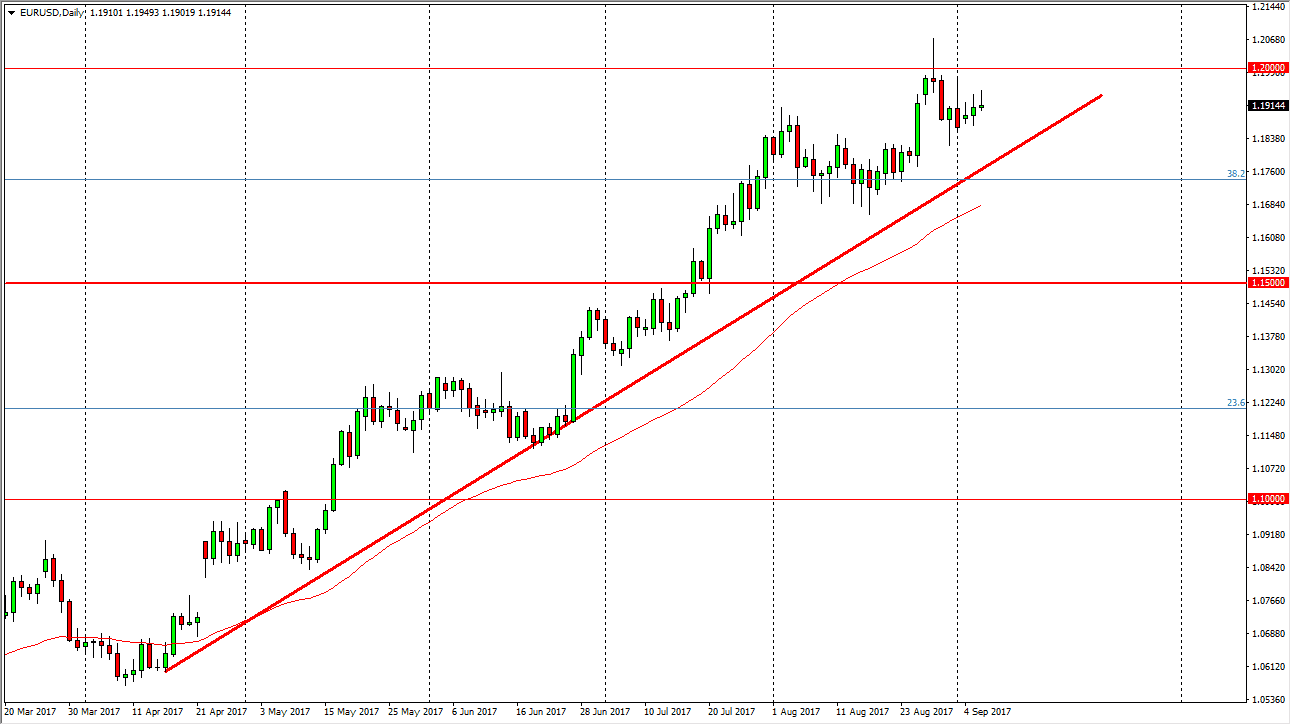

EUR/USD

The EUR/USD pair tried to rally during the day on Wednesday, but sold off slightly as we await words from Mario Draghi about the currency itself. I think that the 1.20 level above is massively resistive, but if we can break above the top of the shooting star from last month, I think the market will continue to go higher and reach towards 1.25 handle. Ultimately, this is a market that should target that level longer term, as we broke above a 1000 pips range recently. With this being the case, I look at the uptrend line as well, and I think that pullbacks will continue to offer buying opportunities. The markets remain a bit skittish, but I still believe that the market will find plenty of buyers going forward as we have seen previously.

GBP/USD

The British pound tried to rally during the day but gave back most the gains to form a shooting star. We may pull back to look for buyers below, as we have broken significant resistance, and I think the given enough time we could go looking towards the 1.3250 level. The market will probably find resistance there, so I think that short-term pullbacks should offer value, unless we close on a daily candle will below the 1.30 level, then it becomes a bit of a false break out. I think there is a lot of noise in this market, but I believe that the rally isn’t necessarily a reflection of the British pound, but perhaps more in line to what we are seeing against the US dollar overall. The Federal Reserve looks very unlikely to raise interest rates anytime soon after 2 hurricanes, so the British pound is benefiting from a soft or greenback overall.