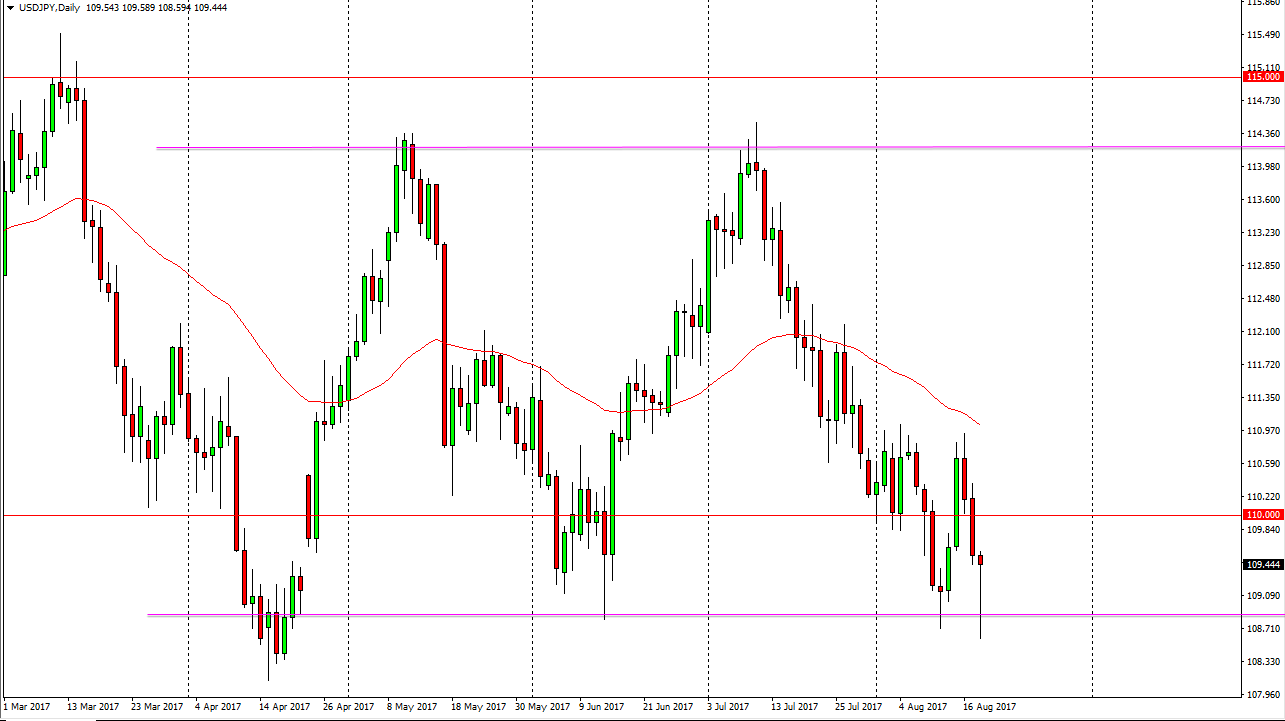

USD/JPY

The US dollar had a volatile session against the Japanese yen again, as we fell rather significantly. However, the Americans picked the ball back up and it now looks as if were going to form a hammer at the bottom of the overall consolidation. Because of this, I think that the buyers will continue to push this market to the upside and therefore I am bullish, but I also recognize that there’s a lot of danger in this market. A small position is probably the best way to go going forward. If we clear the 110 level, I think we will then go to the 111 level. A break above there should be a target to the 112.50 level after that. Ultimately, we could go as high as the 114 handle. A breakdown below the bottom of the hammer for the Friday session would be very negative.

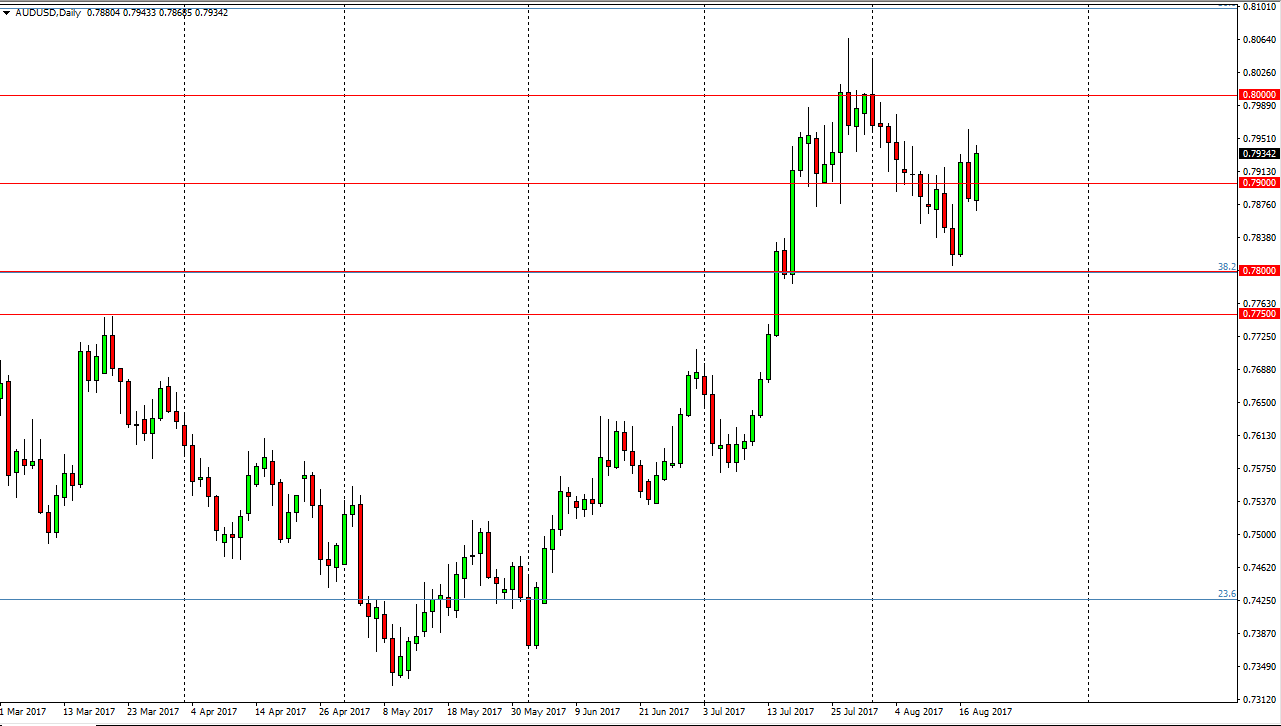

AUD/USD

The Australian dollar rallied during the day on Friday, clearing the 0.79 level. The market broke above to reach towards the 0.7950 level, and it looks likely that the market will probably attempt to reach towards the 0.80 level above. That’s an area that is important on charts going back decades, so it’s likely that it won’t be able to break above the right away. However, I think the given enough time we probably will. Once we break above there, the market should continue to go even higher. I think that the area below the 0.78 level will continue to be massively supportive, extending down to the 0.7750 level. This is a market that I think is also getting a bit of bullish pressure from gold as well, and if gold can break above the $1300 level, this market will certainly follow suit.