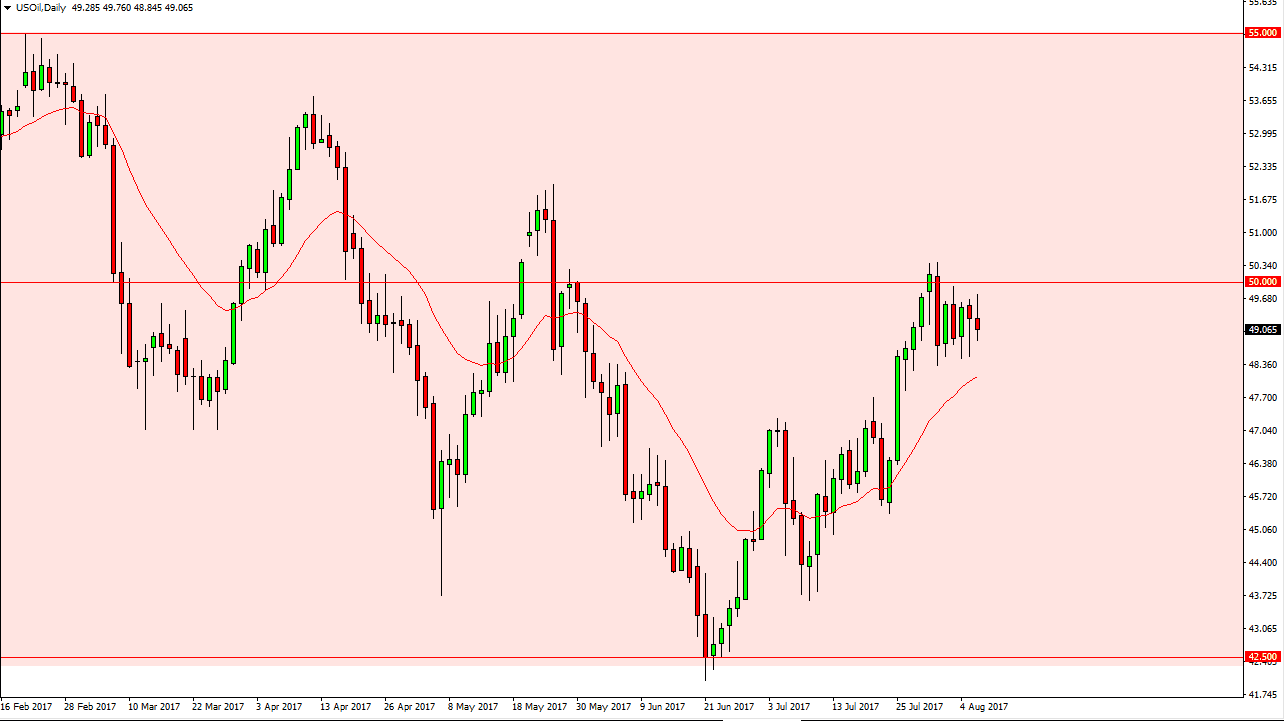

WTI Crude Oil

The WTI Crude Oil market continues to show a significant amount of volatility, as we went back and forth during the Tuesday session. The $49 level looks to be some type of magnet for price, but with the Crude Oil Inventories announcement coming out during the day, we will more than likely see the market making a strong move. If we can break above the $50.50 level, the market should continue to go to the upside. However, if we break down below the $48 level, I believe that the market will drop to the $47 level next. I will however, not take a position until after the inventory announcement has come out. Until then, were probably looking at short-term back and forth trading at best.

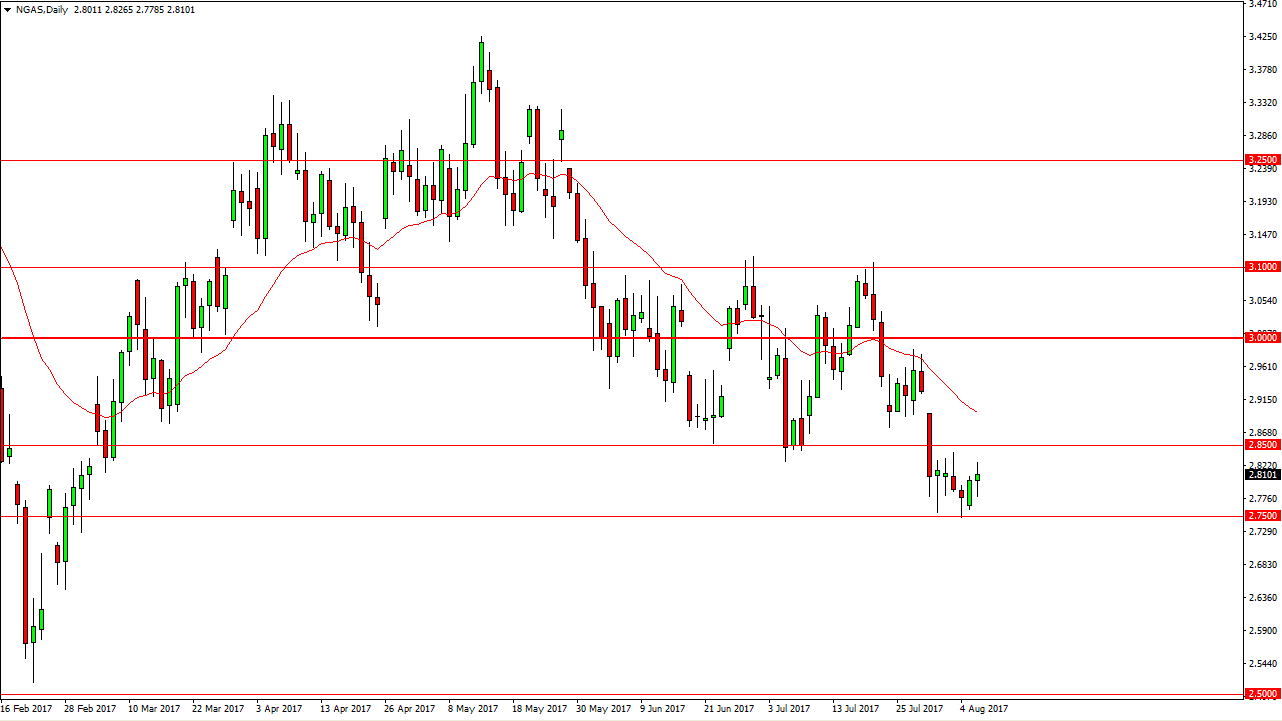

Natural Gas

The natural gas markets had a back and forth session on Tuesday, as I see support underneath at the $2.75 level. However, there is also significant resistance at the $2.85 level and of course the gap near the $2.90 level. Because of this, I believe it’s only a matter of time before the sellers return on any rally, and I look at those rallies on short-term charts as selling opportunities. Eventually, I anticipate that this market will break down below the $2.75 level, and then extend losses down to the $2.60 level, filling a gap, and then reaching towards the $2.50 level under that which has been massively supportive. I have no interest in buying natural gas, as I believe that the market is broken for a good reason. Quite frankly, we have more than enough natural gas out there to supply the world. I am a seller only, and look at bounces as an opportunity to get involved yet again.