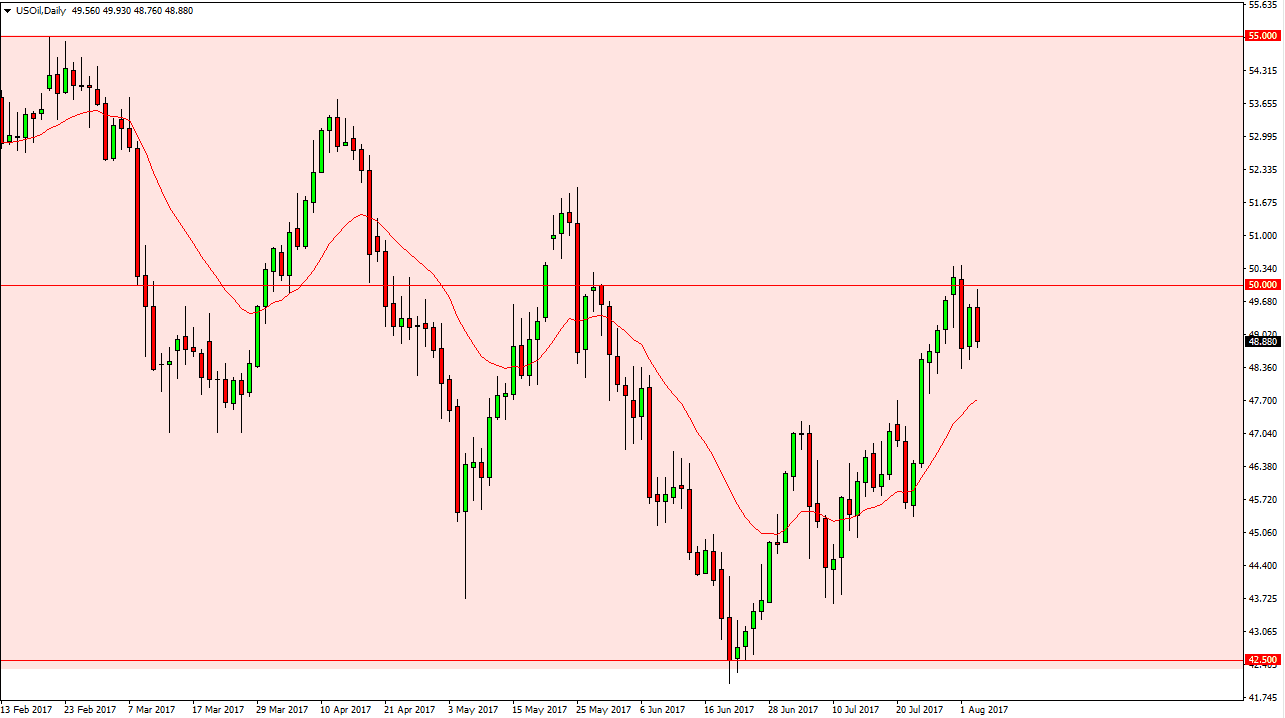

WTI Crude Oil

The WTI Crude Oil market initially tried to rally during the day on Thursday, but as we approached the psychologically important $50 level, the market broke down significantly. Now that we are reaching below the $49 level, it is obvious to me that the market is looking a bit heavy, and with the jobs number coming out today, that could be reason enough to push us in one direction or the other. I suspect that a move below the $48 level should send this market packing and going much lower. Alternately, if we can break above the $50.50 level, the market should continue to go much higher. The market has been very volatile, but if this market rose over here, we have made yet another “lower high.”

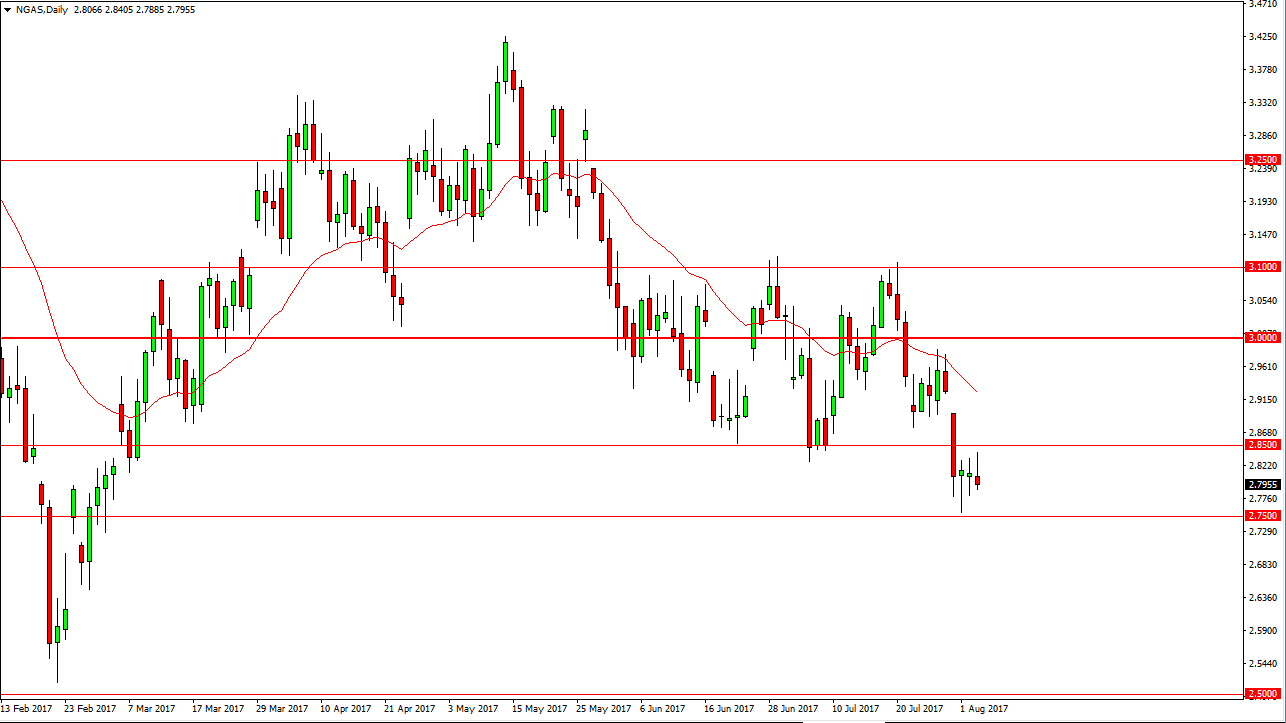

Natural Gas

Natural gas markets initially tried to rally during the day as well, but turned around to form a massive shooting star. I think that the market continues to be a “sell on the rallies” situation, and that we should go looking towards the $2.75 level underneath. That’s an area that has been massively supportive, and I think if we can break down below there, the market will more than likely go to the $2.60 level, and then the $2.50 level. I have no interest in buying natural gas, it is oversupplied. The gap above should continue to keep a lid on the market as well, so I don’t think we go any higher than roughly $2.92, regardless of what happens next. Ultimately, I believe that the market has a massive ceiling in it close to the $3 level. Selling rally short-term should continue to be a nice trading opportunity going forward, and I think we should continue to go back to the downside given enough time.