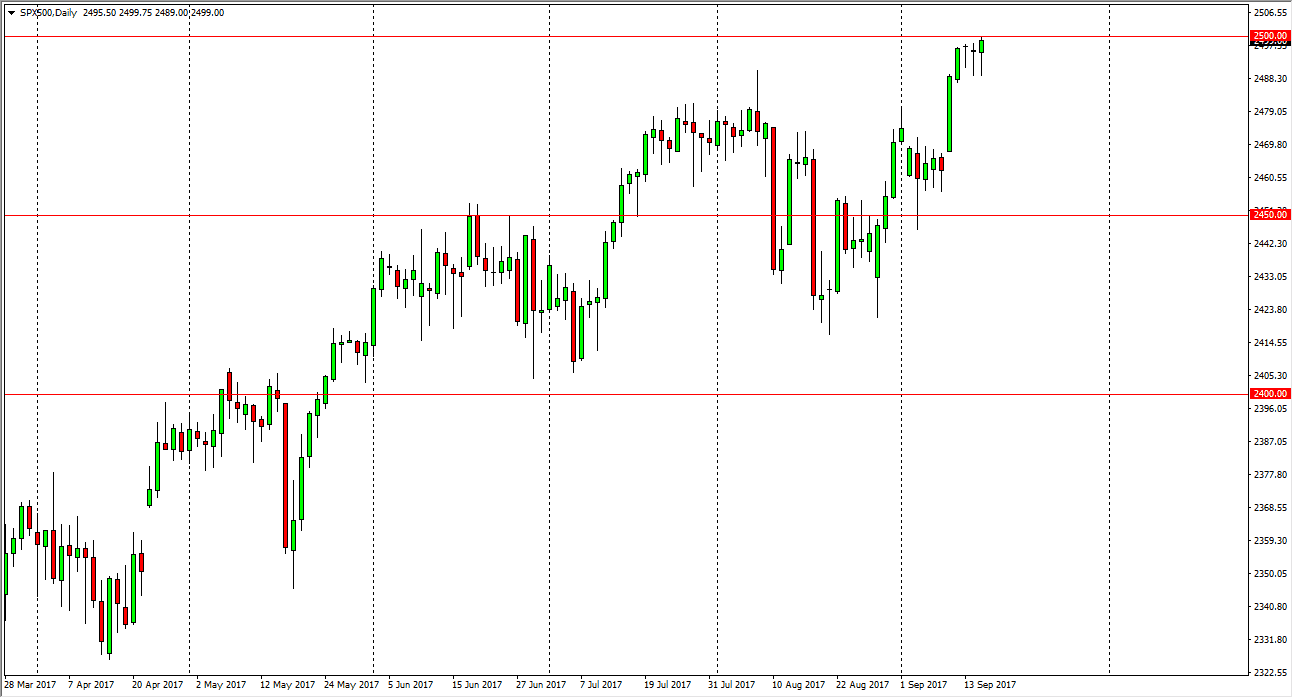

S&P 500

The S&P 500 initially fell on Friday again, but just as we have seen over the last couple of sessions, we turned around to show signs of bullish pressure. I think that a break above the 2500 level is coming, and once it does, I believe that the market should continue to go much higher. I think the pullbacks continue to be bought, and I think that eventually we will continue to go higher. I don’t have any interest in shorting, I believe that the market has plenty of support near the 2450 level, and remain as bullish as I ever have, especially after seeing how resilient the market had been over the last several sessions. Once we do breakout, I think it becomes more of a “buy-and-hold” scenario as the market continues to find plenty of reasons to go higher, real or imagined.

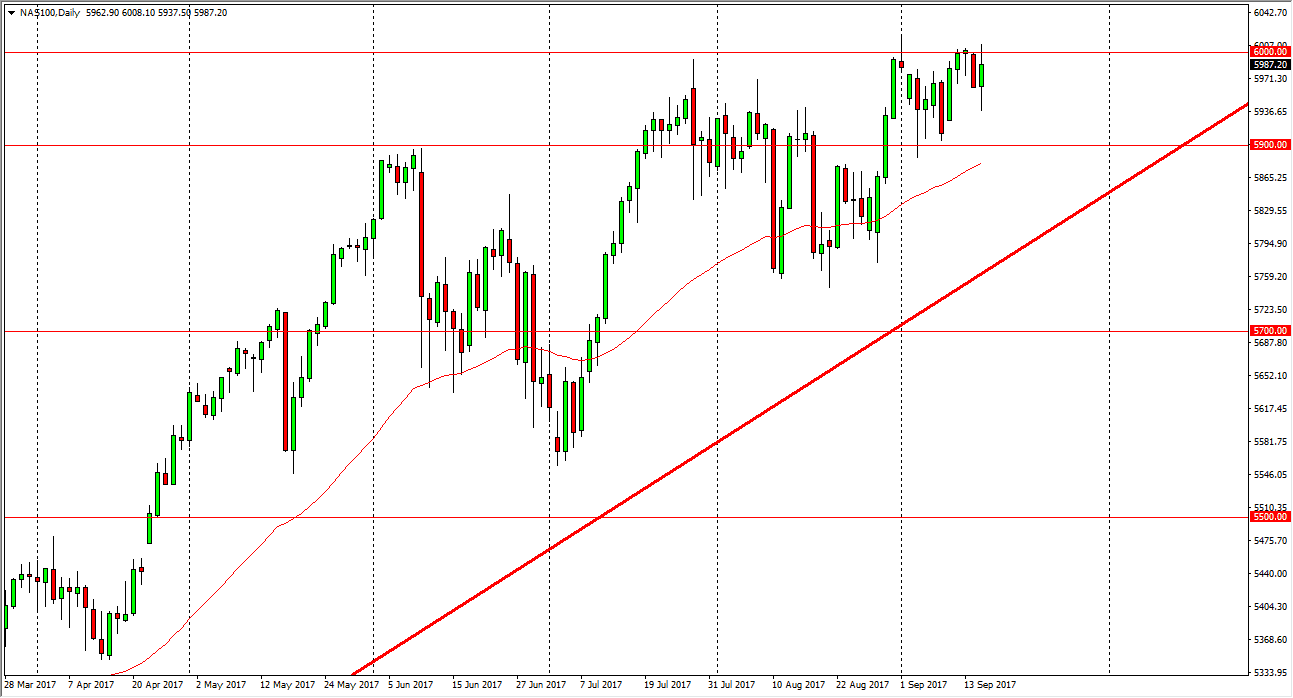

NASDAQ 100

The NASDAQ 100 was very volatile, and even broke above the 6000 handle at one point. It looks as if the buyers are ready to step in every time we drop over here as well, and because of that I think that it’s only a matter of time before buyers get involved in the dip. If we get a pullback, I’m more than willing to buy, and I believe that the support is to be found at 5900 underneath, and that selling is all but impossible as the NASDAQ 100 has been so bullish, although we have been a bit sideways during this past month. Longer-term though, we are very bullish, and I think that the market will eventually break out and reach towards the 6100 level. Expect several attempts to break this market down, but they have all failed in the recent past, and I think it’s only a matter of time before we find enough buying pressure to move.