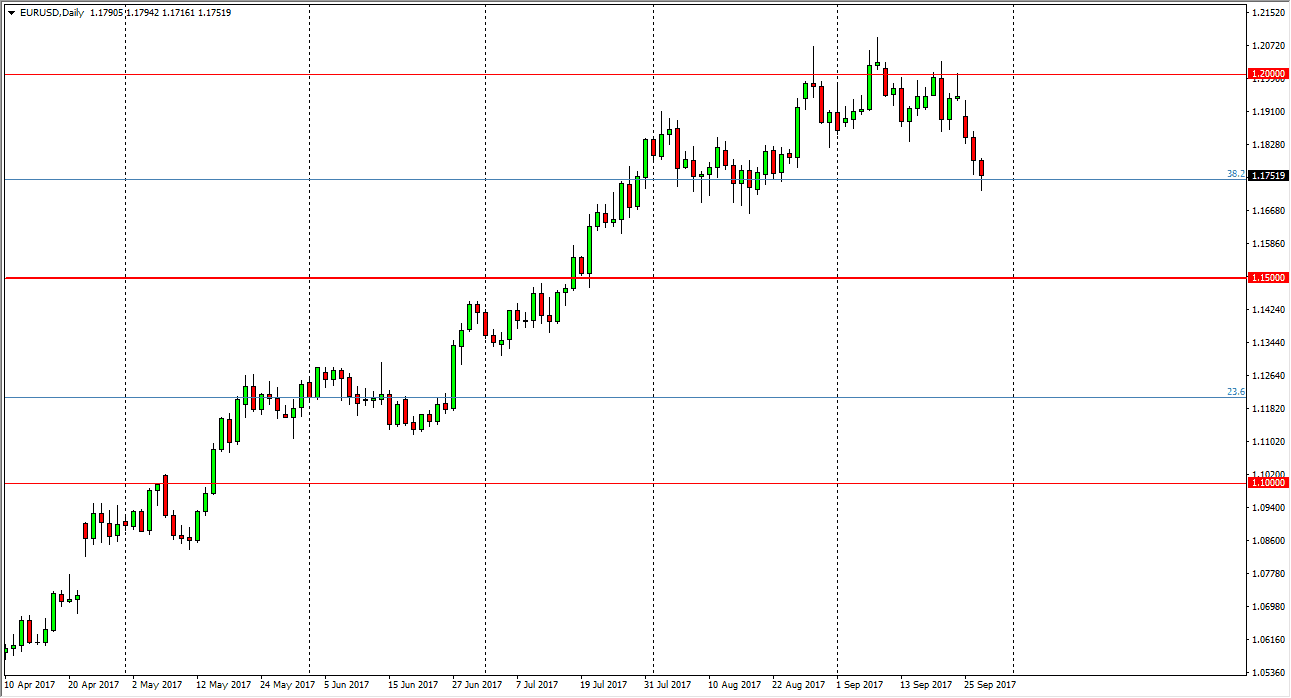

EUR/USD

The EUR/USD pair fell on Wednesday, but has found a bit of support near the 1.1750 level. I think if we can break above the top of the range for the session on Wednesday, we will go higher and go looking towards the 1.20 level again. Alternately, move below the 1.17 level has this market looking for the 1.15 handle. I still think that is can be difficult to break above the 1.20 level, and it may take some time to get there. However, the longer-term technical still suggest that we are going to go to the 1.25 handle. Ultimately, I believe that the market is bullish but we have course have a lot of noise in general, and that should continue to be an issue for those who cannot handle the volatility.

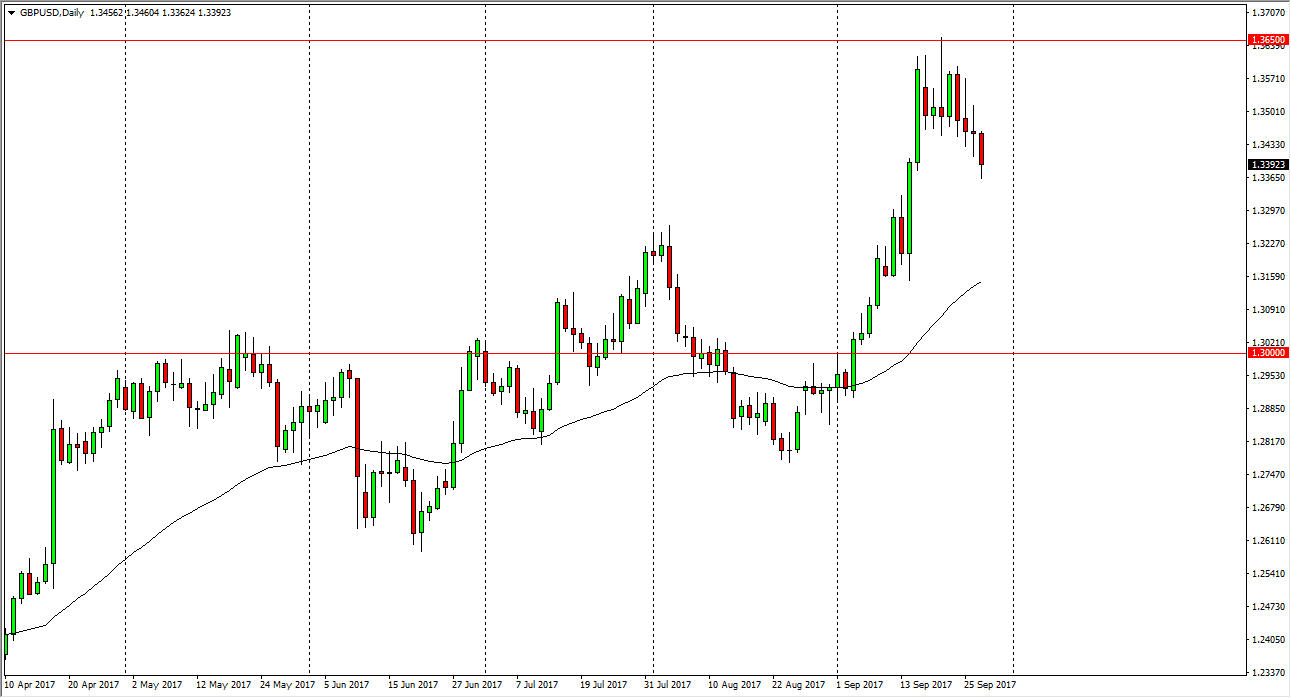

GBP/USD

The British pound fell significantly during the day, testing the 1.34 level. We found a little bit of support underneath her, but quite frankly I think we still need to drift a little bit lower, perhaps looking to the 1.33 level for support. That’s an area that I think we will see a lot of support and, and it’s likely that we turned around and there. The 1.3650 level above should be resistance still as it is the scene of the meltdown after the vote to leave the European Union. If we can break above there finally, then we go much higher. However, in the meantime I think we need to churn the markets around to build up enough momentum to finally do that. I suspect that the market will drift a little bit from here, looking for enough confidence to start going higher. It’s not until we break down below the 1.30 level that I would be concerned.