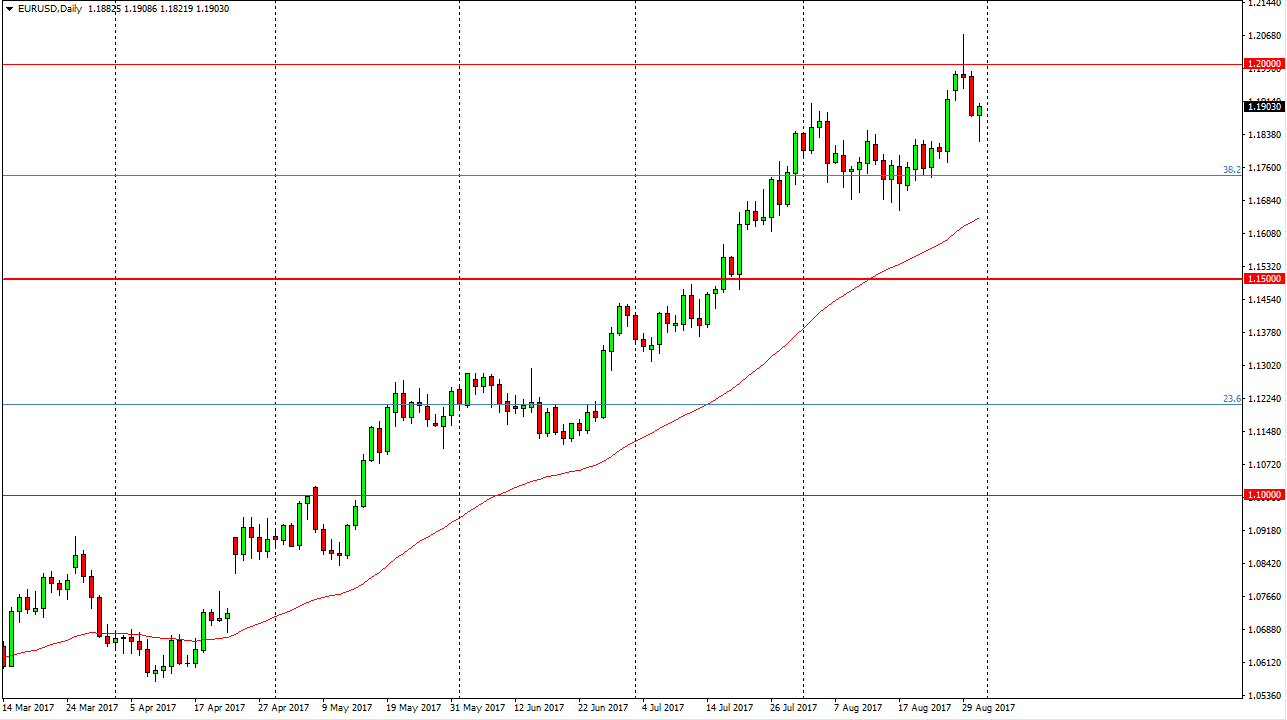

EUR/USD

The EUR/USD pair fell during most of the session on Thursday, but found enough support below the 1.19 level to turn around and form a hammer. This is a market that looks very bullish, and has been extraordinarily strong as of late. This pullback and subsequent hammer suggests that the buyers are very much interested in this market, and are willing to get involved. I think that the 1.20 level will be psychologically resistant of course, but in the end, I think we will break above there based upon the longer-term move and the breakout above the consolidation that had lasted 3 years. I still have a target of 1.25, and look at these pullbacks as buying opportunities. Today’s jobs number is going to cause quite a bit of volatility, so be prepared for that.

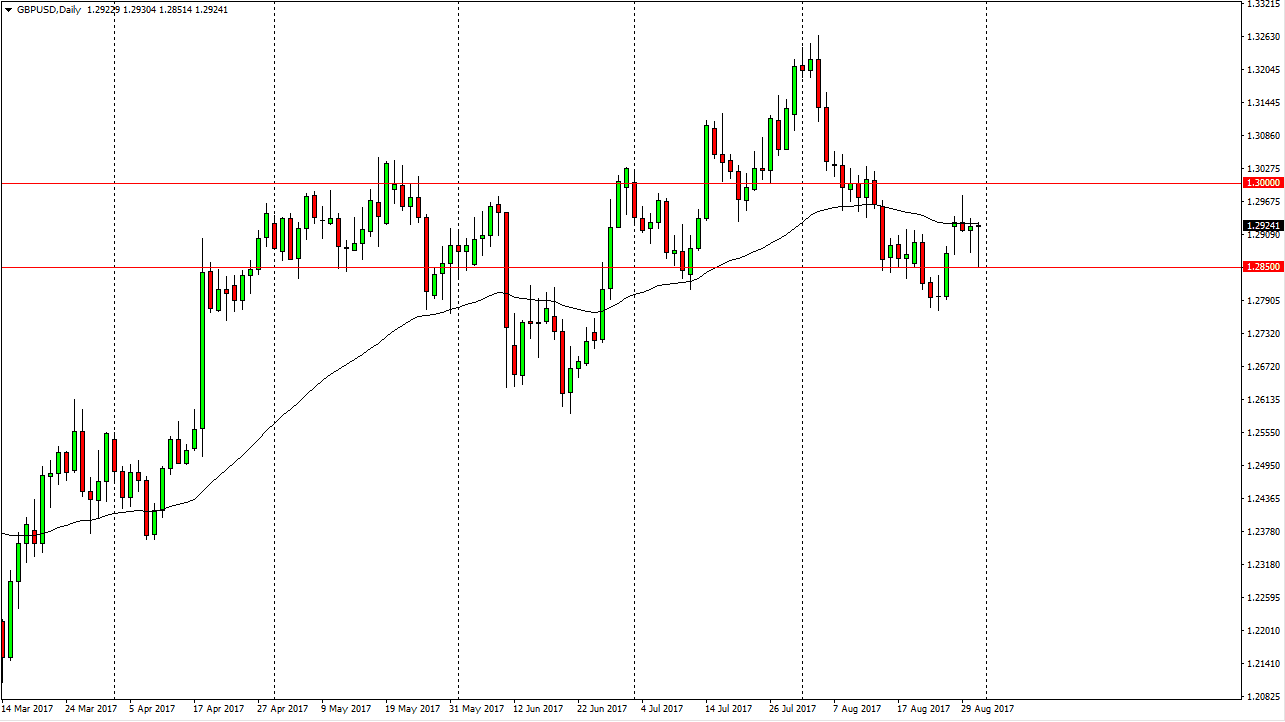

GBP/USD

The British pound has been volatile during the Thursday session, falling all the way down to the 1.2850 level but turning around to form a massive hammer. The market has been very undecided over the last several sessions, and I think today could be the catalyst to finally move in a direction. If we break down below the 1.2850 level, the market should go lower, perhaps reaching towards the 1.28 level, and then the 1.27 level. Alternately, if we can break above the 1.3050 level, the market should go much higher. In the meantime, the consolidation should continue and therefore short-term traders will continue to push this market back and forth. If we stay within this area, I think that it’s going to be difficult to place any large positions on, but short-term scalping is probably going to be the way going forward. Ultimately, we need to make a decision, and hopefully the nonfarm payroll announcement will do that.