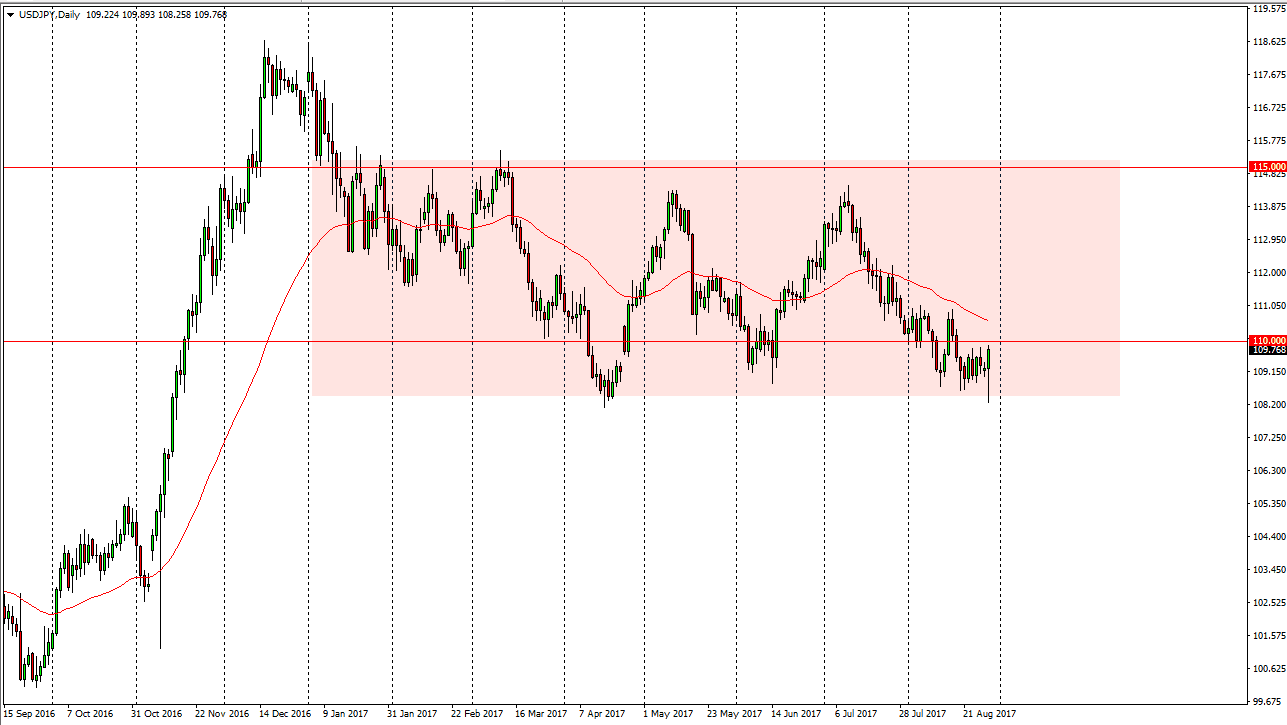

USD/JPY

The US dollar initially fell against the Japanese yen as the North Koreans launched a missile across Japan. However, later in the day, specifically during the American session, buyers came back into the market and started picking up risk assets. This lifted the pair, and sent it looking towards the 110 level. This explosive move shows just how well supported the market is, and how the overall consolidation should continue. At this point, buying on pullbacks continues to be the best way to play this market, as the upside of the consolidation area extends all the way to the 114.50 level above. Ultimately, I believe that “buy on the dips” remains the mantra in equities, and therefore will probably be the mantra over here as well as the 2 tend to be highly correlated.

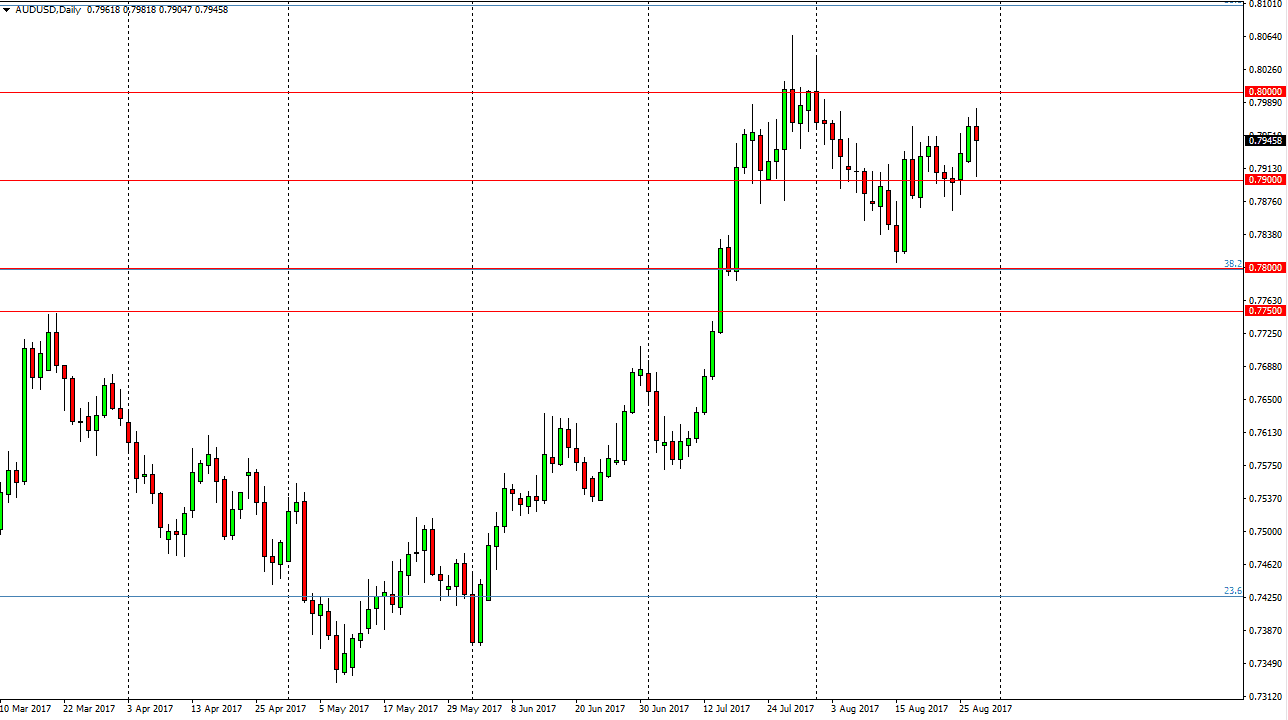

AUD/USD

The Australian dollar initially fell as well, as it is considered to be a risk asset. However, it is highly correlated to gold which shot higher during the day as well. However, as the Americans took control gold started to sell off as fear left the market. That being the case, we drove the Aussie back down. I believe this could be a buying opportunity though, because gold has broken above the vital $1300 level. The 0.80 level above is massively resistive, and certainly important based upon longer-term charts, so I recognize this as a real challenge. Pullbacks are going to be used to build up momentum, which is something that this market will need to clear that significant barrier. If it does, then it becomes a “buy-and-hold” situation, but in the meantime, I think short-term buying is probably about as good as this market gets. I believe that the 0.7950 level is supportive, but there’s even more support at the 0.79 handle.