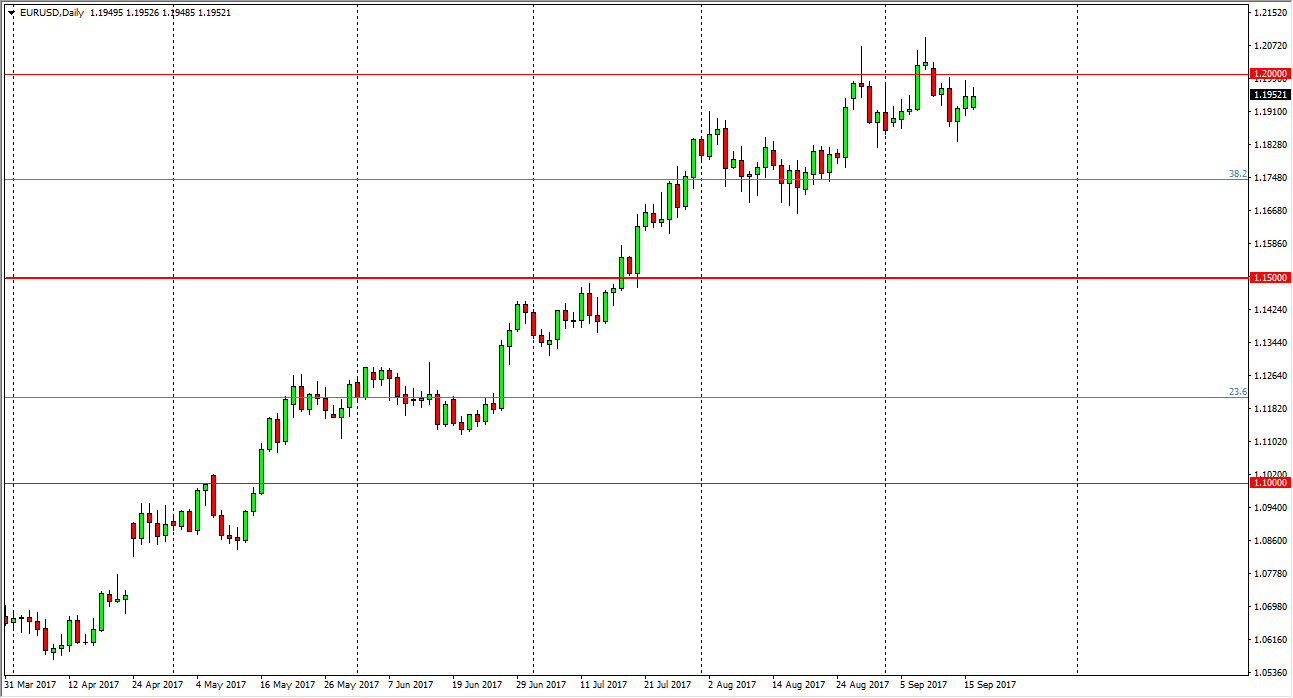

EUR/USD

The EUR/USD pair rallied slightly during the day on Monday, as we continue to struggle with the 1.20 level above. If we can break above there, and more importantly, a close above that level on a daily chart, I think the market will continue to go higher. Longer-term, I still believe that the buyers are going to continue to press higher as well. I think short-term pullbacks are buying opportunities, and I believe that the markets are simply in a holding pattern until we get word out to the Federal Reserve later this week. Nonetheless, I look at pullbacks as value that traders are willing to pick up. I have no interest in shorting this market, as I believe there is massive support below just waiting to be tested.

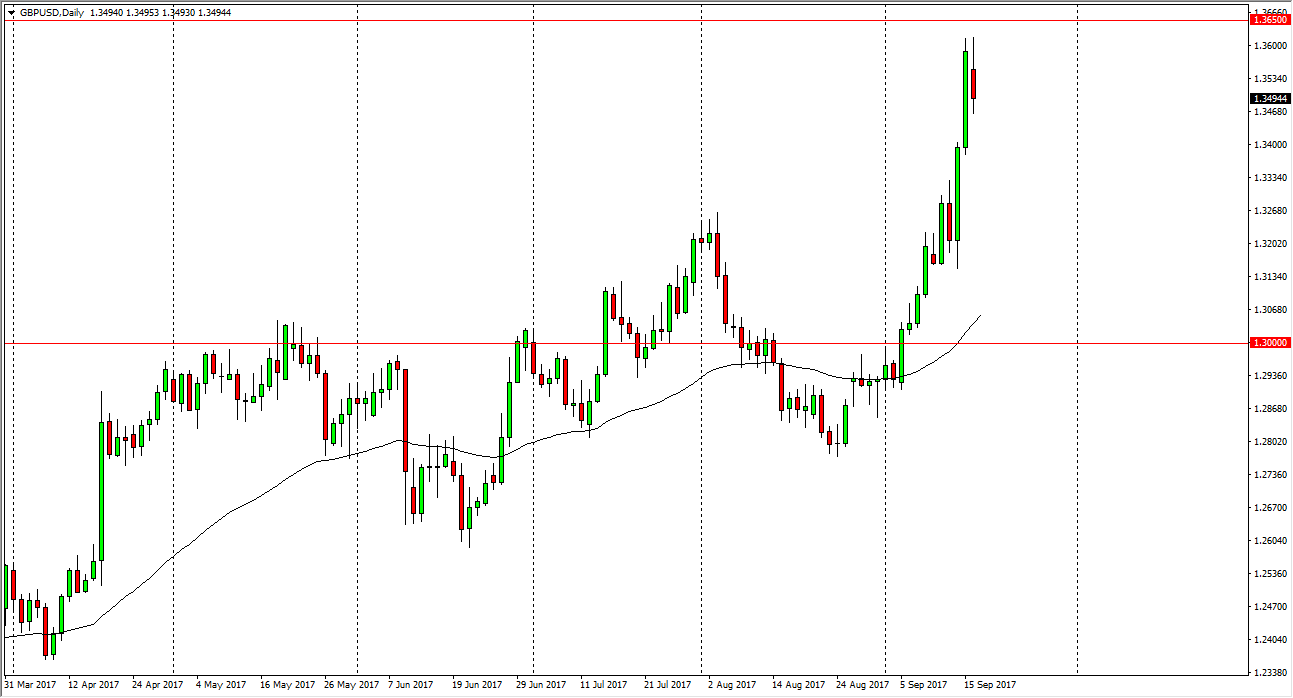

GBP/USD

the British pound went back and forth during the day on Monday, as the 1.3650 level has offered a significant resistance. This is where we gapped lower after the Brexit vote, and therefore it makes sense there would be a lot of resistance here. I think the market needs to pull back to find enough momentum to break out finally. The resulting shooting star for the day is somewhat ominous looking, and we are without a doubt overly stretched. I think this plenty of support underneath, especially near the 1.32 level for buyers to join the market, so I would be very interested in going long on a supportive candle. Obviously, a break above the 1.3650 level is also buying opportunity that I would be willing to take. Regardless, I believe that the British pound is overextended, so this pullback should be healthy. I have no interest in shorting the Pound anytime soon against the US dollar. Alternately, I think the market will go looking for the 1.50 level.