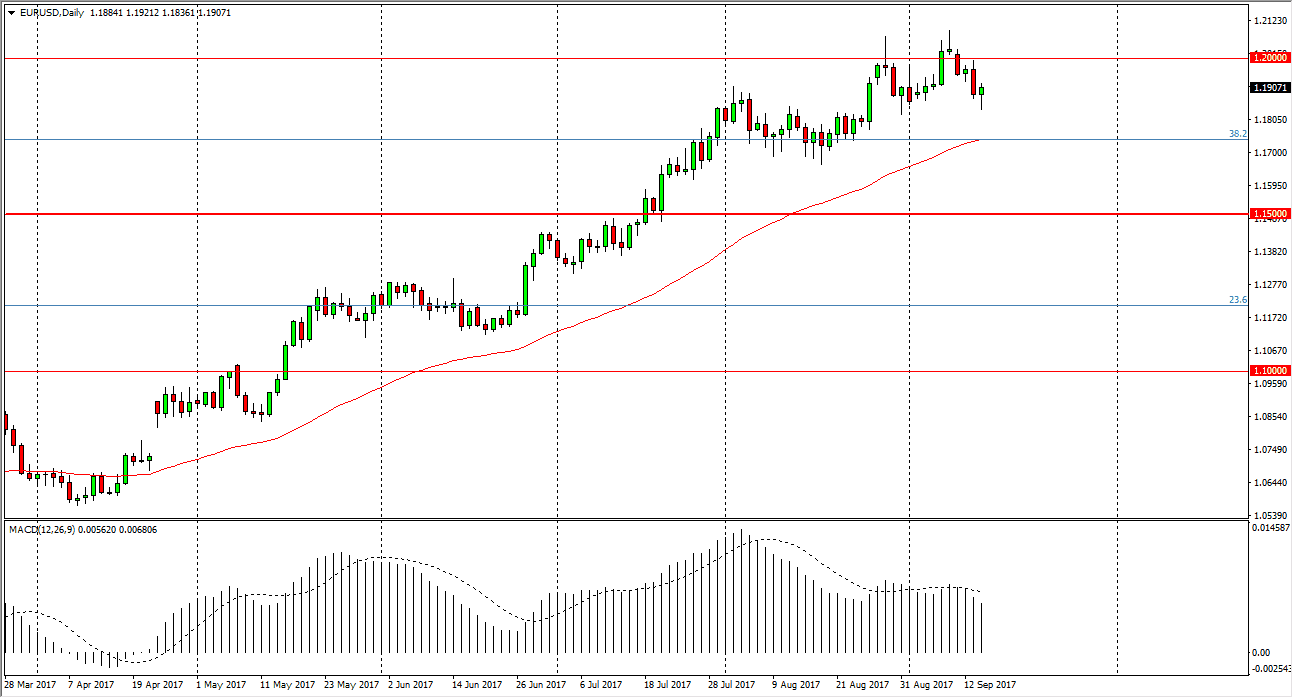

EUR/USD

The EUR/USD pair fell during the session on Thursday, but found enough support underneath to turn around and form a hammer. A break above the top of the daily candle should send this market looking towards the 1.20 level above. I think if we can break out above there, then the 1.21 handle will be the next target. If we can clear above the top of the 1.21 handle, then we can go higher for the longer-term move. In the meantime, it’s very likely that this market will remain volatile, but I do believe that eventually we break out. Because of this, I look at pullbacks as buying opportunities, although I need to see a little bit of bullish pressure to start putting money to work.

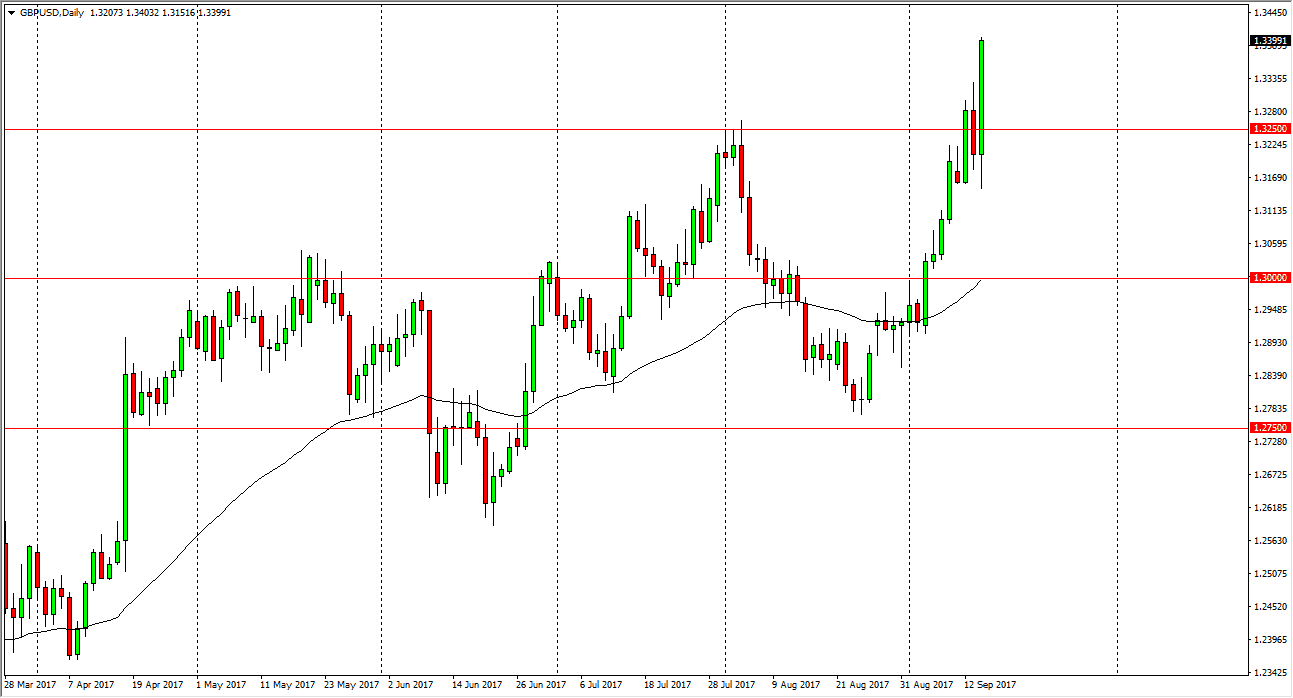

GBP/USD

The British pound initially fell during the day on Thursday, but turned around and exploded to the upside after the Bank of England suggested that interest rate hikes are coming relatively soon. Because of this, the British pound was the biggest gainer during the day, and now I think that the 1.3250 level underneath will continue to be support. I think that the market will then go to the 1.35 handle over the longer term, and that pullbacks offer value. I have no interest in shorting this market, because quite frankly there is still a lot of concern as to whether the Federal Reserve can raise interest rates anytime soon, so having said that I think that the market is going to continue to find buyers on dips. The 1.35 level is a massive resistance barrier though, as we have a huge gap at that level. If we can break above there, then the market can go much higher. In the short term, look at dips as buying opportunities.