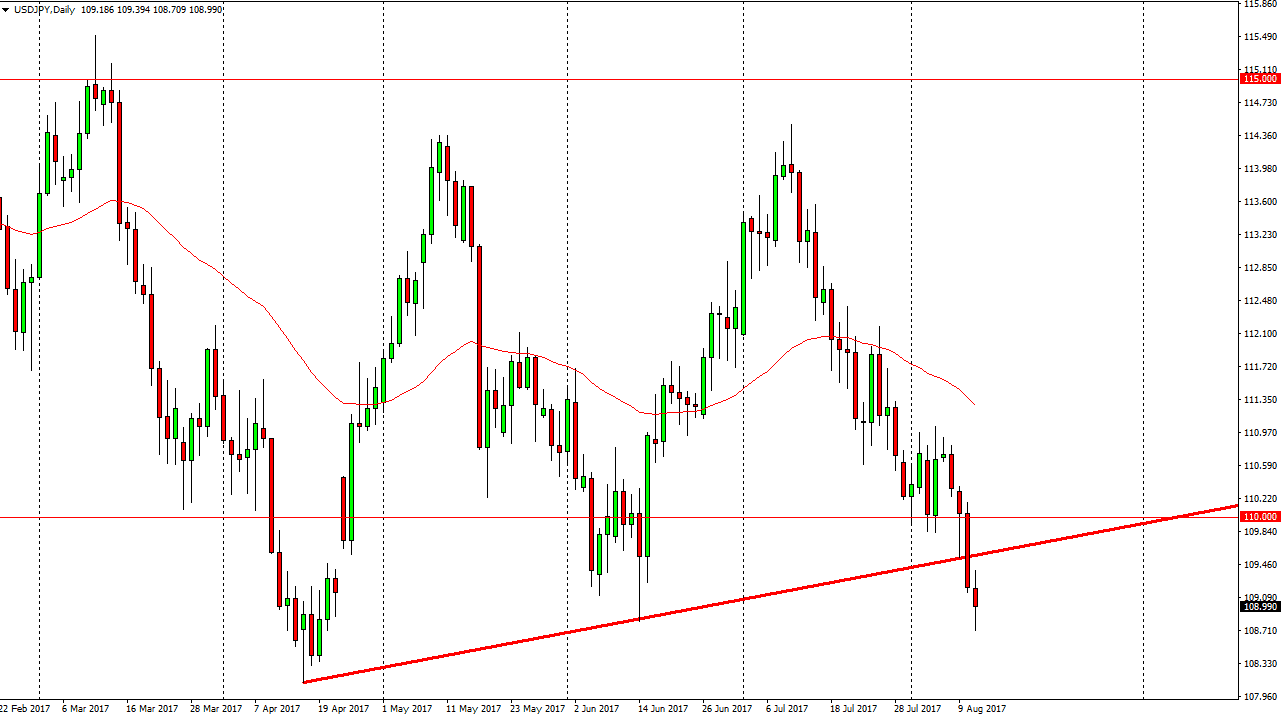

USD/JPY

The US dollar continues to look soft against the Japanese yen, as Friday initially had a bullish move, but then turned around to show a negative move. We did bounce from the lows though, so I think were going to see a significant amount of volatility. Most of this move has been due to the arguments between the United States and the North Koreans, so I think it’s only a matter of time before things calm down, and then we turn around to go higher. However, we need a break above the 110 level to build up the necessary momentum to continue to the upside. In the meantime, we could target the 108 level which should be supportive as well.

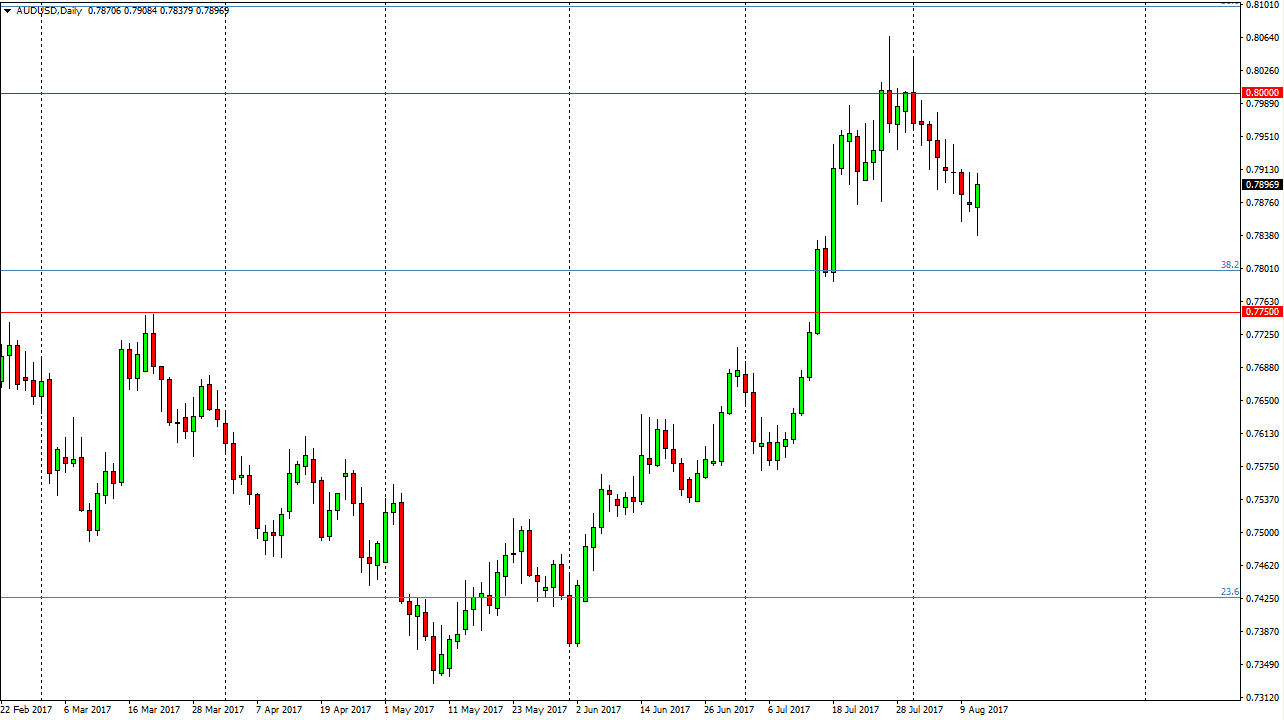

AUD/USD

The Australian dollar initially fell during the day on Friday, but found enough support to turn around and form a massive hammer. That’s a very bullish sign, the market looks likely to go looking towards the 0.80 level above. That is massive resistance though, so it is going to take a certain amount of bullish momentum to continue to go higher. In the meantime, I do think that we go higher and reach towards that level, but that level should hold unless of course we get some type of massive amount of momentum to finally break out. Otherwise, if we break down below the bottom of the hammer for the session, then I think the market goes looking towards the 0.7750 level underneath which was previous resistance. That area has not been tested for support, so it makes sense that we would try to go down to that area. In the meantime, it looks like the short-term buyers have returned. This could be driven by higher gold prices at the end of the day on Friday.