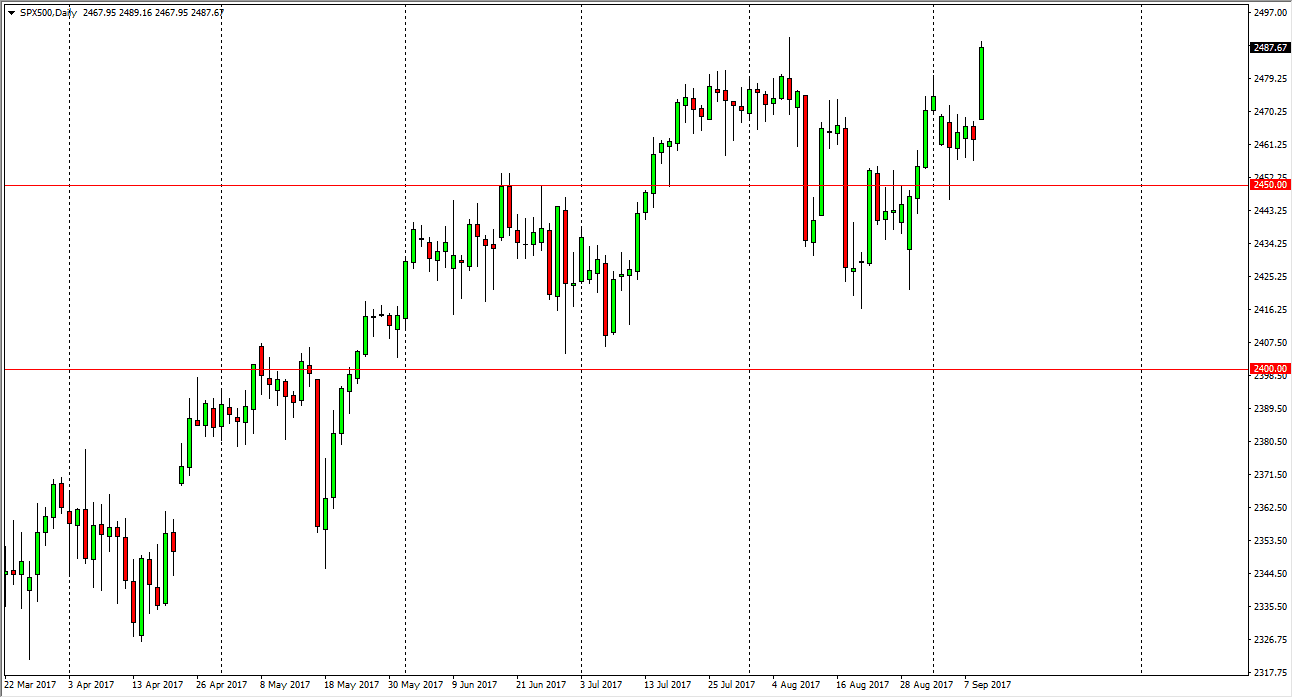

S&P 500

The S&P 500 rallied significantly on Monday as the weekend it did not bring any major bad news. We avoided escalation with North Korea, and of course the hurricanes, although dangerous, did not lay the path of destruction that was once anticipated in the United States. Because of this, the S&P 500 got a bit of a relief rally, and is now pressing the absolute highs. I still see the 2500 level above as massive resistance, and I think it’s going to take a bit of momentum building to get above it. Short-term pullbacks will probably present themselves as buying opportunities, and that’s how I’m looking at this market, as a market with a “buy on the dips” mentality still. I have no interest in shorting the S&P 500 currently.

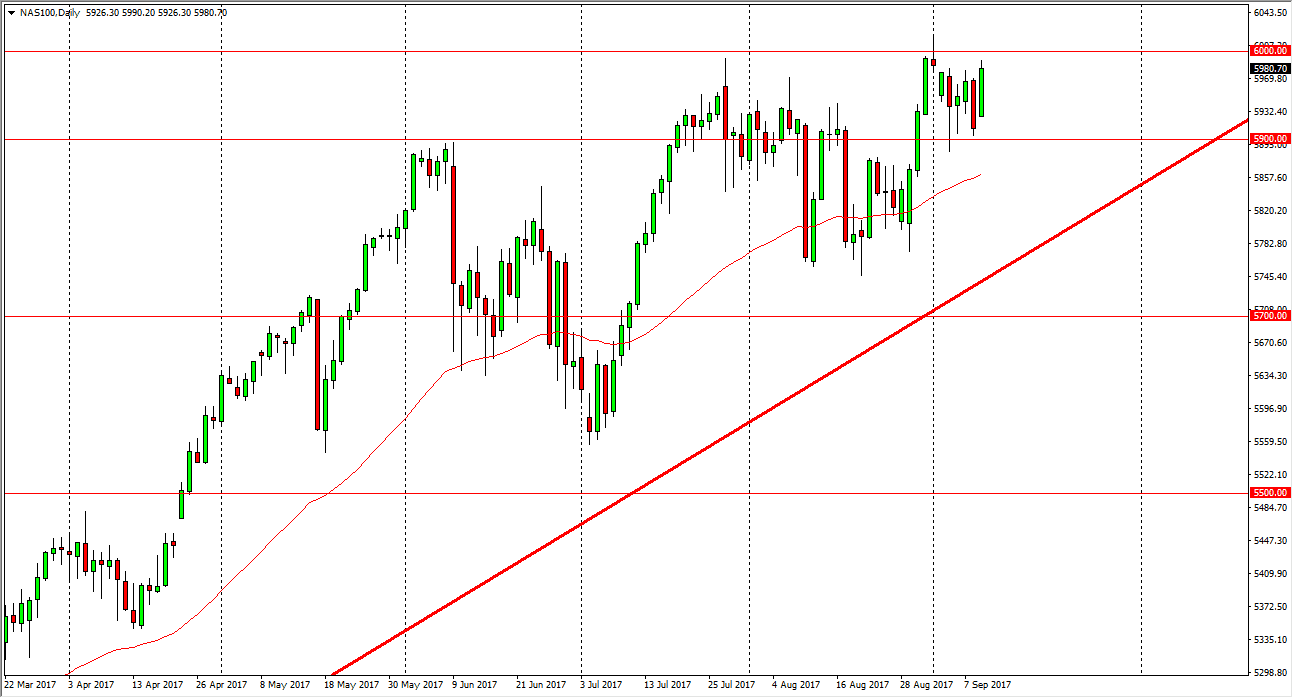

NASDAQ 100

The NASDAQ 100 gapped higher at the open on Monday, as we continue to see bullish pressure in the NASDAQ 100 overall. The 6000 level above continues to offer resistance, so it’s not until we break above the shooting star from last week that I would consider buying at this level. Alternately, we could pull back, which could be a nice buying opportunity. I think that the 5900 level will continue to be supportive, and with that in mind I will look at it as an opportunity to pick up value. The NASDAQ 100 has lead the way higher for some time, and I don’t think that’s going to change anytime soon. With this being the case, I am bullish but I also recognize that we should be looking for value when we start place long positions in this market. Once we can clear to a fresh, new high, I believe it becomes more of a buy-and-hold scenario.