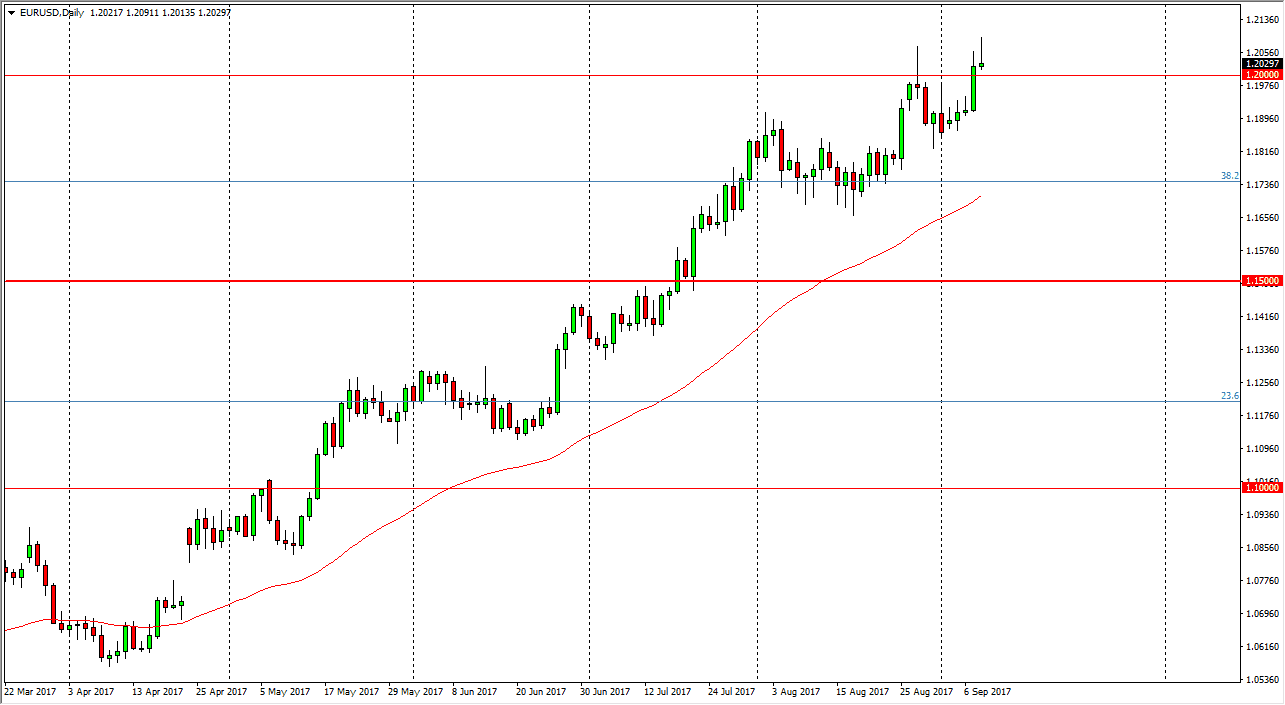

EUR/USD

The EUR/USD pair rallied initially on Friday, but turned around to form a shooting star. The 1.20 level underneath is important, but I think that we will break down below there. It should be supported underneath, and therefore I’m looking for buying opportunities below. Alternately, if we break above the top of the shooting star from the session on Friday, that would be a very bullish sign. I do believe that this pair goes higher of the longer term, but we might be a little bit overdone. Ultimately, I think that the 1.25 level is still the target, but I think that we need to pull back to build up a bit of momentum in the meantime. I won’t be a seller, or just simply wait for value underneath.

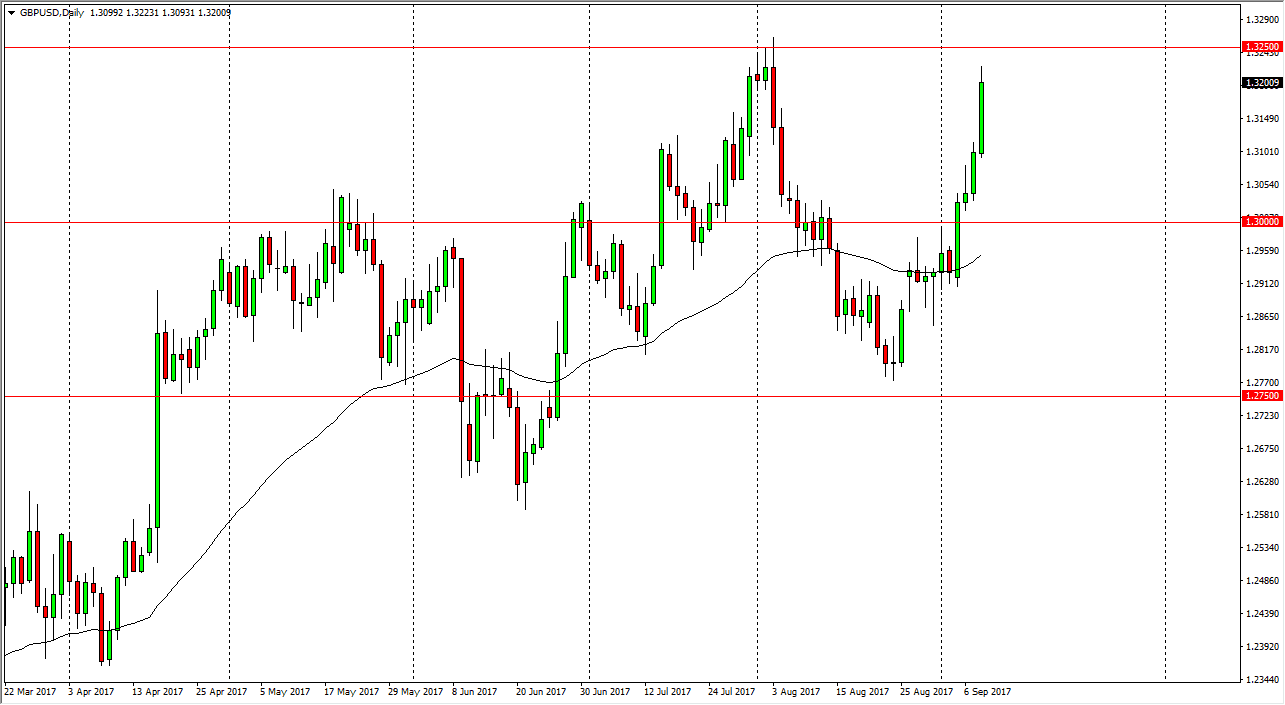

GBP/USD

The British pound exploded to the upside, reaching towards the 1.3250 level above. We have gone a bit parabolic over the last few days, so I suspect that we may get and exhaustive candle. If we do, I think it’s a short-term selling opportunity. Alternately, a break above the 1.3250 level should send this market towards the 1.35 handle that there is a lot of noise between here and there. Ultimately, this is a market that will continue to show a lot of volatility, and although we could go higher, as can be very difficult to deal with. Shorting will probably be easier, but I think the noisy conditions in this market will continue as we have no clarity when it comes to the exit negotiations with the European Union. This is a market that dictates that we use smaller than usual positions, to keep yourself out of serious trouble. I suspect that a pullback is coming in the short term more than anything else.