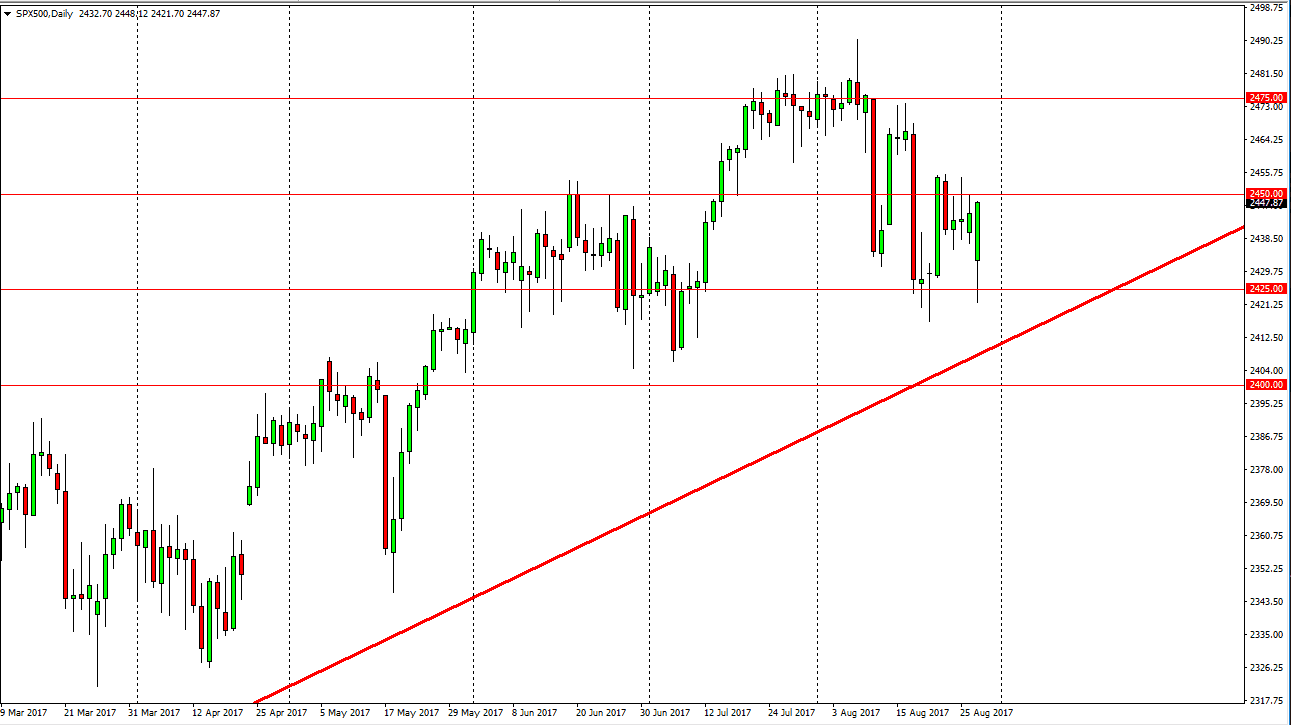

S&P 500

The S&P 500 fell initially at the open on Tuesday, testing the 2420 handle. This was due to the chaos caused by the North Koreans firing a missile over Japan. However, later in the day we started to see US equity traders come back into the market, and let things out. It seems as if the market is still a “buy on the dips” scenario, and with the uptrend line below, I think it is going to be difficult to sell this market for any length of time. Because of this, I believe that the market will continue to offer short-term buying opportunities every time it pulls back. We are in a relatively quiet time of year typically, and certainly the volume is going to be less than desirable as most Americans are away at holiday currently. Nonetheless, selling is all but impossible until we break that trend line.

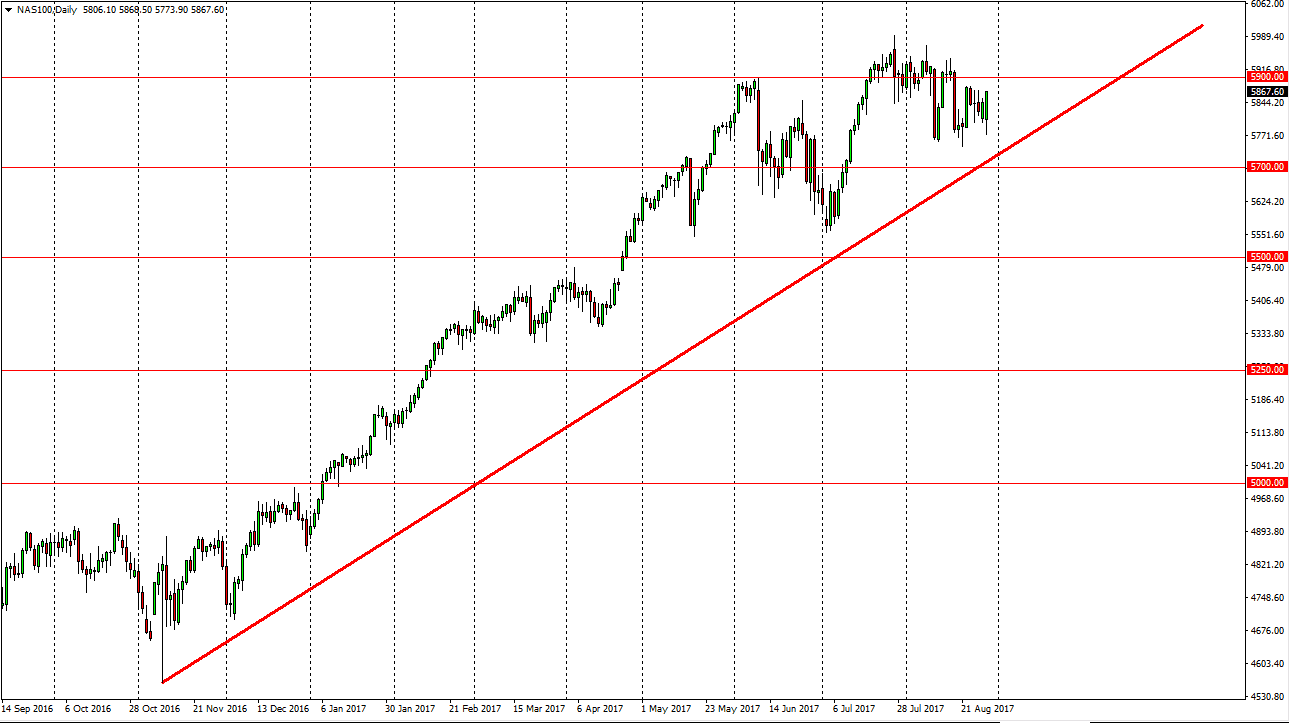

NASDAQ 100

The NASDAQ 100 fell initially as well, but turned around to form a very bullish candle. I believe that if we can break above the 5900 level, the market should continue to go much higher, perhaps reaching towards 6000 over the longer term. The uptrend line is still intact, and if that remains the case, there’s no way to sell this market. We are bit overextended in general, but right now it looks as if the algorithms are coming back into the market to pick up stocks when they pull back. Because of this, I believe that buying on the dips continues to be the way forward in the NASDAQ 100 as well as the Dow Jones 30 and S&P 500. Going forward, I would not be surprised at all to see that trend continue, as the market seems to be on autopilot.