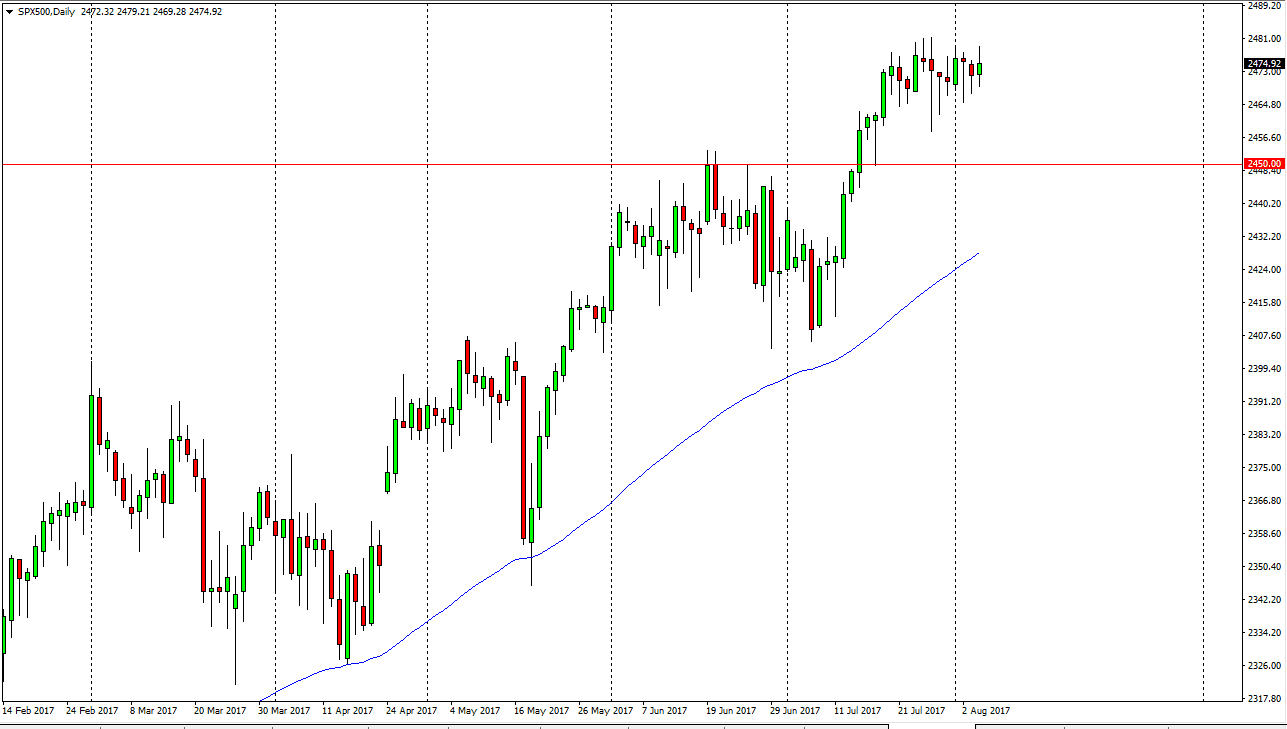

S&P 500

The S&P 500 went back and forth during the day on Friday, as the jobs number rattled the market. The jobs number was much better than anticipated, and this brings on 2 schools of thought: either the Federal Reserve will raise interest rates and that could work against the value of stocks, or perhaps the economy is getting better. With both of these forces working in the market, it’s not overly surprising that we went sideways. I think we continue to grind sideways, and that a short-term pullback could happen. However, the 2450 level should be a bit of a floor, and should push this market higher and towards the 2500 level. I’m a buyer overall and have no interest in shorting.

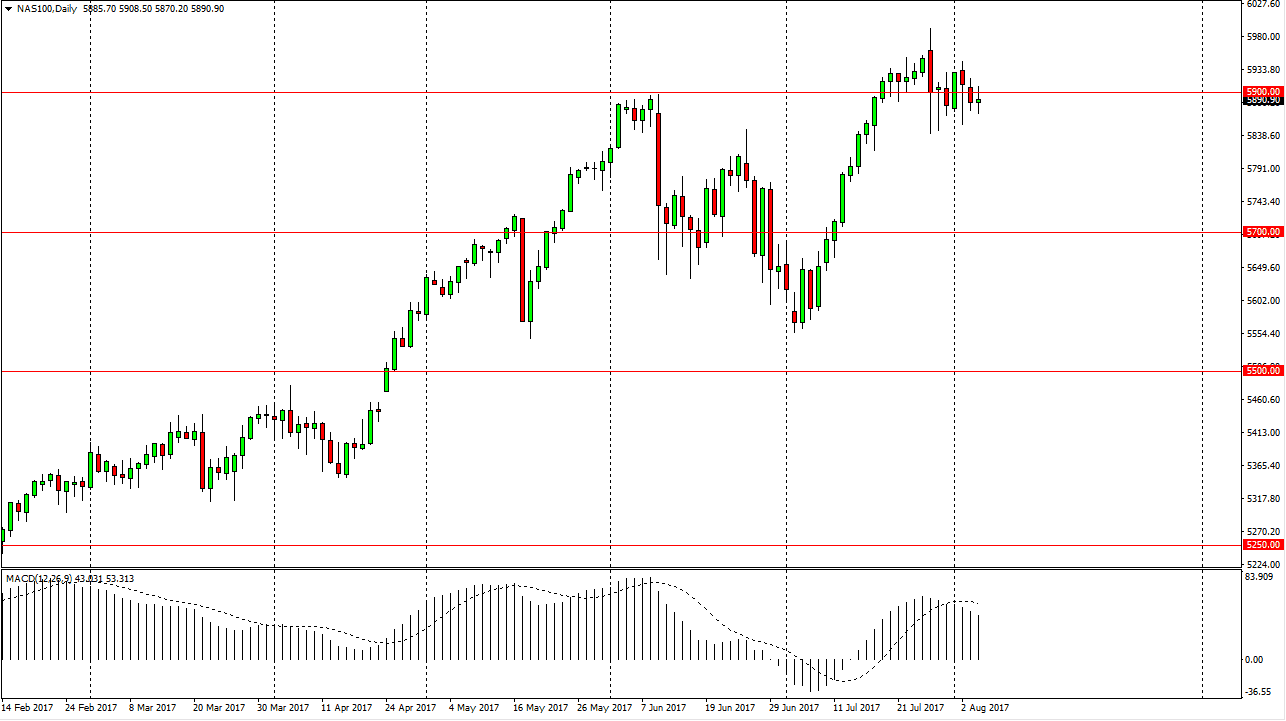

NASDAQ 100

The NASDAQ 100 has gone back and forth just underneath the 5900 level, and I think that the market is currently just trying to digest a lot of the gains that we have recently had. After the impulsive move that we had in the NASDAQ 100, it makes sense that we need to take a little bit of a break. I believe in buying dips, but I also recognize that it might be a while before we get any real momentum in the market. I believe that the 5700 level underneath offers a significant amount of support, and it will be difficult to break below there. I think the given enough time, the market should then go looking for the 6000 level above.