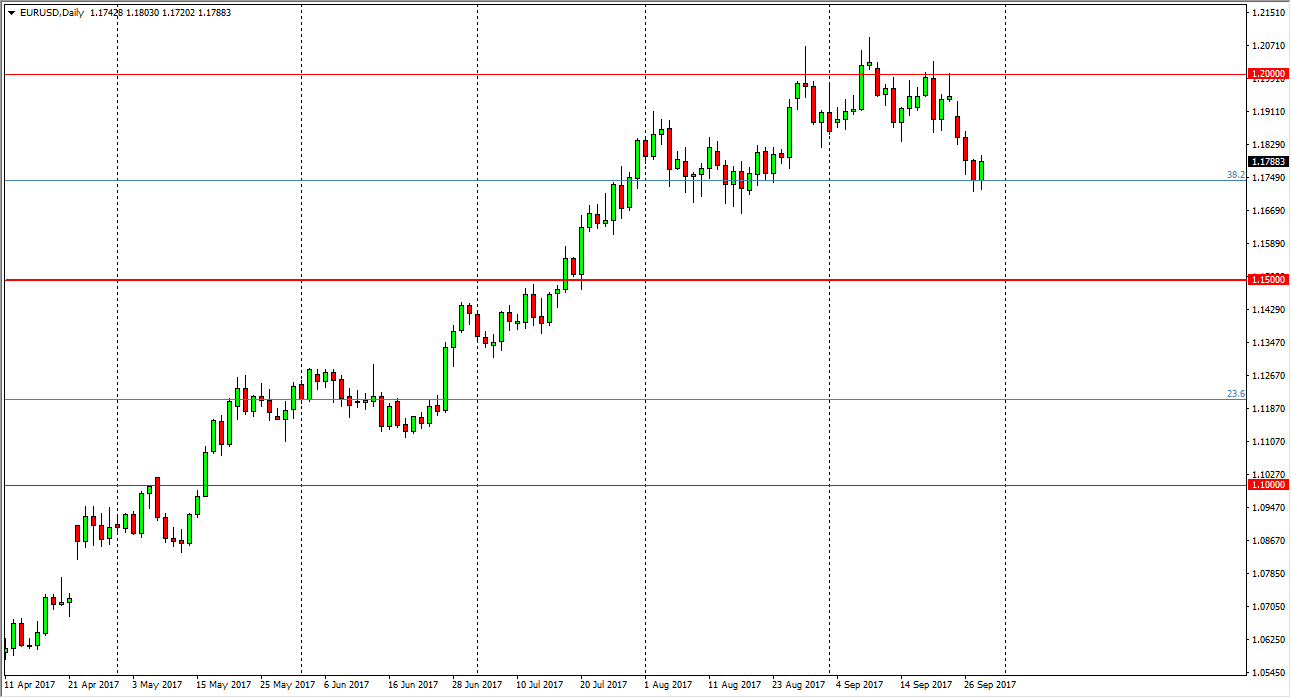

EUR/USD

The EUR/USD pair bounced slightly during the day on Thursday, as the 1.1750 level offers support. This is an area where there has been support in the past, and I think it may be an opportunity to go long as we try to build up the necessary momentum to break towards the 1.20 level, and then possibly even higher. If we break down from here, the market very likely goes down to the 1.15 level underneath there, as the market has been consolidating in the past, and the breakout above the 1.15 level signifies that we should be looking for the 1.25 level after that. I like this market, but I’m waiting for the impulsivity to the upside to return so that I can start buying.

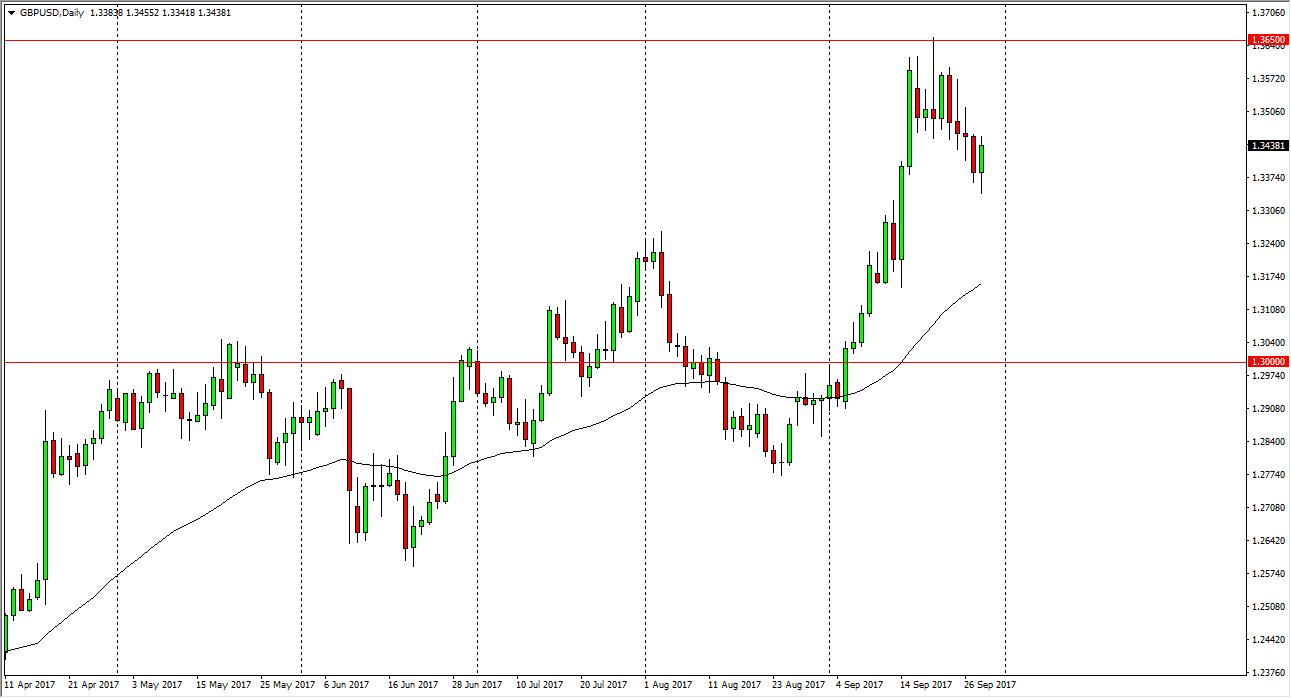

GBP/USD

The British pound initially fell on Thursday but turned around to show signs of life again as we continue to grind to the upside. I believe in the longer-term uptrend, but the 1.3650 level above is massive resistance, as it is the scene of where we gapped lower after the Brexit vote. Because of this, I think that the market break above there should continue to go much higher, perhaps reaching towards the 1.40 level given enough time. Even if we do fall from here, I think that the market offers plenty of support near the 1.30 level after that. This is a market that continues to be noisy, but with the Bank of England looking to raise interest rates, I feel it’s only a matter of time before the buyers return to the market as it pulls back.