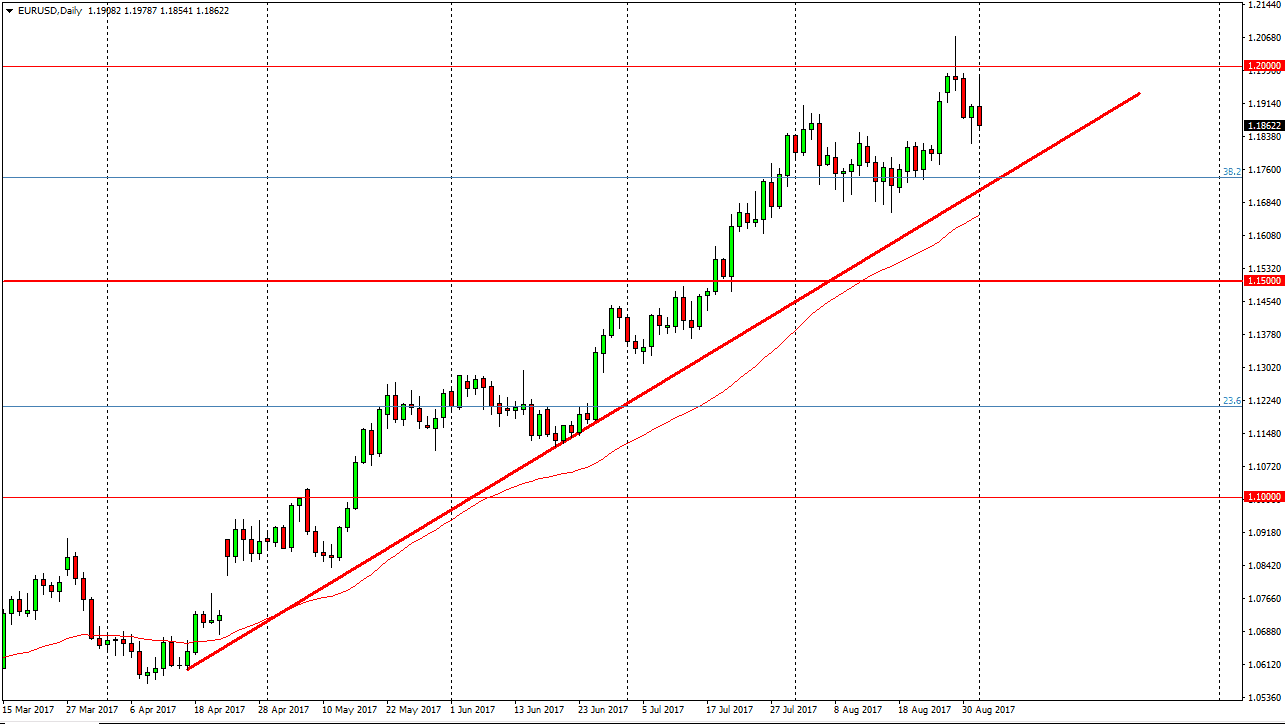

EUR/USD

The Euro initially rally during the session on Friday, in reaction to the less than anticipated jobs report. However, we turned around to form and exhaustive shooting star candle, and it suggests that we may be running into a bit of weakness. The market has been relentlessly bullish for some time now, so a little bit of a pullback could offer the value necessary to push this market towards the upside. You can see that we struggled at the 1.20 level, and a pullback makes plenty of sense. I think that the 1.17 level as well as the uptrend line should be reason enough to start thinking about support again. If we did breakdown below there, we will more than likely test the 1.15 handle. Most of the concern in this market is just that we have not had any significant retracement. However, we have recently broken out of a massive consolidation area that should send this market much higher.

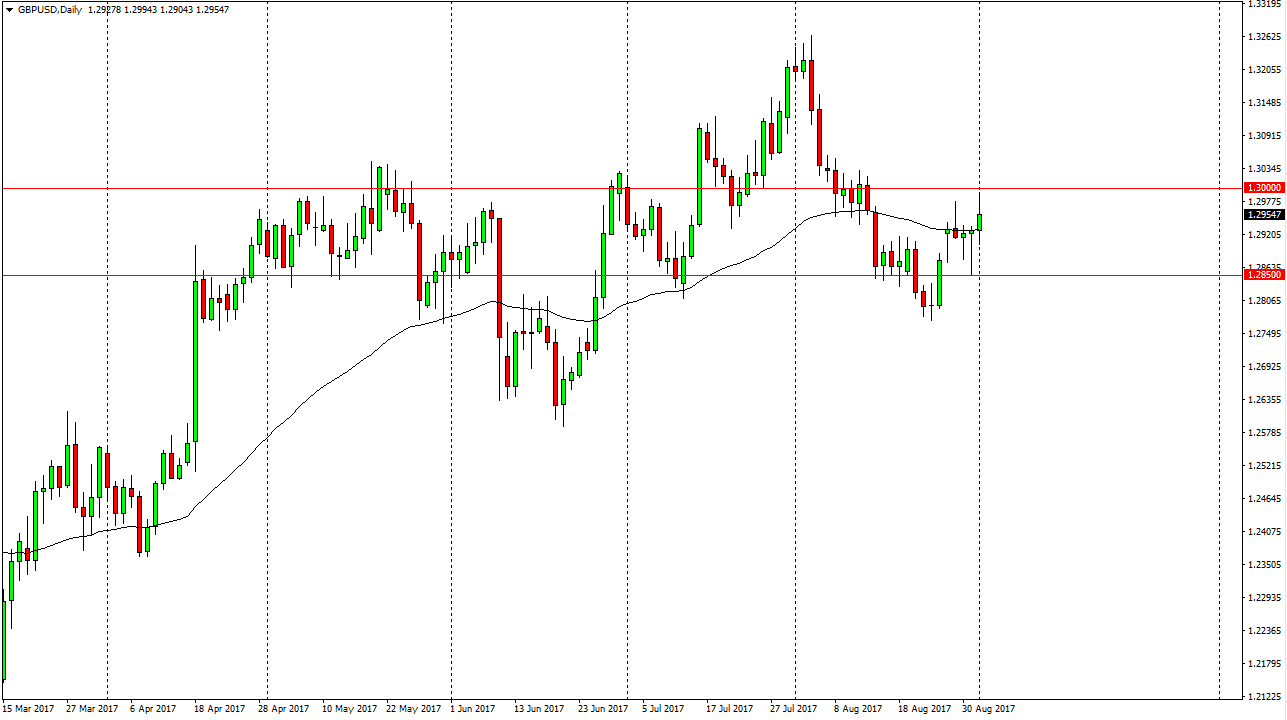

GBP/USD

GBP/USD traders send the market back and forth during the day on Friday, as the jobs report came out less than anticipated. We are still within the consolidation area over the last several sessions, as the 1.3 level has offered resistance, while the 1.285 level has offered support. Ultimately, when we break out of this range I think that the market will continue to go in that direction, so the meantime a short-term range bound trading scenario has presented itself.

I believe that even if this pair does go higher, it will probably underperform the EUR/USD pair as the British pound has a significant amount of concern around it as the British are leaving the European Union. If we break down, it’s probably going to be more of a general US dollar rally than anything else.