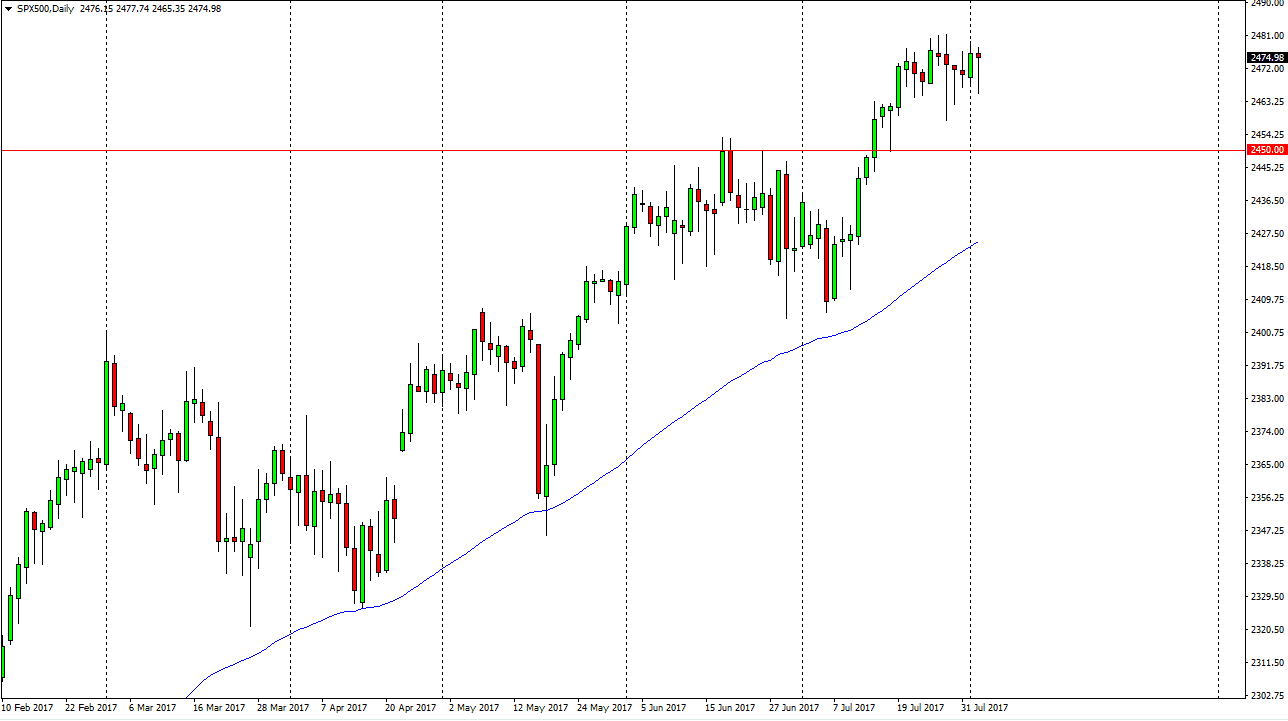

S&P 500

The S&P 500 fell significantly during the day on Wednesday again, but just as a we keep seeing, algorithmic traders are jumping into the market and picking up with a perceived as a move beyond standard deviation. Because of this, it’s likely that every time we dip, the buyers will continue to jump in. The 2450 level underneath should continue to be a “floor” in the market, as we are most certainly in an uptrend. I think that the market will eventually try to reach towards the 2500 level, and I look at these pullbacks as nice buying opportunities. Because of this, I remain bullish but I also recognize that tomorrow is the jobs figure, so it could be fairly quiet during trading today as US traders will most certainly be on the sidelines and waiting for that important information.

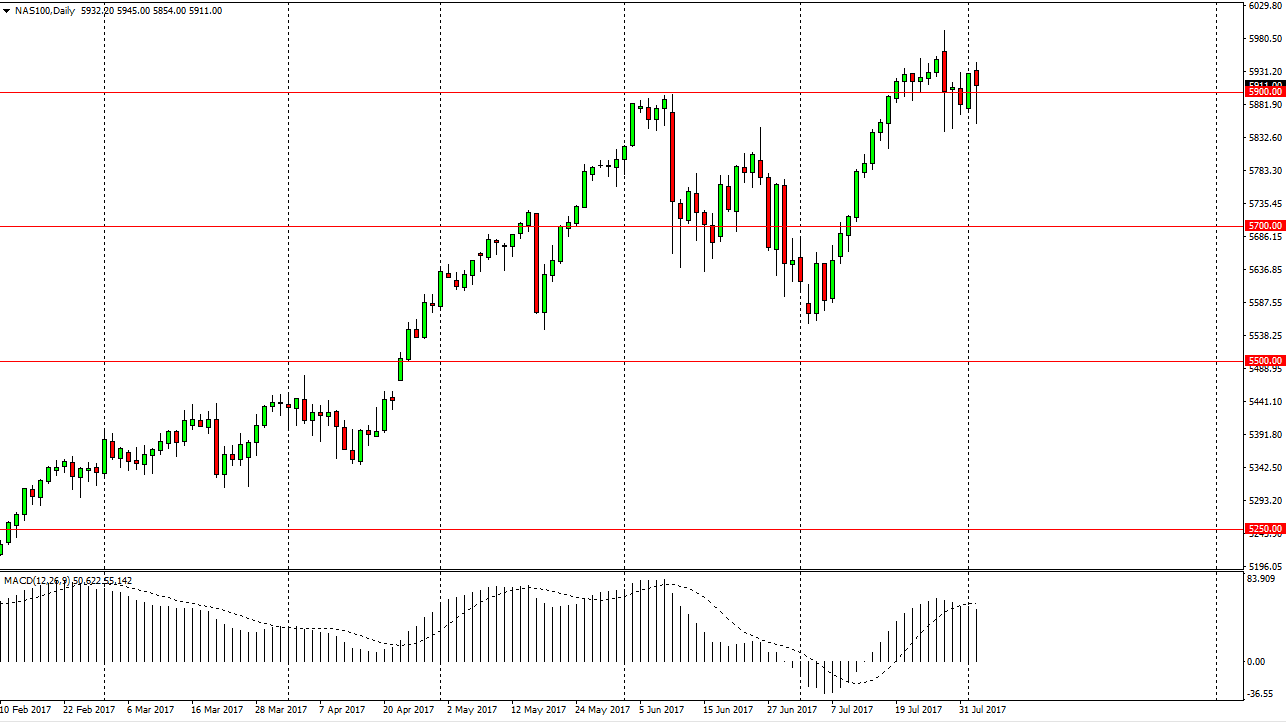

NASDAQ 100

The NASDAQ 100 initially fell during the day as well, but continues to find buyers underneath also. The computerized trading looks at these overall pullbacks as an opportunity to take advantage of value, so as the market has been behaving this way, it’s likely that we should continue to look at pullbacks as buying opportunities. I believe that the 6000 level is the next target, and that the 5900 level is a psychological support level for this market. Again though, the jobs number is tomorrow so is very likely that we could be reasonably quiet during the day. Given enough time, I do think that we breakout above the 6000 handle, but right now I believe that a lot of the volatility is due to the market trying to digest all of the massive gains that we had recently enjoyed. I have no interest in shorting, least not until we break down below the 5500 level, which is all but impossible from what I see.