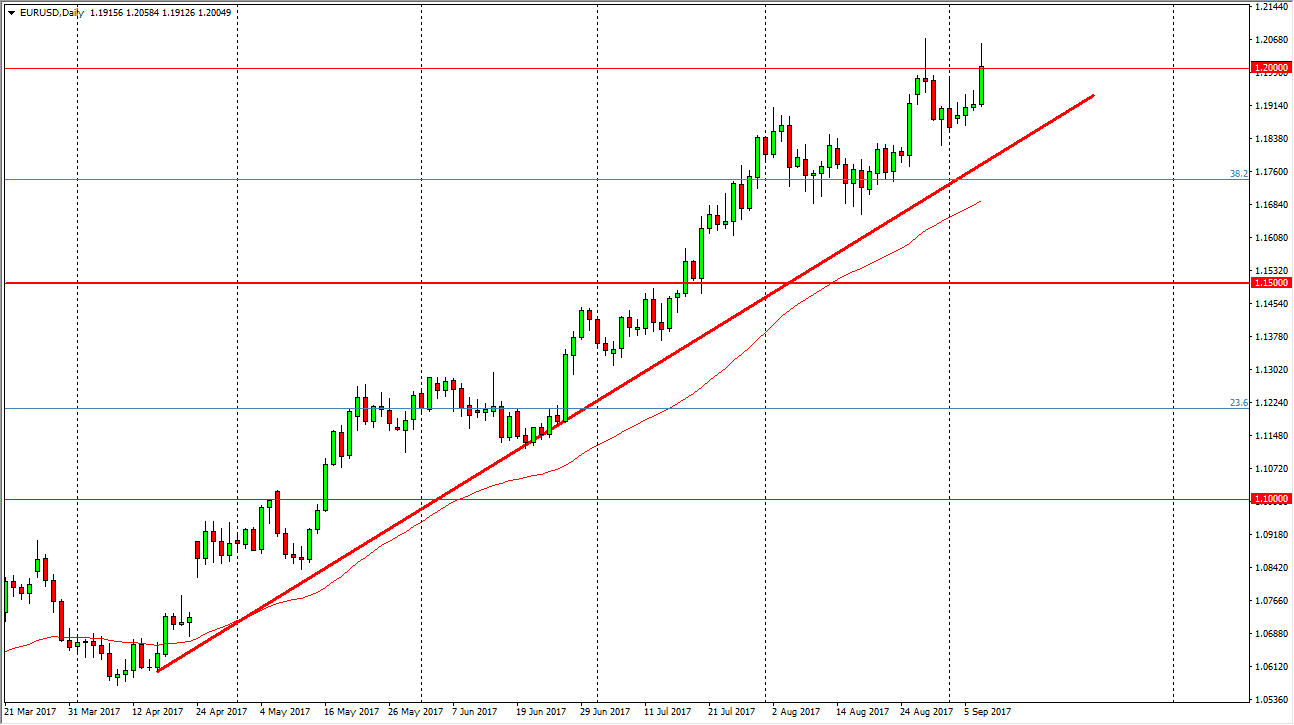

EUR/USD

The EUR/USD pair rallied a bit during the day on Thursday, breaking above the 1.20 level. We did stop just about at that level, so I think we need to make a fresh, new high to start buying. In the meantime, we could get pullbacks that are attempts to build up momentum to finally make that move. You can clearly see on the daily chart there is a nice uptrend line that keeps this market to the upside, and based upon the recent breakout of the 3-year consolidation, I am still of the mind that this market goes to the 1.25 handle. Ultimately, I believe that buying on the dips will probably be the best way going forward, as this is a market that will probably grind its way to the upside as the Federal Reserve looks very unlikely to be able to raise rates in the wake of 2 hurricanes.

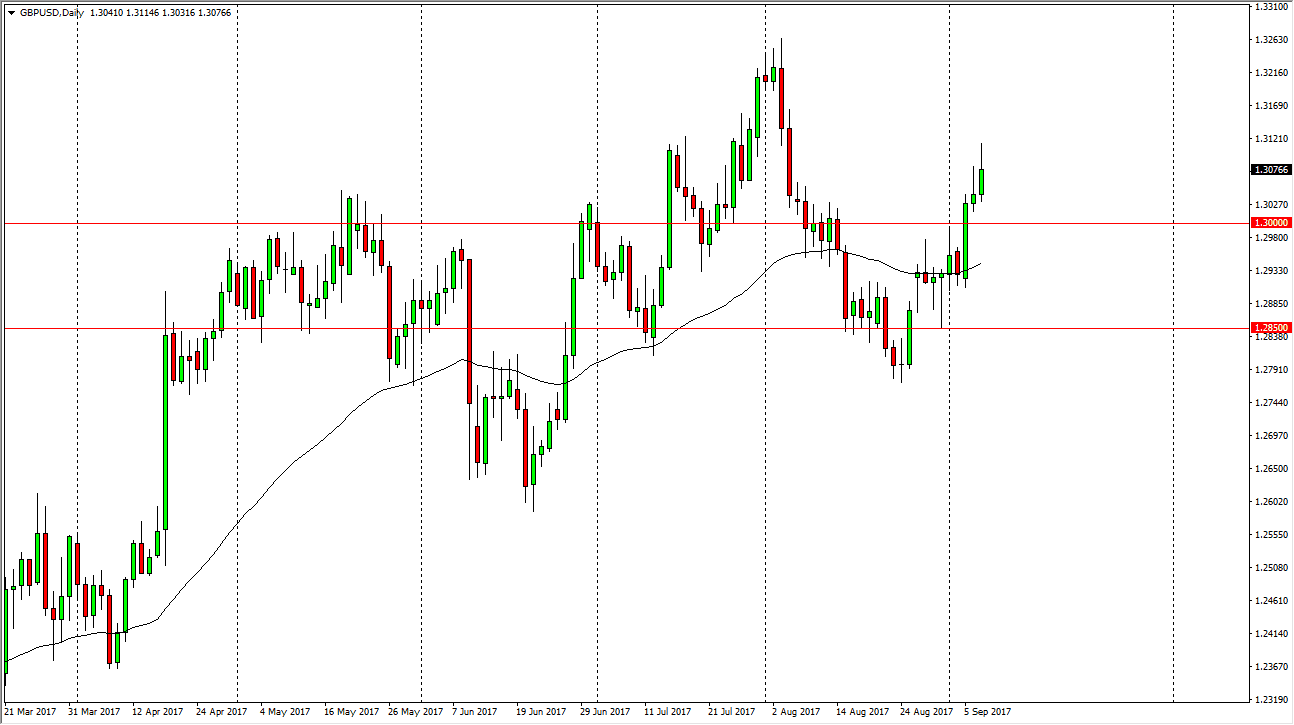

GBP/USD

The British pound rallied during the day, breaking the top of a shooting star from the Wednesday session. That’s a very bullish sign, and I think we are going to go to the upside from here. I look for short-term pullbacks as buying opportunities as we reach towards the 1.3250 level above. The 1.30 level underneath should be supportive, as it was previous resistance. Ultimately, this is a market that looks very healthy, although probably not due to the British pound, it’s probably more about the US dollar at this point. If we can break above the 1.3250 level, the market can go much higher. The British pound appears to be trying to change the overall trend on longer-term charts, but this is always a messy affair, and typically takes several attempts before the trend turns around completely.