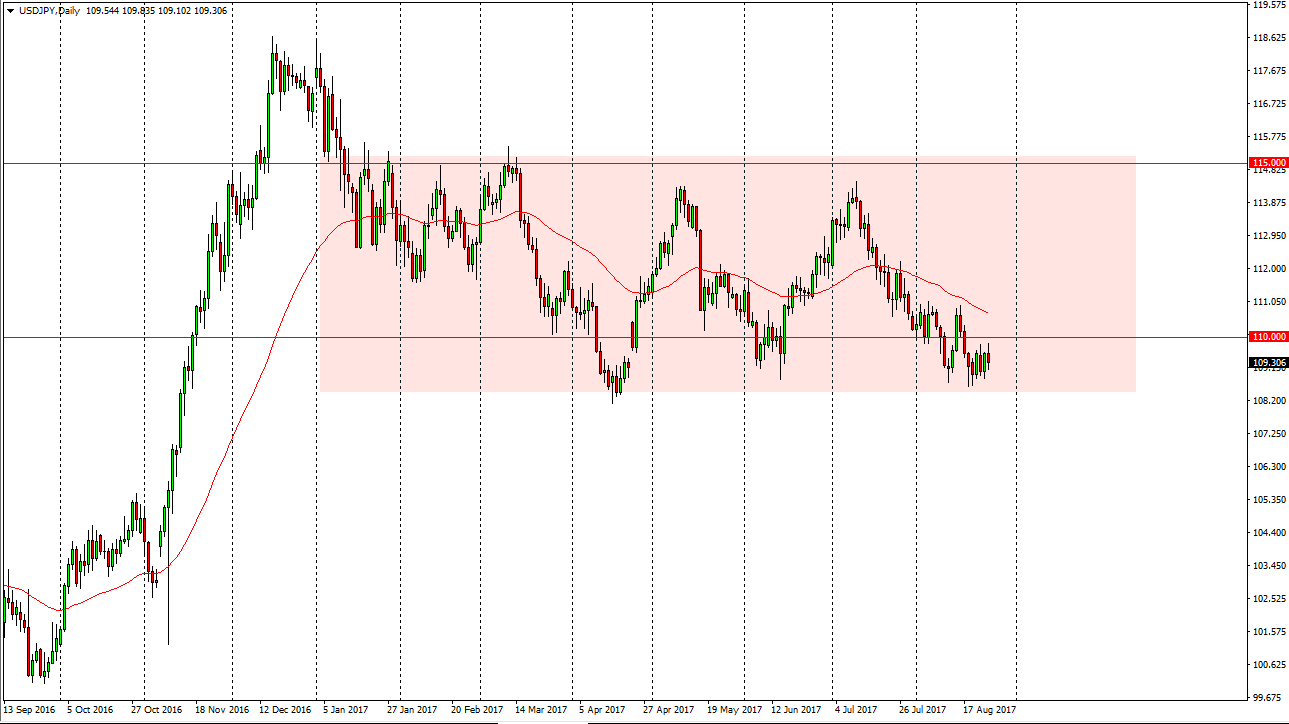

USD/JPY

The USD/JPY pair had a slightly negative session on Friday as we continue to bounce around below the 110 level. The 108.50 level has offered support yet again, and it looks as if were going to consolidate. If we can break above the 110 level on at least a daily close, then I think we could go looking for the 111 handle, and perhaps even the 114.50 level after that. If we were to break down below the 108.50 level, the market could then break down towards the 105 level. Keep in mind that this pair is highly sensitive to risk appetite, so pay attention the stock markets and the like, as the spillover effect can affect where this currency pair heads next.

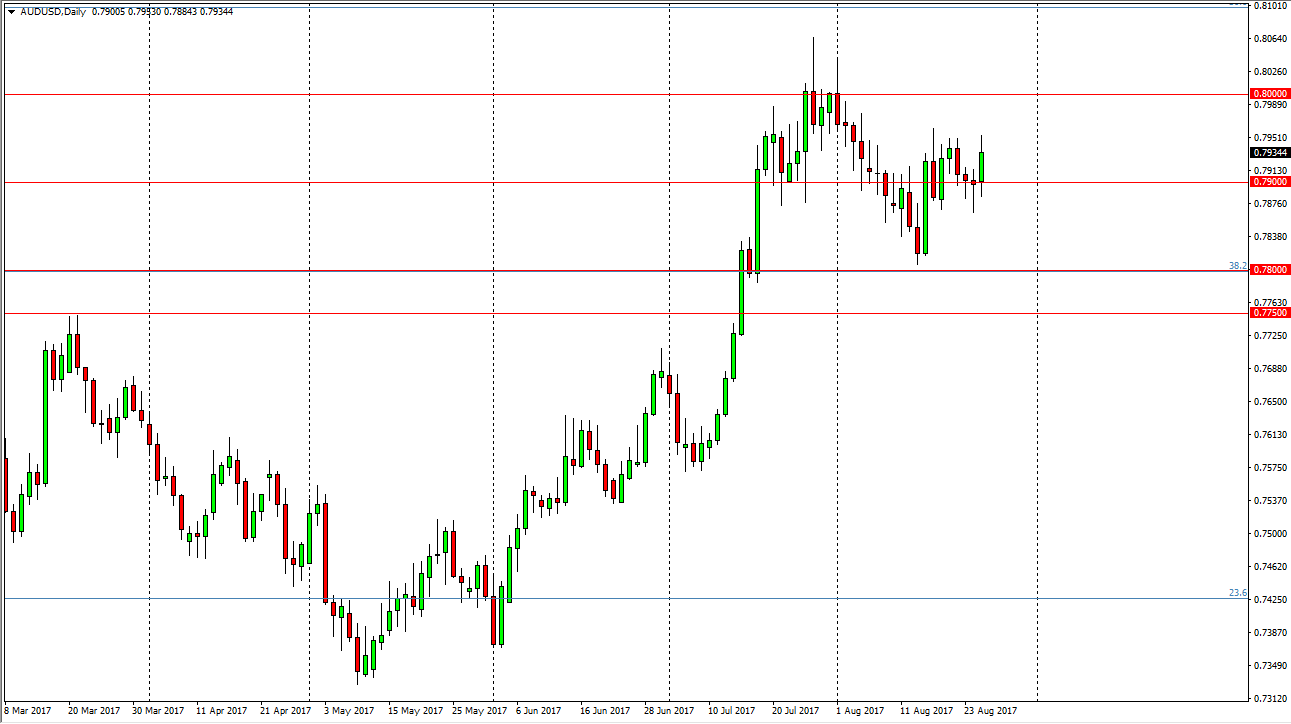

AUD/USD

The Australian dollar initially fell during the session on Friday but turned around to show signs of strength again as Janet Yellen spoke. However, the 0.80 level above is massively resistive, and were going to need a bit of help to get above there with any sustainability. This will probably come from the gold markets, so I’m not interested in buying this market until we get the gold market breaking above the $1300 level, a formidable barrier on the chart. The 2 should happen in tandem, and therefore confirm each move. If we pull back from here, I expect to see support near the 0.79 level. I also believe that the 0.78 level underneath is supportive as well. I don’t necessarily look at this market is one I want to sell, but I’m not willing to put a lot of risk into the Australian dollar until we clear the 0.80 level, something that is going to take serious momentum building to do so. Going back decades, that level has been important.