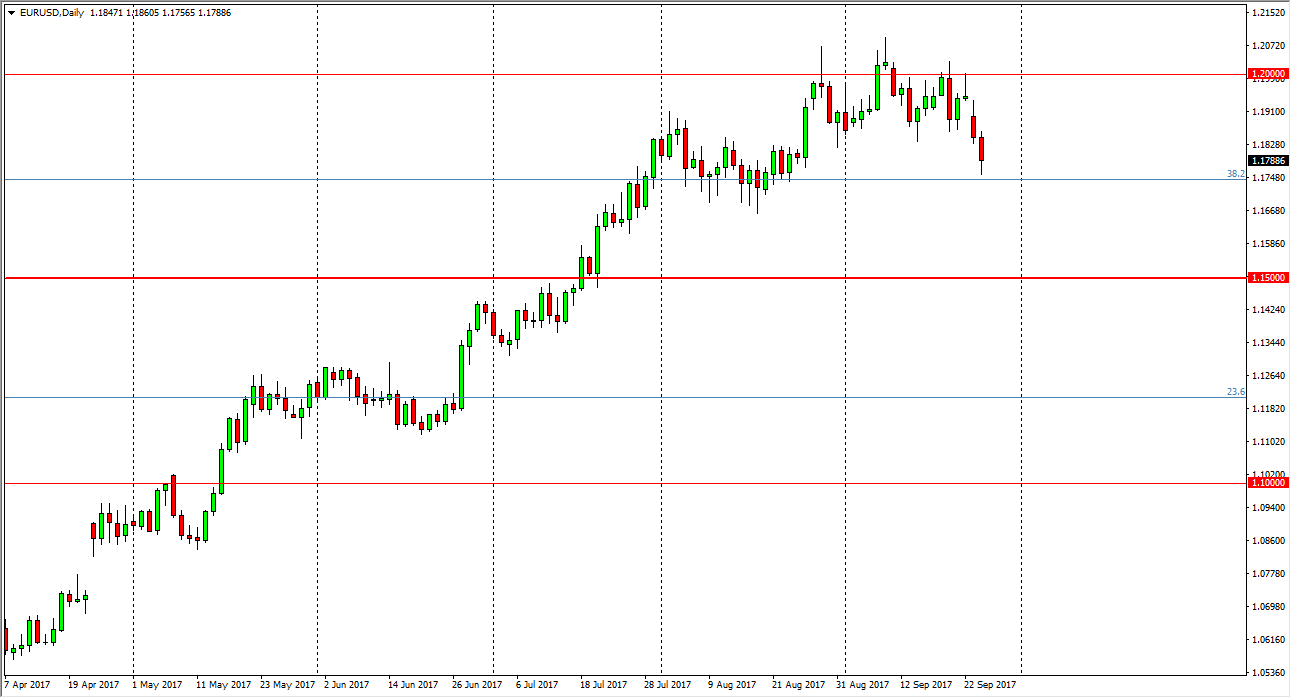

EUR/USD

The EUR/USD pair has continued the negative pressure during the trading session on Tuesday, as we have tested the 1.1750 level. We could bounce from here, but I believe that the 1.20 level above will continue to be very resistive. Alternately, if we break down below the 1.17 level, I think we will then go looking towards the 1.15 handle. Expect a lot of noise, people have been a bit spooked by the results of the German elections. Also, we should keep in mind that the Federal Reserve is looking likely to continue to shrink its balance sheet, and that is monetary tightening that should continue to favor the US dollar. I don’t know that the trend has changed completely, just that the market is getting help falling from here.

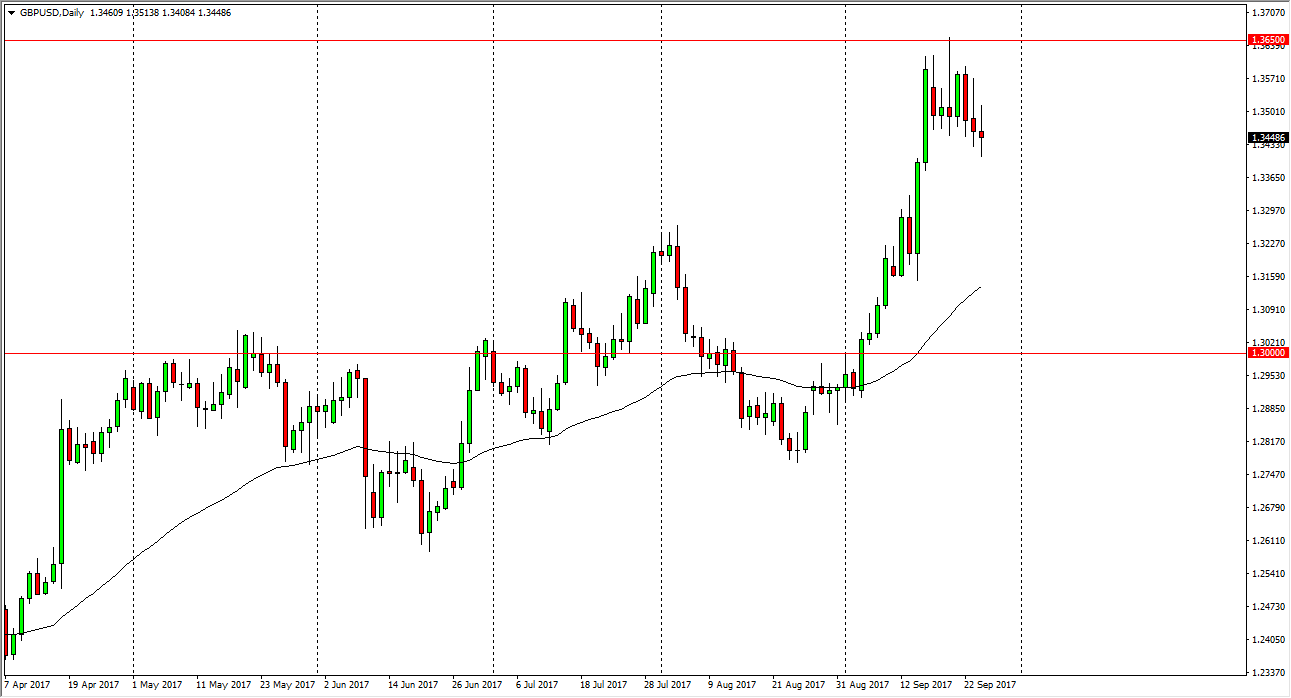

GBP/USD

The British pound tried to rally on Tuesday, but found enough resistance above the 1.35 level to turn around and form a shooting star. The shooting star was preceded by a couple of other shooting stars, and I think that perhaps the market will probably continue to drop from here. This is a market that has been a bit parabolic anyway, so pullback to the 1.33 level is very doable. I think that would be good for the longer-term uptrend, and I would be willing to buy the pullback that heads towards that direction. Alternately, if we can break above the 1.3650 level, the market should continue to go towards the 1.40 level above which is the next large, round, psychologically significant number. Ultimately, I believe that the market should continue to find support near the 1.30 level underneath, which should be the “floor” in the market. Either way, I think that volatility is one thing you can probably count on.