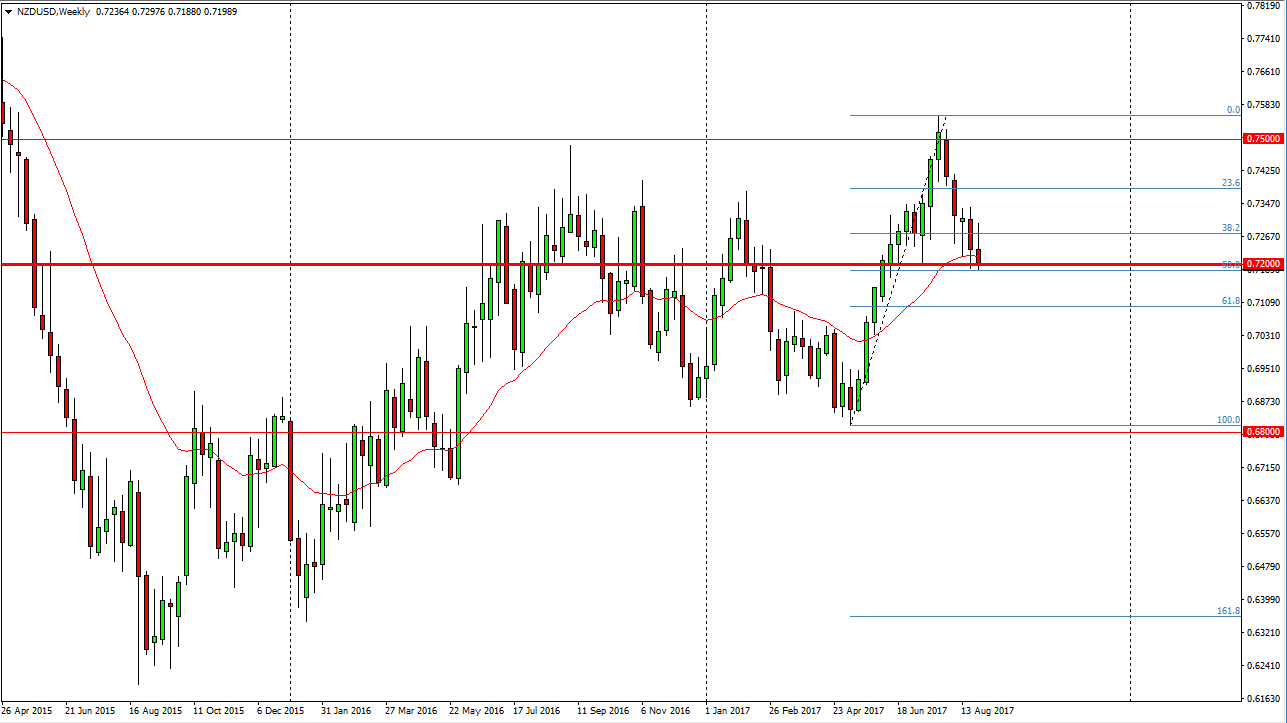

The New Zealand dollar has been negative during most of August, as we are approaching the 0.72 level. This was the 50% Fibonacci retracement level from the move higher, but what concerns me is that we are seeing serious pressure to the downside. I think if we break down below this level successfully, the market should then go towards the 61.8% Fibonacci retracement level which is closer to the 0.71 handle. That could be a nice trading opportunity, but also could offer a nice counter trading opportunity as well. This is because the “golden ratio” comes into play, and a lot of traders will look at it as such. However, I am a bit concerned because it appears that the pressure is building.

Risk on/risk off

I believe that risk appetite will have a lot to do with where the New Zealand dollar goes next, meaning that if stock markets are commodity markets start to fall, we could see this market roll over. If we can break above the 0.73 handle, I think the market probably goes higher, perhaps towards the 0.75 level. That’s an area that has been resistant in the past, and probably would be in the future. The move to the 0.75 level is overdone in my estimation, but this pair does tend to be very volatile. Remember, the New Zealand dollar is one of the least liquid of the major currencies, so this will cause issues.

I suspect that you will have to pay attention to the CRB Index, which is a basket full of commodities that are easy to follow. By doing so, gives you an idea of the external influences on the New Zealand dollar, but you should keep in mind that Asia will come to play as well. If tensions continue to ratchet up against North Korea, it’s possible that we may see the New Zealand dollar selloff also.