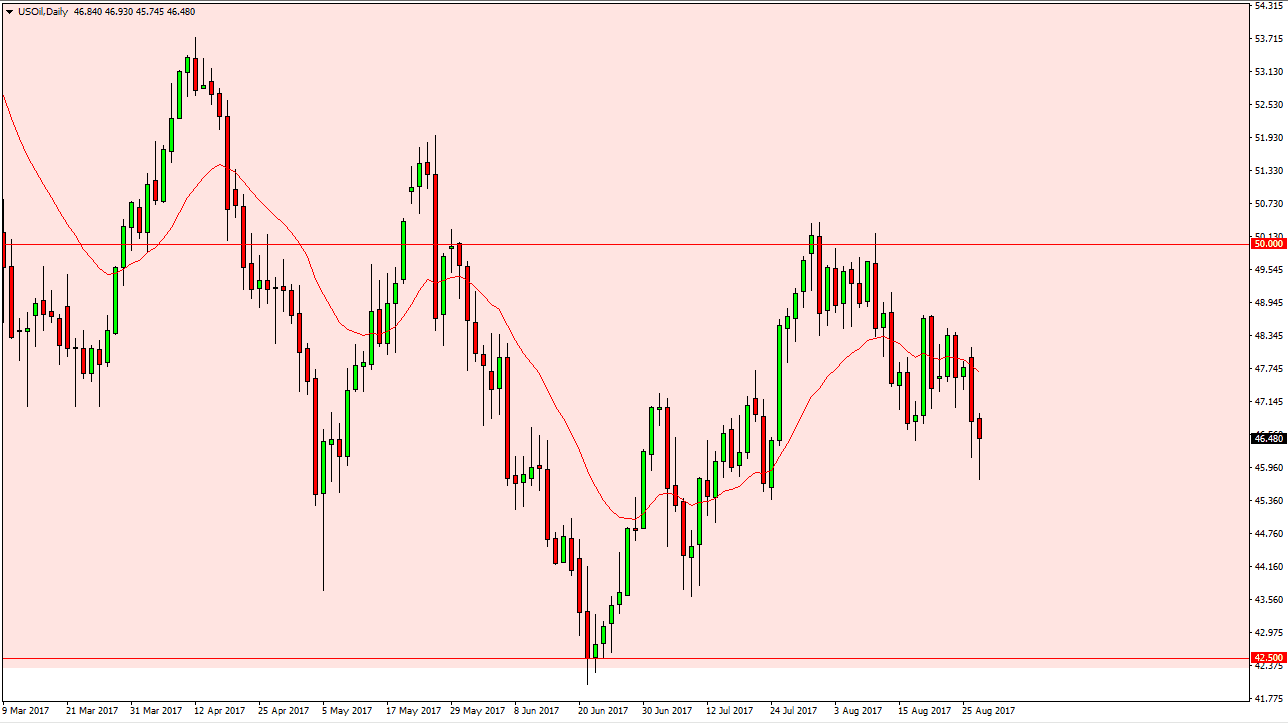

WTI Crude Oil

The WTI Crude Oil market fell during most of the session on Tuesday, but found a bit of support as we formed a hammer like candle. I think that any rally at this point should be a selling opportunity though, and perhaps the market has just gotten ahead of itself. With this in mind, I believe that the market should continue to be one you sell. A breakdown below the hammer of course is a negative sign as well, and I think will go looking towards the $42.50 level underneath which has been supportive in the past. I believe that the $50 level above is far too resistive to overcome, least in the short term as there is going to be less demand for petroleum by the oil refiners in the United States.

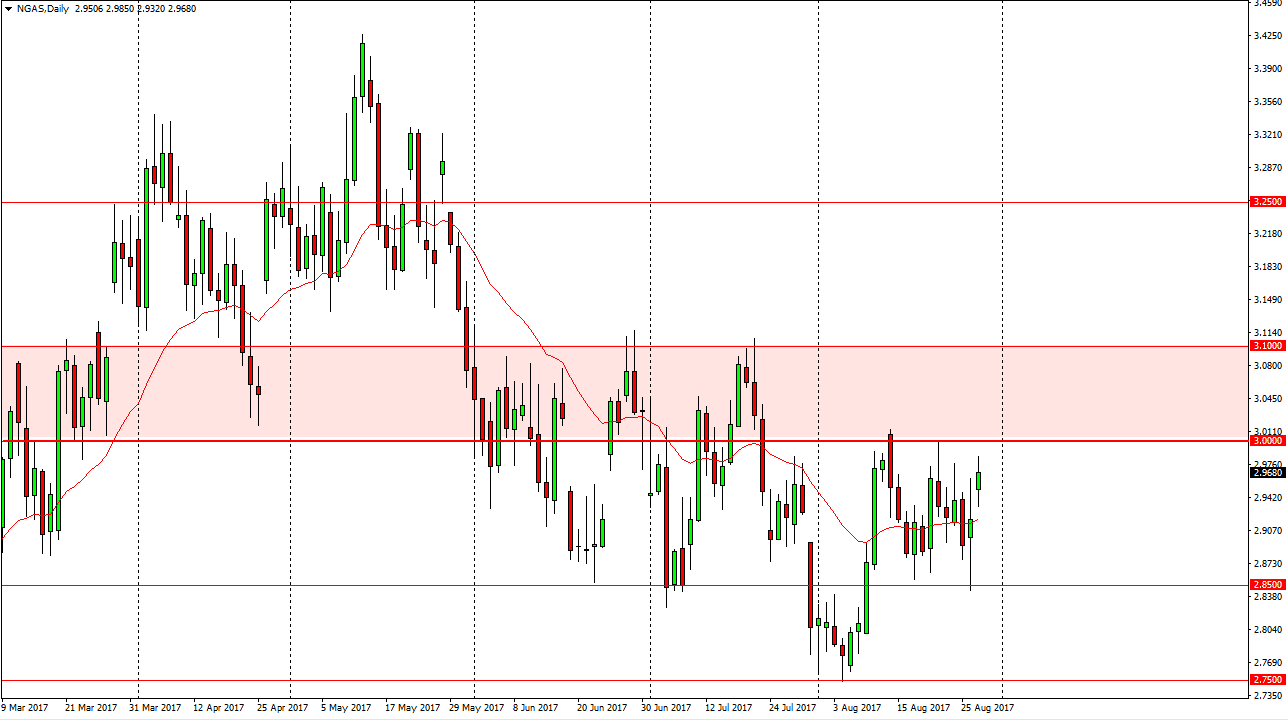

Natural Gas

The natural gas markets gapped higher at the open as we continue to see a lot of volatility coming out of the Gulf of Mexico as far as supply is concerned. However, the $3 level above is massively resistive so I think that we should continue to see sellers jump into this market. I look at short-term rallies as selling opportunities, and will continue to be the attitude of the market overall. Eventually, the market should then go down to the $2.85 level, which has been massively supportive. Even though we are starting to see a lot of concerns with the weather and disruption of supply, the reality is that any rally in this market should be thought of as an opportunity to go short. I see a massive barrier extending to the $3.10 level above, and therefore this is a “only” situation and what I can see. I have no scenario in which a willing to buy this market.