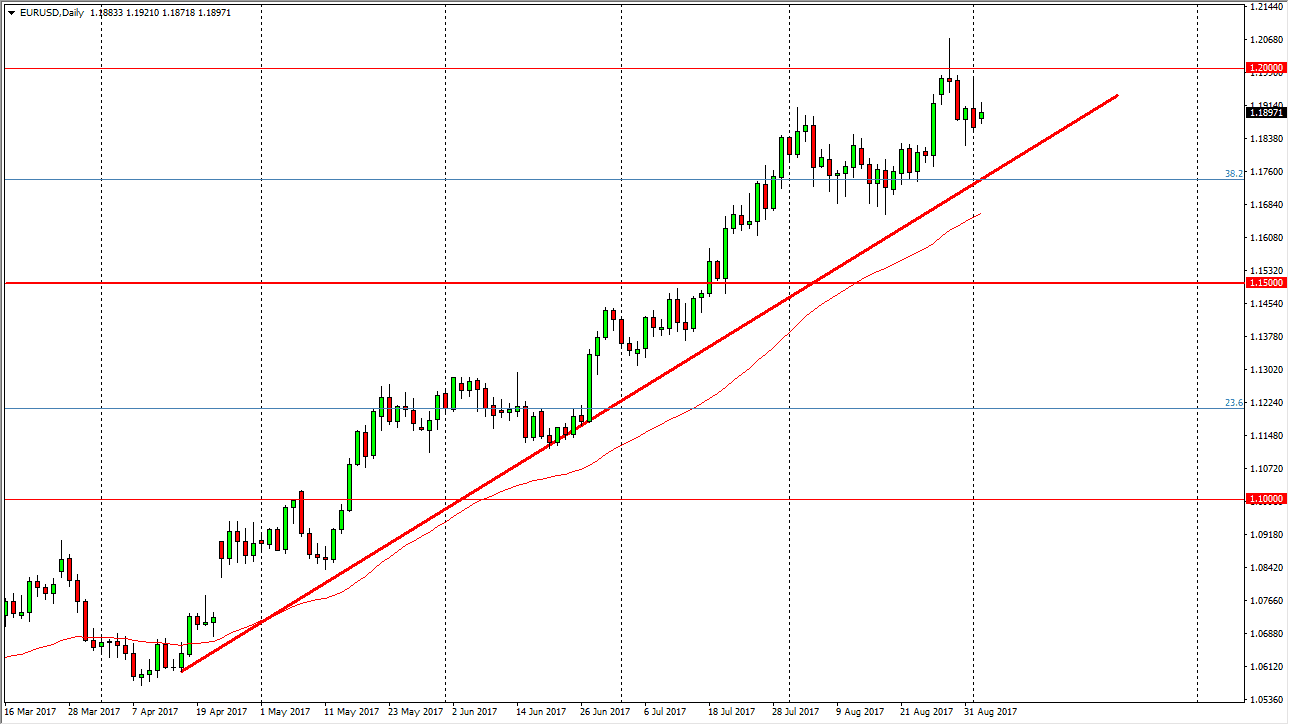

EUR/USD

The EUR/USD pair had a fairly quiet session after initially trying to rally on Monday. The 1.20 level continues to offer resistance, and I think that we may have to build up a bit of momentum to finally break above that level. However, you can see I have an uptrend line drawn on the chart that is relatively reliable. I think pullbacks will continue to offer opportunities to pick up value, but expect Mario Draghi to try to talk down the value of the euro. This is why we may have a bit of volatility, and you can also make an argument for this market being a bit overextended. Nonetheless, I believe that the buyers are firmly in control overall, so I’m avoiding any selling at this point in time.

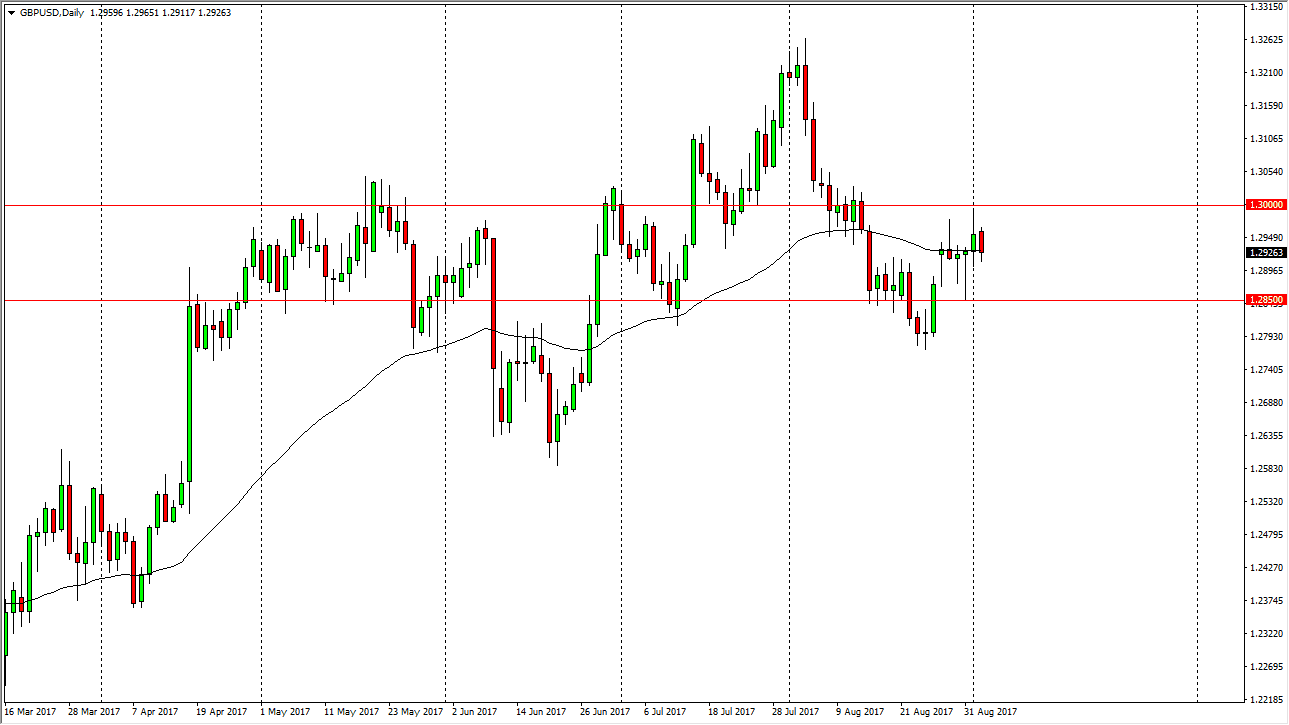

GBP/USD

The British pound was slightly negative during the day after initially trying to break out to the upside, but I think a pullback to the 1.2850 level is going to be a nice buying opportunity and the market trying to build up momentum. On the other hand, if we break down below that level I think we probably drop down to the 1.27 handle. On the other side of the equation, if we can break above the 1.3050 level, I would feel that the market is finally ready to go much higher, as it would be a significant move to the upside. I believe that the market should continue to be volatile, as there are a lot of concerns when it comes to the United Kingdom, and of course there are questions now as to whether the Federal Reserve will be able to raise rates this year. Expect choppiness, as the market tries to make sense of several factors at the same time.