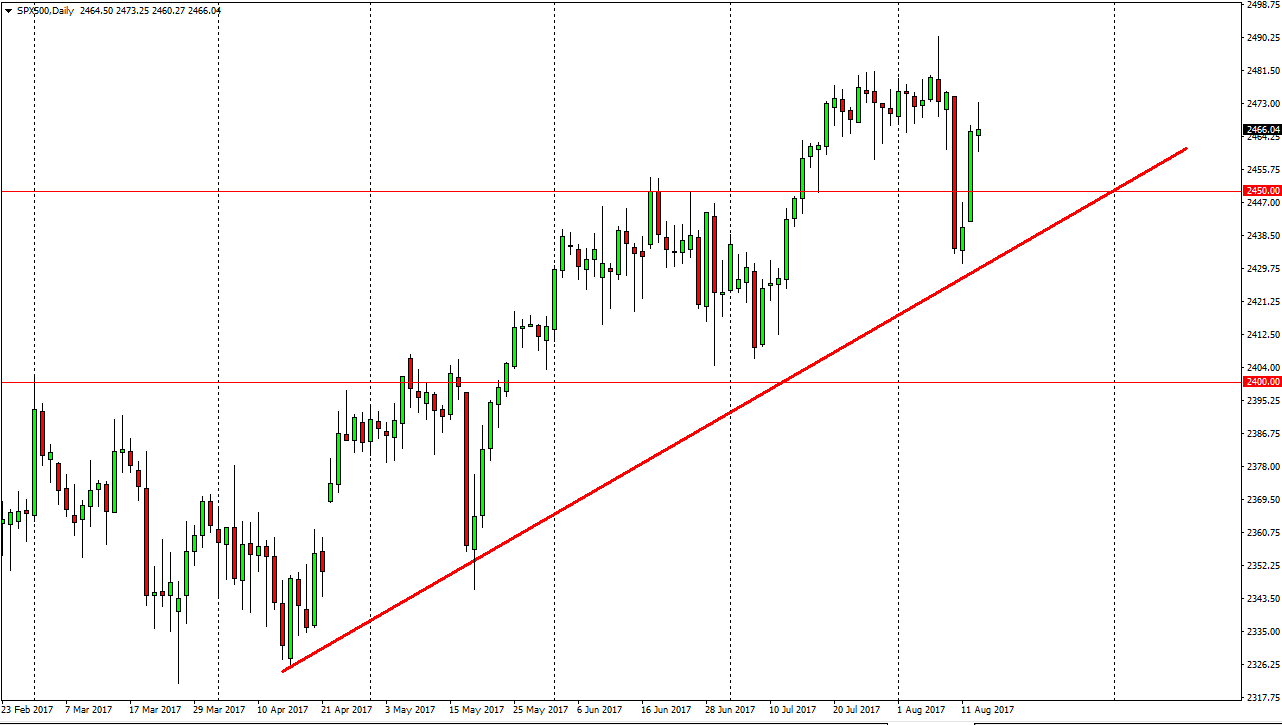

S&P 500

The S&P 500 went back and forth during the day on Tuesday, but ended up forming a bit of a shooting star. This suggests to me that we are going to see another pullback. As you can see on the chart, I do have an uptrend line market, and if we break below that I think things could get a bit ugly. We are starting to see people become somewhat concerned about the uptrend, and I am a bit discouraged by the fact that we could not break higher than the impulsive candle to the downside on Thursday. I’m not ready to start selling yet, but I do recognize that a pullback is likely. I will be looking for a supportive candle to buy at lower levels, or perhaps buying on a break above the top of the shooting star the form for the day on Tuesday.

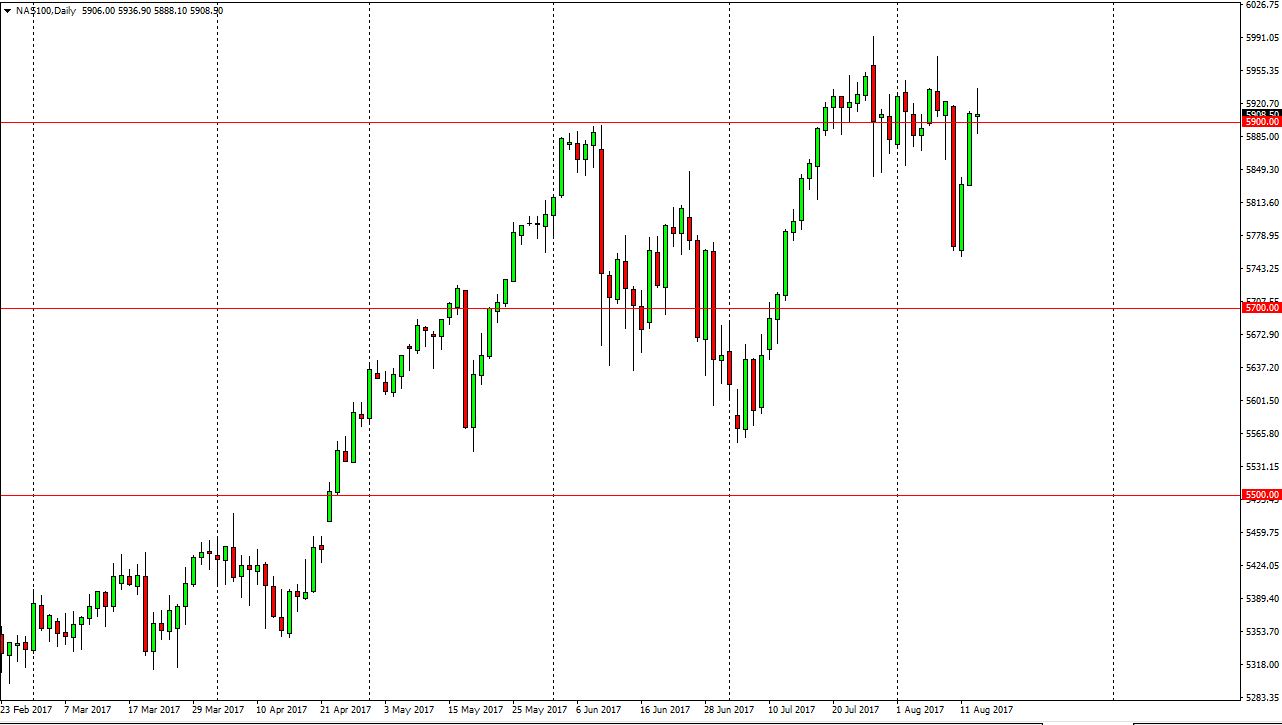

NASDAQ 100

The NASDAQ 100 went higher initially during the day but turned around to form a shooting star as well. If we break down below the bottom of the shooting star, I think that the NASDAQ 100 rose over a bit and continues to go lower. Alternately, if we break above the top of the shooting star, I think it’s time to start buying again as we should then go hunting for the 6000 handle. The NASDAQ 100 has been a leader for US indices overall, and I think that it should continue to be. That being said, as it has lead the other US indices to the upside, it certainly could do it to the down if it fell apart. It’s very important to pay attention to this market, as I believe we are at a reasonably important inflection point on the charts.