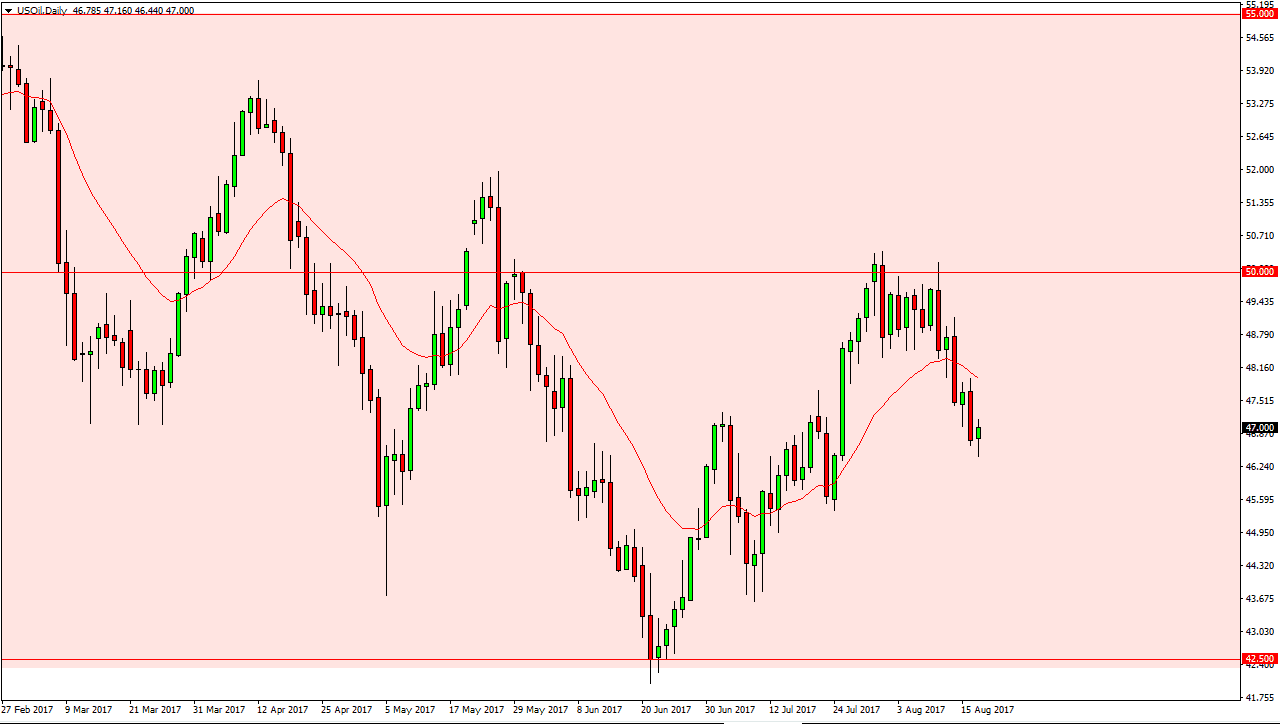

WTI Crude Oil

Thursday saw the WTI Crude Oil market fall significantly, but turned around and form a hammer. Because of this, I think we could get a bounce but today is can be a very interesting session as we get the Baker Hughes Rig Count, and this could give us an idea as to how much production is coming out of the United States. Because of this, it’s likely that we will continue to see a significant amount of volatility, and if that number is above the 783 from last week, we could see a drop. Ultimately, I think that the market should continue to see quite a bit of volatility, but I think that any rally at this point would have to be looked at with suspicion, as the $50 level should be massively resistive.

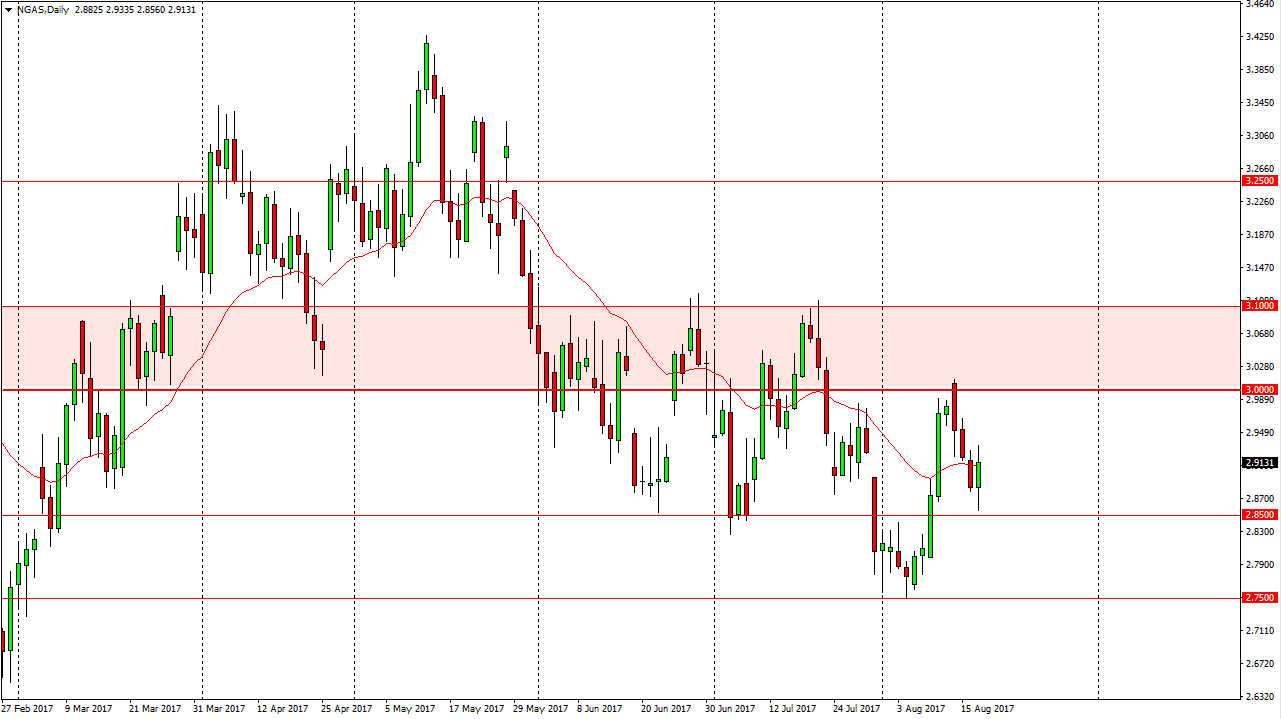

Natural Gas

Natural gas markets fell initially during the day on Thursday, but found enough support at the $2.85 level to turn around and rally. Ultimately, we found enough resistance above to turn things around, so I think that the market will probably bounce around and cause quite a bit of consternation. I think that the market near the $2.95 level should find plenty of resistance, and most certainly will at the $3 level above. If we break down below the $2.85 level, the market should then go to the $2.75 level. I am bearish natural gas overall, so regardless of what happens, I am not buying. Ultimately, I think that the sellers will return in the pink band on the chart should be a massive resistance barrier that I think the market cannot break above. Because of this, I remain very bearish on natural gas. Expect choppiness, but ultimately, I believe the sellers are going to continue.