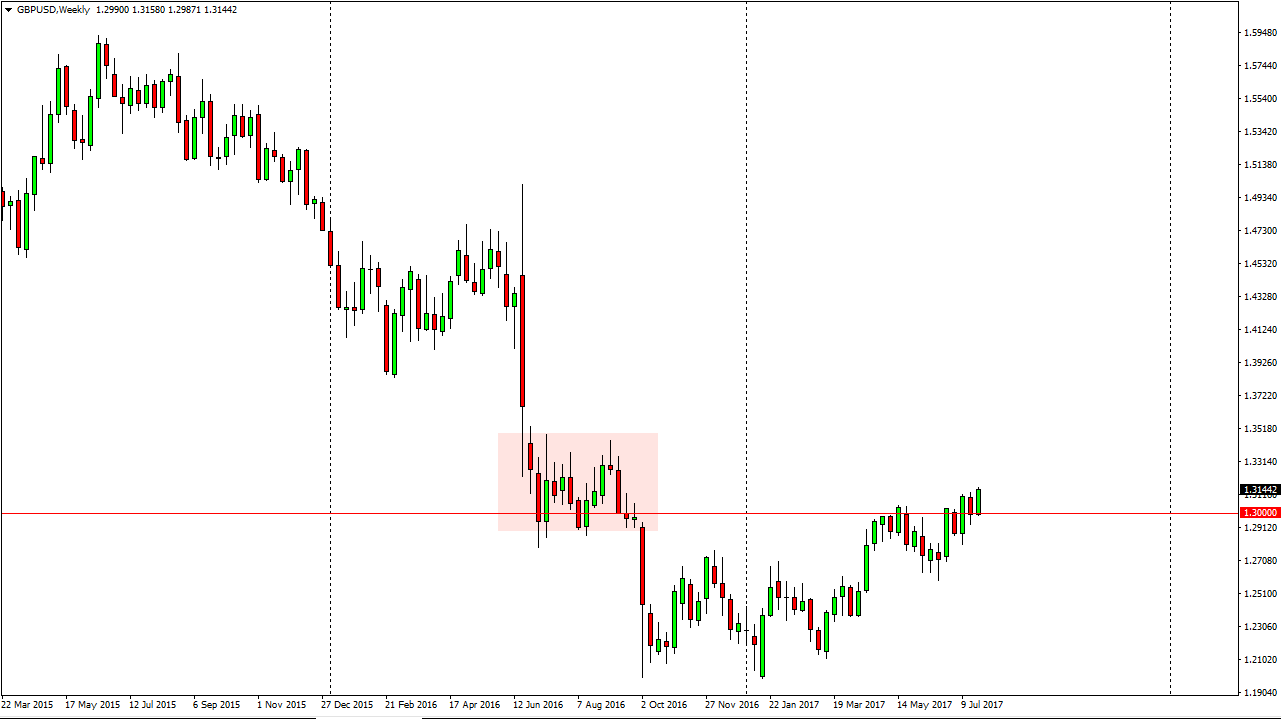

The GBP/USD pair showed signs of strength yet again during the month, as we broke above the 1.30 level. In fact, the last week of July showed signs of real improvement, and because of this I think that the market may be getting ready to reach towards the top of the rectangle that I have seen on the chart that is now highlighted. If that’s the case, the market should go looking towards the 1.35 level, but I think that short-term pullbacks continue to offer buying opportunities. If we can find support at the 1.30 level, the market should continue to be very bullish. I have no interest in shorting this market until we break down below the 1.2850 level, which seems unlikely.

Buying dips

I continue to be a buyer of dips going forward, and I think that the 1.35 level will continue to be the target. I don’t know that will get there this month, because quite frankly I see a lot of volatility coming. On top of that, we have the concerns of headlines coming out of the negotiations between London and Brussels, which of course can knock the market around at any time. While I am bullish of this market, I think that it is going to be more of a grind than anything else. Just above the rectangle that I have put on the chart, you can see a massive gap, and I think that gap will be very resistive. Longer-term, markets tend to fill gaps, so I think we are going to get this market looking for that. I don’t know it’s going to happen anytime soon, and it certainly will be during the month of August. However, I think longer-term that might be where we are looking to go, and with that I think that the British pound buyers will continue to be rewarded.