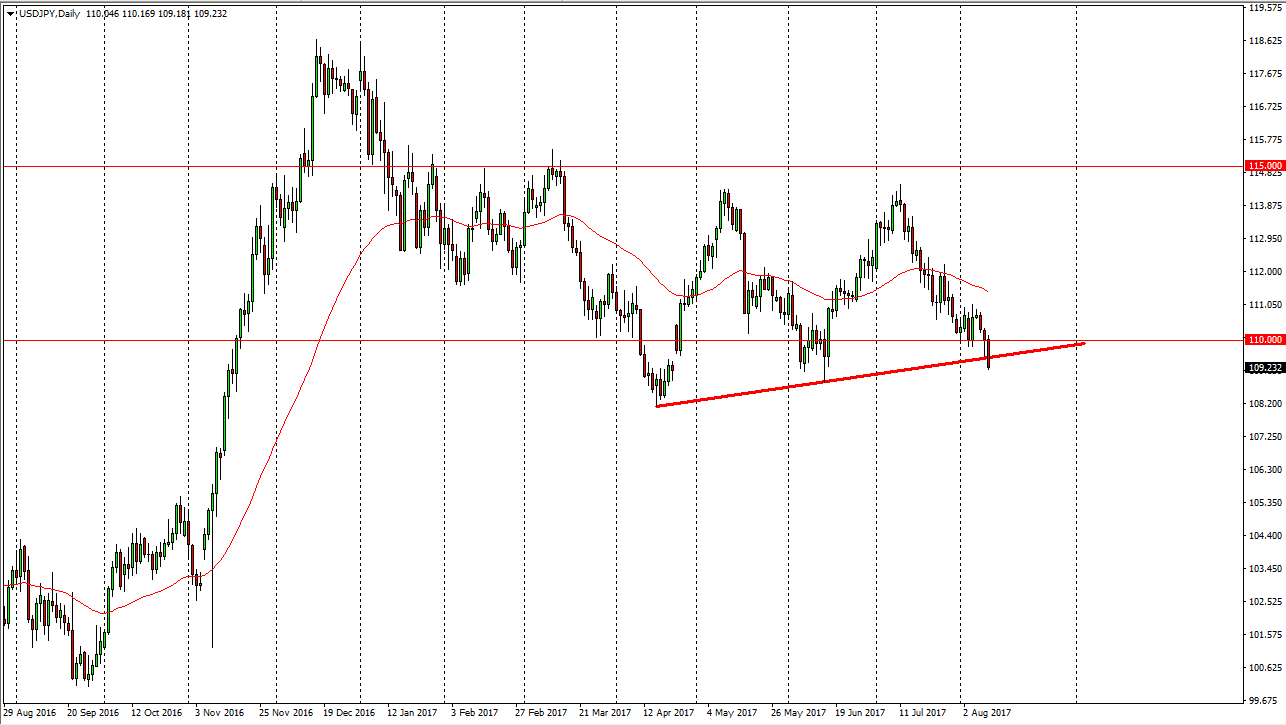

USD/JPY

The US dollar fell during the day on Thursday, breaking below the bottom of the hammer from Wednesday and even breaking down below what could have been a very supportive uptrend line. Because we have done this, I think we are going to continue to go lower, but I don’t necessarily believe that is can be an easy breakdown. This is a market that has a lot of noise underneath it, extending down to the 108 level. If we do breakdown below the 108 handle, the market will then break down rapidly and reach towards the 105 level. Because of this, it’s very likely that we will see continued bearish pressure. However, if we break above the 110.25 level, I would be a buyer as it would be a complete reversal of the selling pressure.

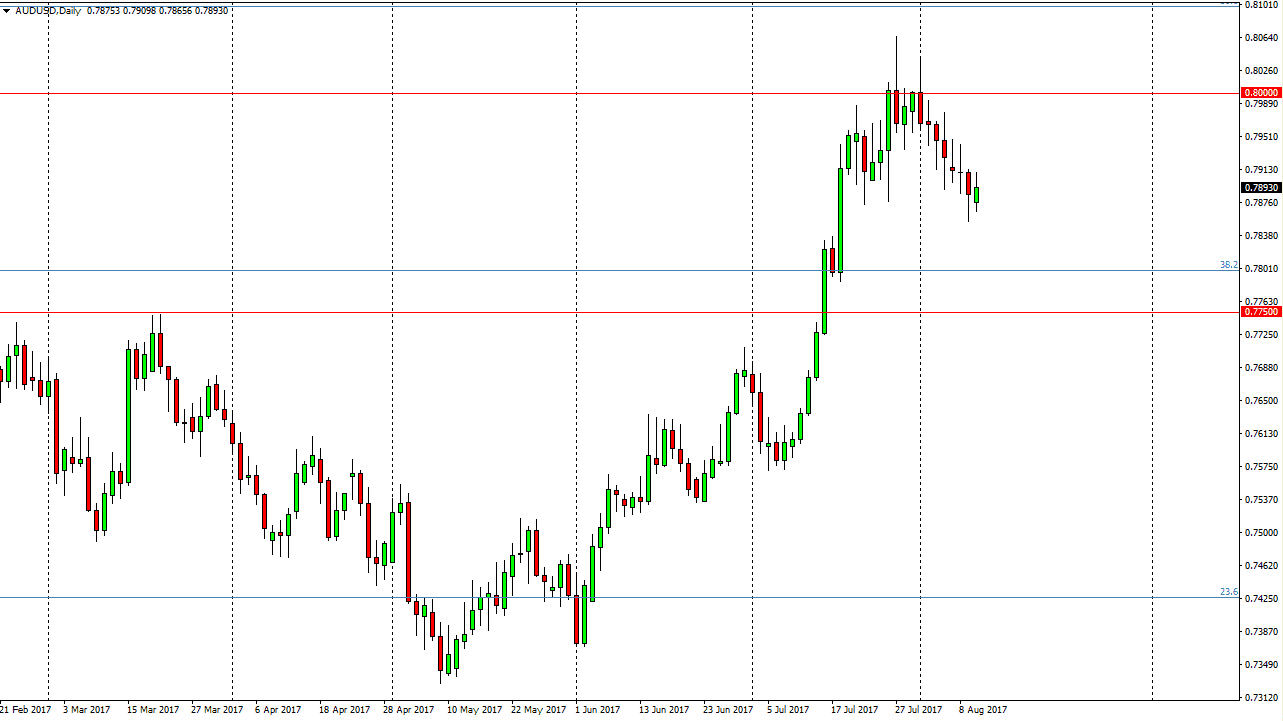

AUD/USD

The Australian dollar fell initially during the day but did see a bit of a resurgence as gold has been bought out. Now gold has to deal with the $1300 level, and if we can break out above there the Australian dollar could go much higher. If we break down below the bottom of the hammer from the Wednesday session, the Australian dollar will go looking towards the 0.7750 level underneath, which is massively supportive based upon the massive resistance that we saw in the past. Because of this, I believe that a pullback is healthy, and that we will get a buying opportunity given enough time. The 0.80 level above should be a target for longer-term traders, and if we can break above there I think that the market becomes more of a “buy-and-hold” situation as the 0.80 level is so important going back decades. In the short term though, I think that we will probably see a little bit of a slow grind lower.