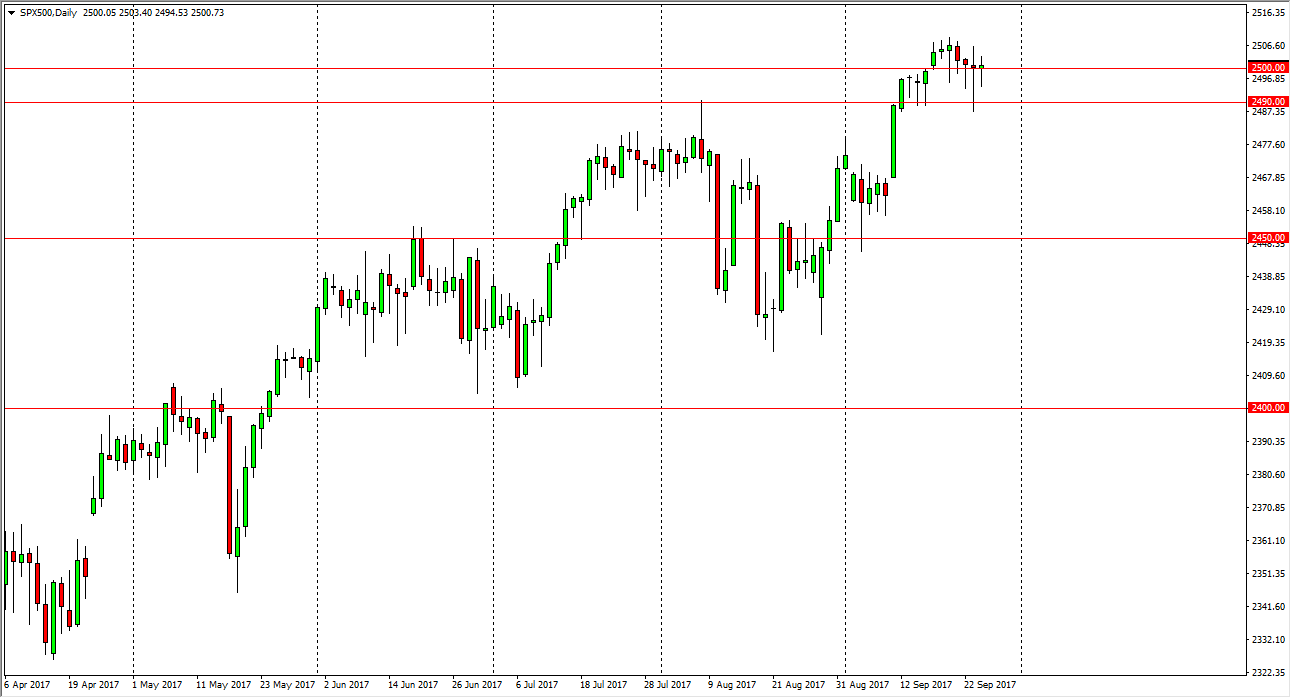

S&P 500

The S&P 500 had a choppy session again on Tuesday, as we continue to dance around the 2500 level. This is a market that I think continues to see volatility, but I also believe that it is only a matter of time before the buyers return to this market on these pullbacks. Longer-term, I believe that the S&P 500 continues to find plenty of reason to go higher, and of course the massive hammer from the Monday session suggests that there is a building of a base at this point. Given enough time, I believe that we go looking towards the 2525 level above, and perhaps even higher levels. If we break down below the Monday session lows, then I become a bit more concerned. Until then, it’s a “buy the dips” scenario.

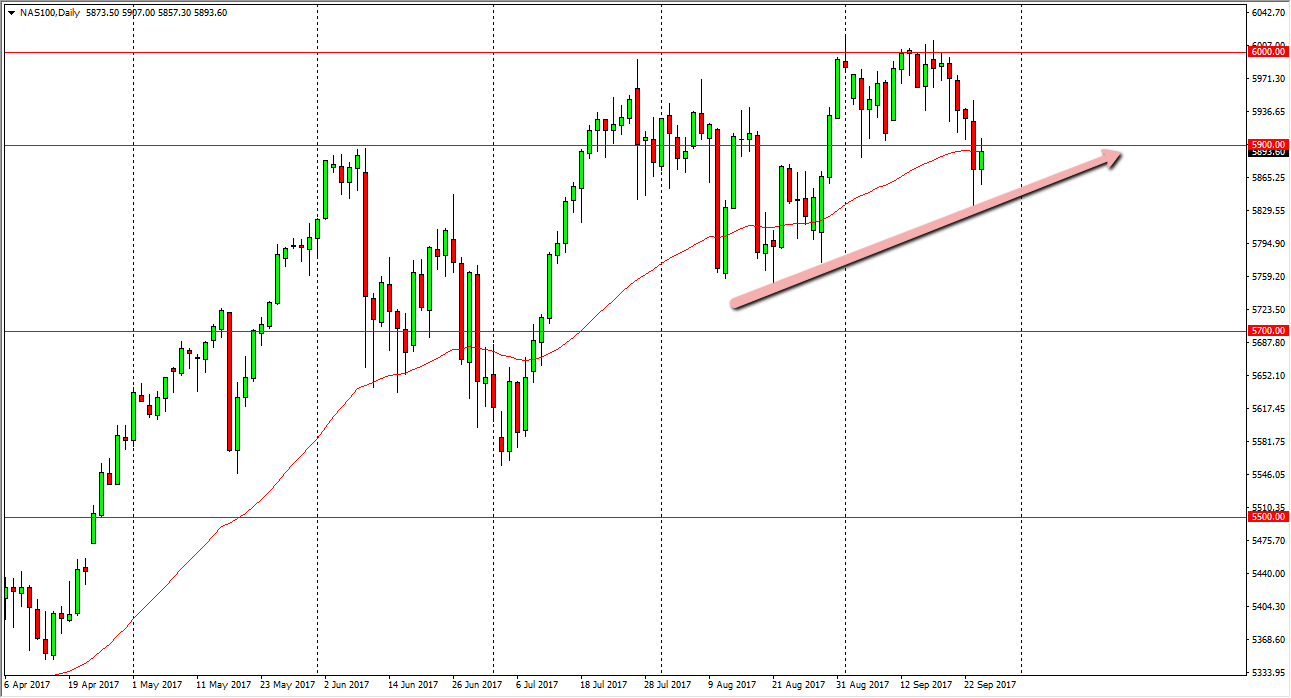

NASDAQ 100

The NASDAQ 100 continues to look a bit soft, as the 5900 level has offered resistance. If we can break above that level, it’s likely that the S&P 500 will pull the NASDAQ 100 much higher. I think it happens given enough time, but I also recognize that there is a lot of noise geopolitical lead to keep this market a bit jumpy. Ultimately, this is a market that I believe finds reason to go higher, as we have been going through cyclical rotation lately. That gives us a little bit of the bearishness in this market, perhaps more than is due, and therefore I think that eventually things calm down and we should continue to go higher. Ultimately, I believe the market goes back to the 6000 level and eventually breaks out above there. US stock indices in general tend to move in the same direction, so I believe that the NASDAQ 100 will follow the others. However, it may be a bit of a laggard.