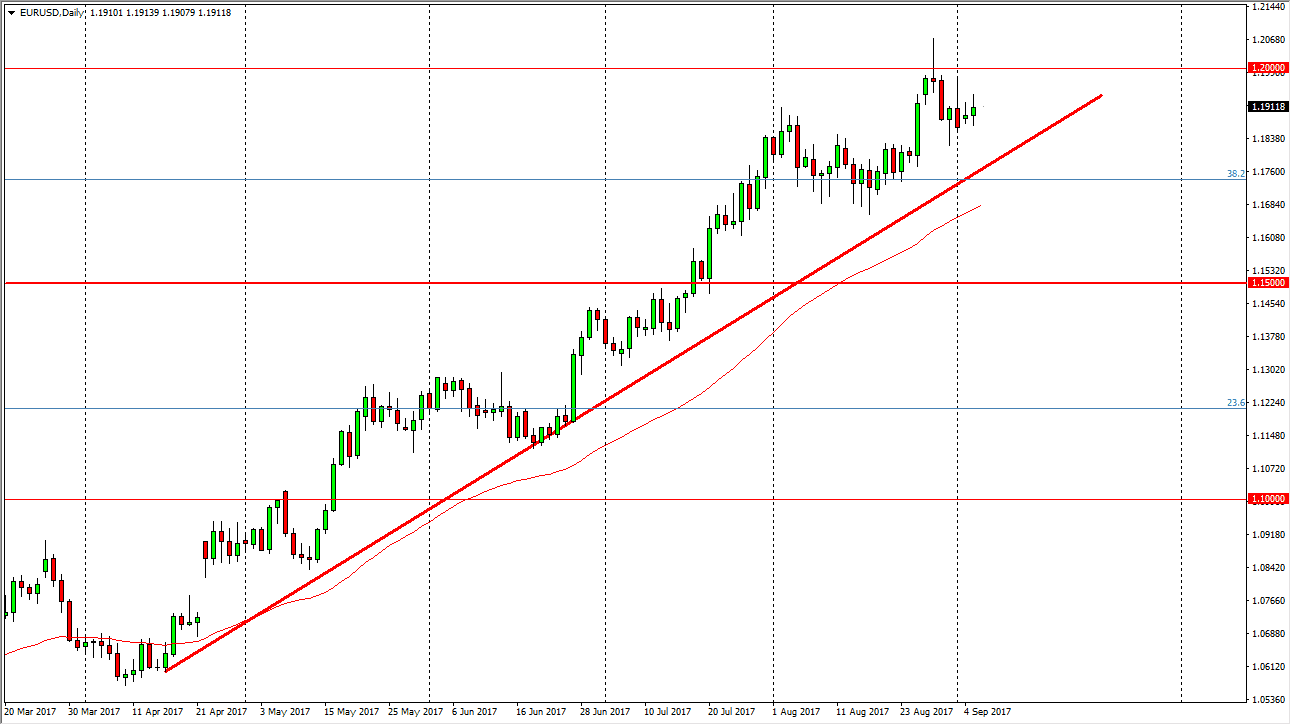

EUR/USD

The EUR/USD pair went back and forth during the day on Tuesday, as we continue to try to grind higher. However, the 1.20 level above continues to be major resistance, so I think we are going to continue to see sellers in that general vicinity, but I think in the meantime we will probably see a lot of volatility. I certainly don’t want to sell this market, at least as long as we are above the uptrend line, so I think that buying dips is probably the best way going forward. If we get a daily close above the 1.20 level, I think the market then goes to the 1.25 level above. A breakdown below the uptrend line would be very negative, and could send this market as low as 1.15, but that is not my thesis currently.

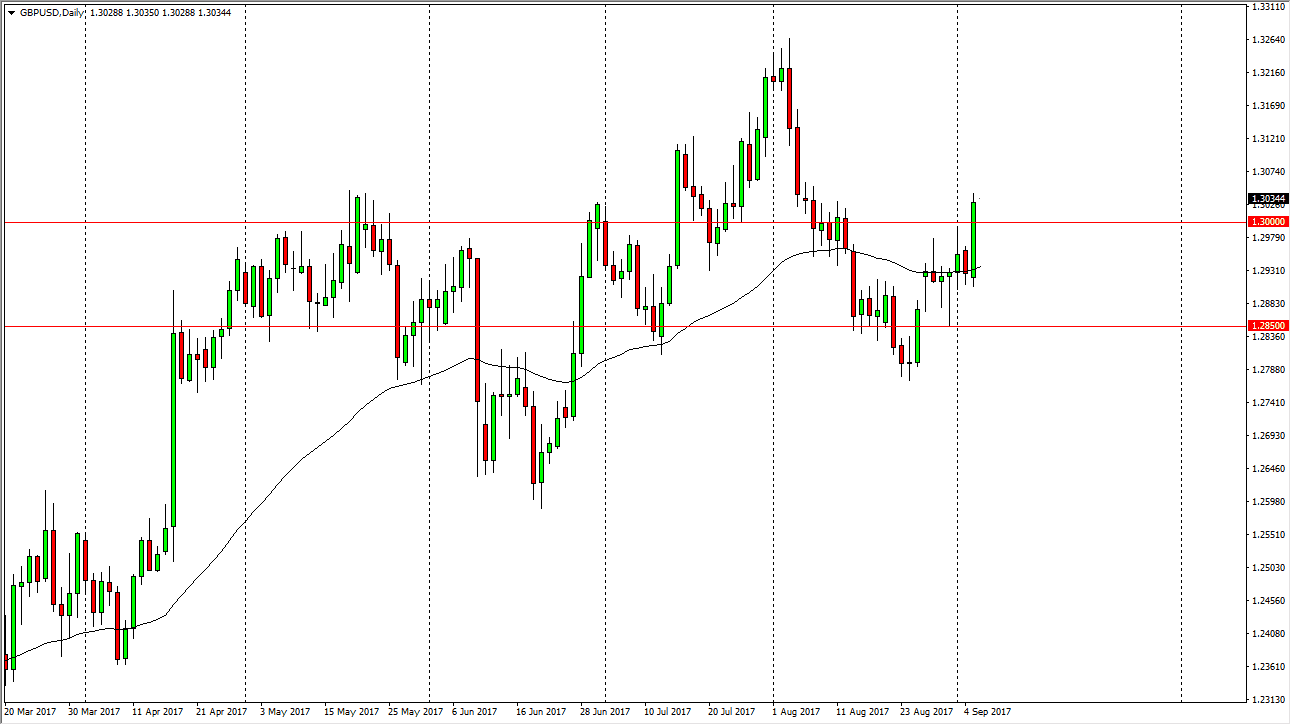

GBP/USD

The British pound rallied significantly during the session on Tuesday, and now I believe that if we can break above the 1.3050 level, the market is ready to go to the 1.3250 level. Some type a pullback from here could find support, but if we turn around below the 1.30 level, we could find ourselves returning to the consolidation that we had been in. I believe that the buyers are certainly taking control, so I would anticipate that we are going higher but I want to see some type of confirmation, hence the move above the 1.3050 level. Once we get that, then I think that the buyers will be very attracted to this market, and therefore selling would be possible. If we can break above the 1.3250 level, the market could go to the 1.35 level next. I think this has more to do with the US dollar then the British pound, and therefore it’s likely to follow that aspect.