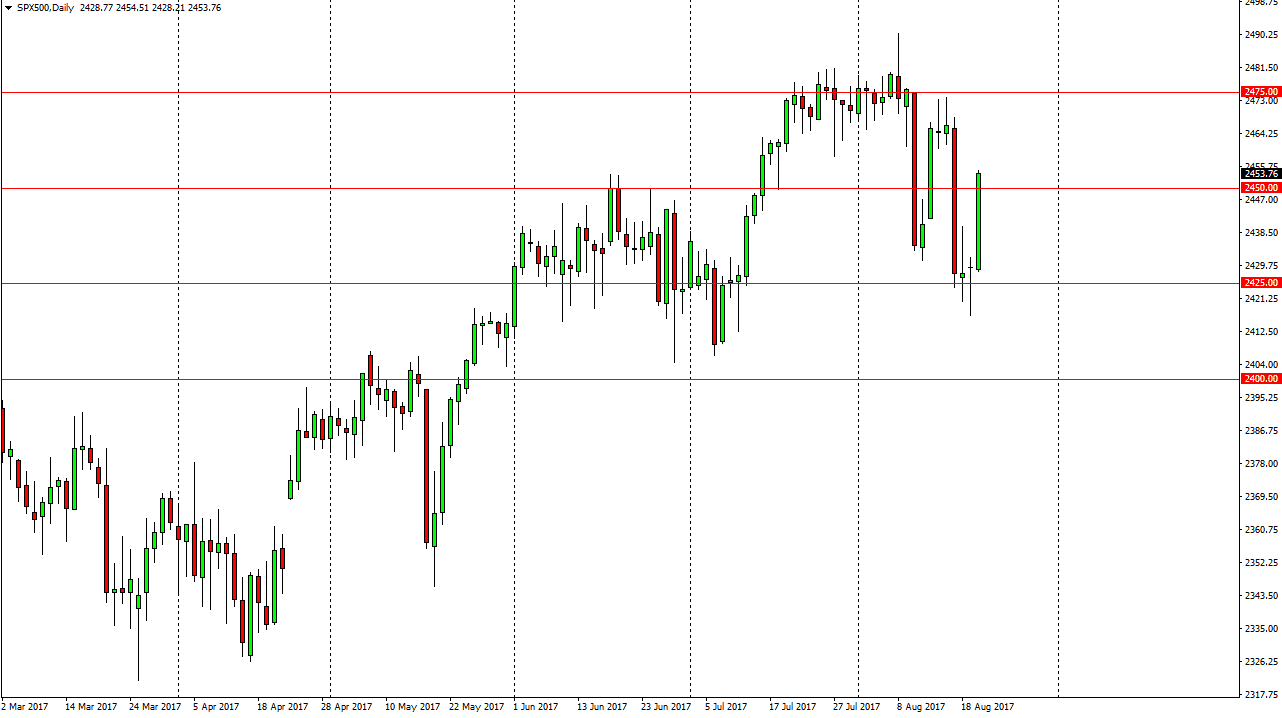

S&P 500

The S&P 500 exploded during the day on Tuesday, clearing the 2450 handle. By doing so, it looks very bullish but we have not made a “higher high” yet. There is a lot of noise above, so I would not be surprised at all to see a bit of a pullback. However, closing at the highs of the day is very bullish, so it is possible that we see a least a little bit of upward momentum in the short term. There was talk about possible progress being made in tax reform issues in America, and that seems to be a very positive sign for markets. I have no interest in shorting, and believe that until we are below the 2400 level, it’s all but impossible.

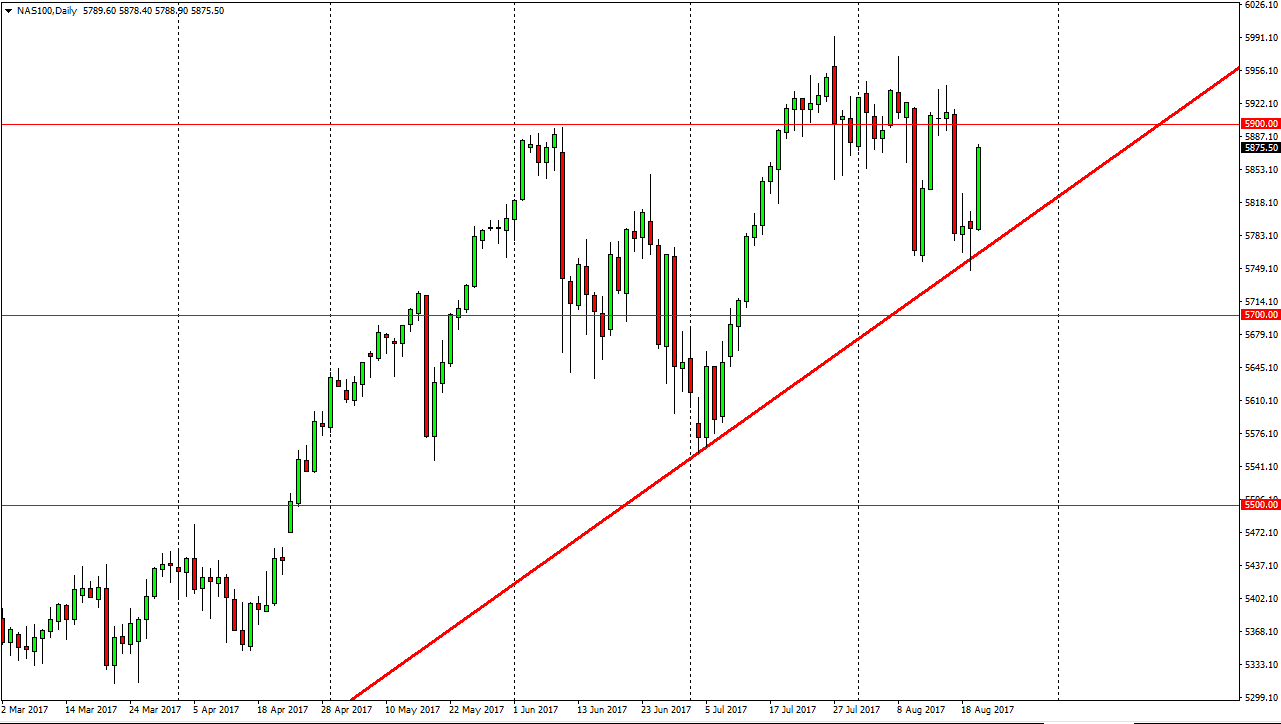

NASDAQ 100

The NASDAQ 100 broke higher and clear the top of the hammer from the Monday session on Tuesday. We also closed near the highs of the session, and we also broke above the top of the shooting star from the Friday session. However, the 5900 level looks like it will probably be somewhat resistive, so I’m not looking for anything major here. I believe pullbacks will offer buying opportunities, and if we can stay above the uptrend line on the chart, I still remain bullish. That’s not to say that this is going to be an easy move, far from it, but I do think that eventually the buyers win. The market has been a “buy the dips” market for some time, and that seems to continue to be the way forward. Eventually, I think that this market goes hunting for the 6000 handle but liquidity is a bit thin as we are in the middle of vacation season, so you should keep that in mind.